How Tighter Government Spending Contributed to China Rate Spike

December 25, 2013 Leave a comment

Dec 23, 2013

How Tighter Government Spending Contributed to China Rate Spike

An unusual shift to slower government spending toward the end of the year caught the Chinese central bank off guard and helped send money-market rates last week to their highest levelssince a crisis in June, economists say.The People’s Bank of China said Friday it had been forced to inject more than 300 billion yuan (US$49.2 billion) into China’s money markets over a three-day period after the interest rates banks charge each other for short-term loans surged to 8.2%. The injection helped bring down rates to 5.6% by Monday morning.

Last week’s levels were the highest since June’s cash squeeze sent short-term rates soaring above 28%. Then, China’s lenders were caught in a credit squeeze caused by a combination of factors, ranging from lower capital inflows and seasonal tax payments to a mismatch between banks’ short-term funding and longer-term lending. The PBOC let the problem fester before stepping in, to teach banks a lesson.

Those seasonal factors have come into play now as well. But “the recent rate spike is, to a large extent, a reflection of the government’s tighter stance on spending,” Citigroup economist Ding Shuang said.

The Chinese government usually draws down fiscal deposits — the amount of funds the government keeps in the financial system—more quickly in December, as it speeds up spending and fiscal disbursements before the end of the year, UBS economist Wang Tao said in a recent note.

That boost in government spending adds liquidity to the banking system, and the PBOC normally withdraws liquidity at the end of the year to offset the inflows. This time, though, the government’s tighter fiscal policy means year-end spending has been restrained, Ms. Wang said.

China’s Communist Party has launched a campaign this year to crack down on unnecessary government spending, from official banquets to investment projects. Even budgeted investment projects that are deemed unnecessary won’t get funding, Citigroup’s Mr. Ding said.

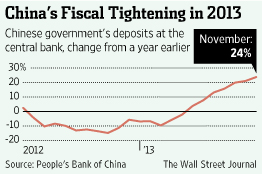

The balance of fiscal deposits was unusually high at the end of November – the most recent data avaialble — as the economy’s third-quarter pickup boosted tax revenue and the frugality campaign curbed spending, Mr. Ding said. Fiscal deposits totaled 4.5 trillion yuan at end-November, up from 3.6 trillion yuan a year earlier and 3.8 trillion yuan two years earlier.

The fiscal deposits are placed at PBOC accounts at commercial banks. When the government spends that money, it eventually filters back into bank accounts that are available for bank lending. Slower government spending means the money stays in the accounts and is not available for bank lending. Thus, the larger the amount of fiscal deposits, the more liquidity that’s effectively being drained from the system.

Fiscal deposits rose steadily and more quickly this year than their historical average, reflecting the government’s tighter policy, Nomura economist Zhang Zhiwei said.

Fiscal revenue grew 9.9% from a year earlier during the January-November period, higher than the budgeted target of about 8%, while fiscal spending rose 9.3%, lower than the budgeted target of about 10%. That resulted in a total fiscal surplus of 495 billion yuan in the first 11 months of the year, Finance Ministry data showed.

The data suggest this year’s budget deficit is likely to be just 1.5% of gross domestic product, undershooting the government’s 2% target, Mr. Ding said.

Coordination between the central bank and Finance Ministry is not that smooth, Mr. Ding said. The central bank sees the uncertainties in the recent government spending and uses short-term tools to manage liquidity, he noted.

“The central government is cautious about injecting a lot of liquidity because if all of a sudden the government speeds up spending, that will lead to excessive liquidity,” Mr. Ding said.

China is unlikely to see another cash crunch like the one in June because that’s not the PBOC’s intention this time around, Mr. Ding said. The central bank is likely to use longer-term tools this week, such as 14-day reverse repurchase agreements, to ease market nerves, he said.

UBS’ Ms. Wang said some fiscal disbursements are expected in the next few days, which also should help to relieve some stress in the market.