Dirty money: Rich smell; The forum for rich countries issues an overdue mea culpa

December 26, 2013 Leave a comment

Dirty money: Rich smell; The forum for rich countries issues an overdue mea culpa

Dec 21st 2013 | From the print edition

THE leakage of wealth from poor countries through tax evasion, money laundering and other misdeeds is becoming an ever bigger worry for those who want poor countries to get rich. Global Financial Integrity calculates that such “illicit financial flows” have increased sharply over the past decade and may now be $1 trillion a year or more. Even experts who question the campaigning group’s methodology accept that outflows probably exceed incoming aid and investment combined.Big rich countries often accuse small offshore financial centres, such as Jersey and the Cayman Islands, of acting as willing conduits for dodgy money. The minnows say they are being bullied: big hypocrites should clean up their own acts first. This case is bolstered by a damning report on its own members by none other than the Organisation for Economic Co-operation and Development (OECD), a Paris-based club of industrialised countries.

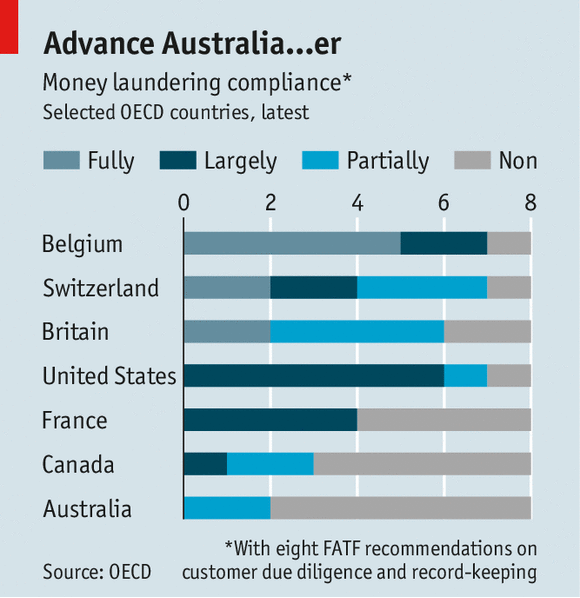

The report is harshest in its assessment of how international money-laundering standards crafted by the Paris-based Financial Action Task Force (FATF) are implemented. Only 12 of the OECD’s 34 members were fully or largely compliant with a majority of the standards that recent peer reviews have set on customer due diligence and record keeping. Penalties for banks with poor controls are (America apart) mostly feeble. Anonymous shell companies are easier to set up in the OECD (especially in America) than in tax havens. Barely any countries apply the FATF rules to non-financial “gatekeepers”, such as lawyers and incorporation agents, who play an important role in setting up opaque ownership structures.

The rich countries also score poorly on recovering and returning assets looted by kleptocrats and their clans. They repatriated a mere $147m between 2010 and 2012. (To be fair, proving that assets are ill-gotten is hard in places where they tend to be parked, such as Britain and Switzerland.)

The report could have been tougher still. Strong resistance from the OECD’s constituents and some secretariat officials repeatedly delayed its publication and diluted its content. In particular, a section on “transfer mispricing”—trade between related parties, such as two companies in a multinational group, designed to hoodwink tax authorities or manipulate markets—was removed after the OECD’s tax division complained. It was apparently worried about maintaining consensus on an overhaul of international corporate tax.

Fortunately, Canada, Australia and other countries that fared poorly in the international comparisons (see chart) failed in their efforts to have them all taken out. They had argued that such rankings would not reflect improvements made since their last peer reviews. Outside experts counter that these have been modest at best.

Some real progress has been made. Britain, for instance, now backs public registers of corporate ownership. A transatlantic consensus is building on the automatic exchange of tax information. But big rich countries still like to portray themselves as leaders in the fight against black money. In fact they are laggards. In 2014 they should practise what they preach.