As Coffee Prices Decline, Investors Brace for More

December 31, 2013 Leave a comment

As Coffee Prices Decline, Investors Brace for More

LESLIE JOSEPHS

Dec. 30, 2013 7:25 p.m. ET

Coffee prices have tumbled 20% this year, capping the biggest two-year plunge in a decade and highlighting commodity markets’ struggle with a supply deluge.Global coffee output is soaring, the result of more acres dedicated to coffee and the widespread adoption of more productive and sturdier plants. Growers from Colombia to Ethiopia made decisions to boost production more than three years ago, when prices were rallying.

Now, the $6.1 billion futures market for arabica, a mild-tasting variety that is used mostly in high-end brews and accounts for the majority of global coffee production, is grappling with the consequences.

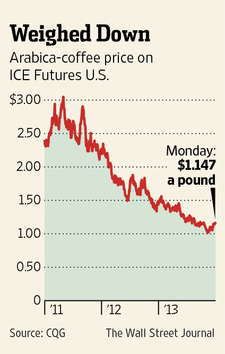

On Monday, prices for arabica coffee fell 1.65 cents, or 1.4%, to $1.1470 a pound on ICE Futures U.S. Barring an unprecedented spike on Tuesday, the last trading day of the year, coffee will end the year in negative territory, as it did in 2011 and 2012.

Coffee prices haven’t fallen for three consecutive years since the early 1990s.

Since 2011, coffee prices are down 49%. That is the largest two-year decline since 2000-2001, when prices fell 63%.

Investors have bailed out of bullish bets and as a group are betting for prices to keep falling, according to Commodity Futures Trading Commission data. Protests in Colombia, the world’s No. 2 arabica grower behind Brazil, have erupted, with farmers facing falling incomes demanding more government support.

Meanwhile, retail prices for bagged coffee and lattes have stayed relatively steady, a boon for roasters and food companies that are able to capitalize on lower coffee costs.

The sharp fall in coffee prices is the most prominent example of the oversupply situation that has beset many commodity markets, weighing on prices and turning off investors. Mining companies are ramping up production in some copper mines, U.S. farmers just harvested a record corn crop, and oil output in the U.S. is booming. The Dow Jones-UBS Commodity Index is down 8.6% year to date.

In the season that ended Sept. 30, global coffee output rose 7.8% to 144.6 million bags, according to the International Coffee Organization. A single bag of coffee weighs about 60 kilograms (about 132 pounds), an industry standard. Some market observers believe production could rise again in 2014.

“I don’t think we’ve seen the absolute low for prices,” said Sterling Smith, a futures specialist at Citigroup. “There is a strong possibility that we will see record production in a new crop of coffee.”

The U.S. Department of Agriculture forecasts that global coffee stockpiles will rise 7.5% to 36.3 million bags at the end of this crop year, an indication that supplies are expected to continue to outstrip demand in the next several months.

Brazil, which grows about a third of the world’s coffee, is headed for what is known as an “on-year” crop next year. The productivity of the country’s coffee trees alternates between high- and low-output years.

In a research note, analysts at Macquarie Group warned investors that a potential bumper Brazilian crop could push coffee prices lower. The analysts said the country’s coffee-growing regions were experiencing weather that was conducive to good development of coffee cherries.

The global coffee glut has its roots in a price rally more than three years ago. Farmers across the world’s tropical coffee belt poured money into the business, spending more on fertilizer and planting more trees as prices reached a 14-year high above $3 a pound in May 2011.

Three years ago, José Eliuth Muñoz Manrique and thousands of other Colombian coffee farmers ripped out trees that were ravaged by a fungal disease to plant a heartier and more productive variety. “It was a very serious mistake,” said Mr. Muñoz, a third-generation coffee farmer in El Tambo, in Colombia’s southwestern highlands.

Now Mr. Muñoz and other growers are shifting back to plants that are less productive but yield coffee types that command a higher premium. It is a nascent sign that farmers throughout the coffee belt are scaling back as prices fall below the cost of production in some areas. That could mean thinner supplies of beans in coming years and higher prices.

“You’ve got to look at it long term,” said Hector Galvan, a senior broker at R.J. O’Brien, a Chicago brokerage. “The second we start talking about expectations of a worse yield, you see the market start bouncing.”

Coffee prices recently have rebounded, albeit from seven-year lows. Prices are up 13% since early November.

Hedge funds and other money managers in November held the biggest net position that coffee prices would fall since at least 2006, according to the CFTC. They have since scaled back those bearish bets. In the week ended Dec. 24, investors held the smallest bearish position since May, at 9,610 contracts.

Still, some analysts said the recent optimism could peter out once Brazil’s next crop hits the market in June. Rabobank, a Netherlands-based bank with a strong presence in global agriculture, estimates that prices could fall to 95 cents by the fourth quarter of 2014.