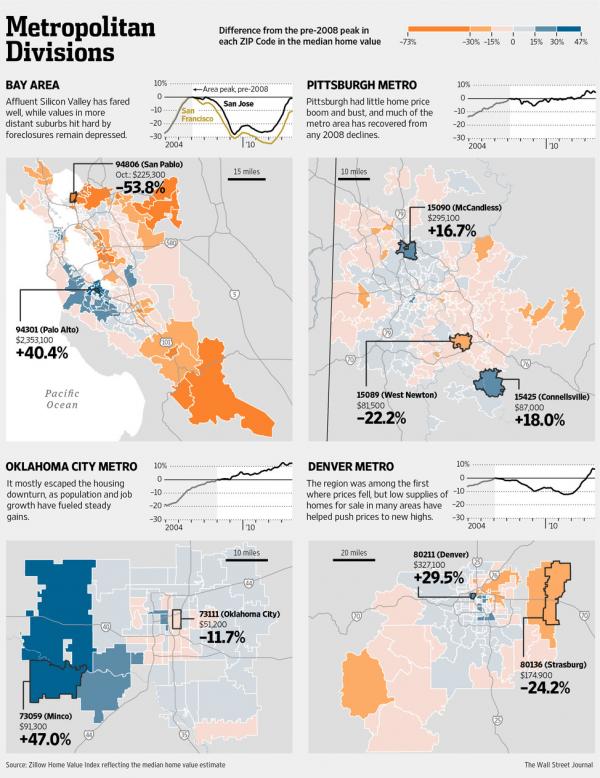

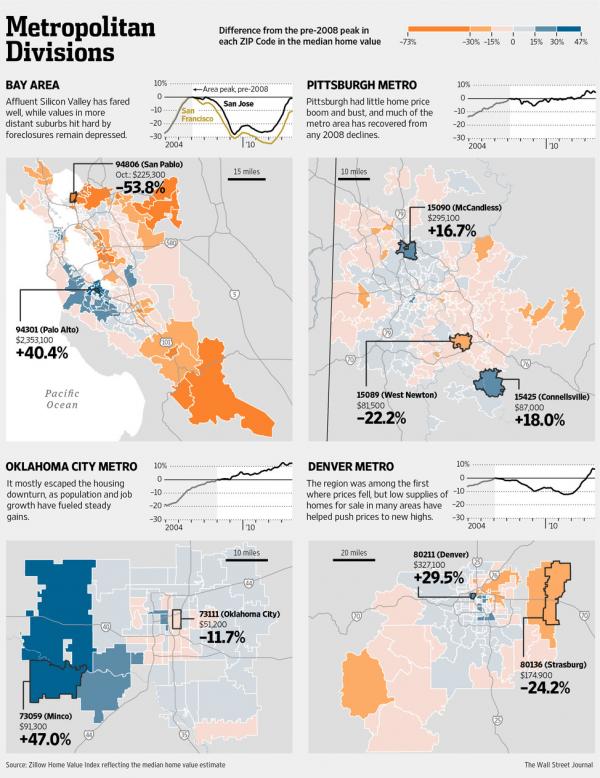

The Bifurcated Housing Bubble; From “Why Didn’t I Buy?” To “This Is Crazy”

Tyler Durden on 12/30/2013 18:31 -0500

Never was ‘location, location, location’ more important than in the current housing ‘recovery’. From the Bay Area to Pittsburgh and from Denver to Oklahoma, the divergence in price movements is incredible. As the WSJ reports, while headlines gloat of several cities enjoying full-scale rebounds,these cities are largely exceptions with prices in many part of the US still well below the peak. In some 1,500 cities, values are still at least 25% lower than their previous highs. For the ‘bubble’ zip-sodes, “what you’ve got is something other than a sensible market-deciding price. You’ve got it goosed by the terms of finance, which are extraordinary,” warns one realist realtor, “prices shouldn’t be up this high, this quickly. It’s a big, flapping yellow flag saying we’re back in territory that we should not be in.” Read more of this post