Big Data Sparks Corporate Turf Fights; Companies Debate Which Department Should Oversee This Vital Asset

April 7, 2014 Leave a comment

Big Data Sparks Corporate Turf Fights

Companies Debate Which Department Should Oversee This Vital Asset

BEN DIPIETRO

March 24,2014

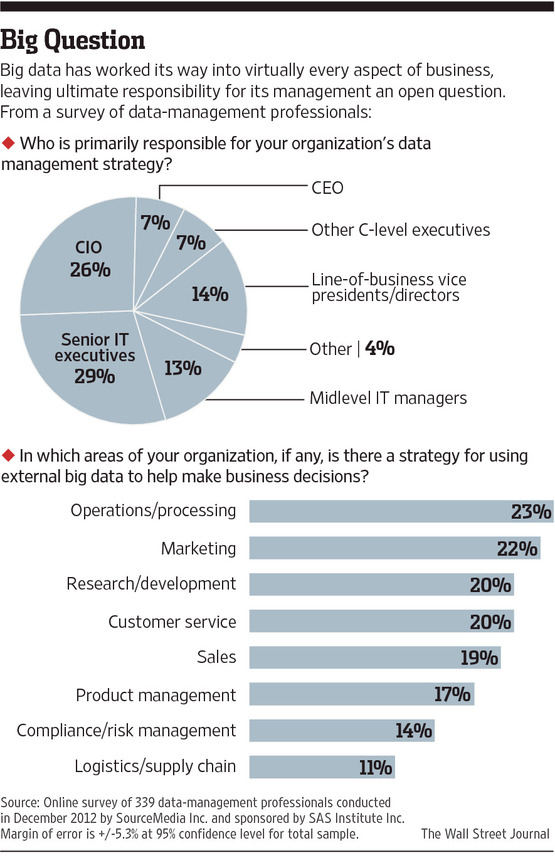

Big data comes with a big internal turf question: Who gets to decide how it’s collected, used, stored and protected?

These troves of new information are becoming a high-stakes issue for companies, with significant opportunities to leverage the data and boost business—but also to make significant missteps. So, corporate departments are debating which of them is best set up to oversee the process.

Tony Jewitt, a vice president at big-data firm Avalon Consulting EMC +0.97% LLC, says it resembles “the early days of the Internet,” when companies were trying to understand the technology, figure out the best ways to use it and which department should be in charge of it.

Going With Legal

For instance, at the U.S. unit of France-based manufacturing company Manitou Group, the IT department and the legal department both made a case for overseeing big data in 2011.

IT felt their technical expertise allowed them to best manage the process of collecting and protecting data.

The legal side argued that placing big data under their control could offer some attorney-client protections in case the company was sued for improperly using or collecting data, among other things, says James C. Green, the company’s U.S. unit general counsel.

Another argument: The legal department was better positioned to understand how to use big data without violating vendor contracts and joint-venture agreements, as well as keeping trade secrets.

Mr. Green’s argument won. “It was the recognition of liability exposure the company has with big data…so it made sense to have legal be the gatekeeper,” he says.

He adds that it “wasn’t as though there was a battle,” but rather the discussion was a sign that different teams thought they could best manage the responsibility.

Some big-data experts think that other parts of companies are better suited to oversight roles.

Mr. Jewitt, for one, thinks compliance departments are more attuned to flagging potential problems that could arise with big data.

“The reason compliance needs to own this is…data is being pulled together from all different sources and we don’t know all the impacts of having that information in one place,” Mr. Jewitt says.

A Vote for the CIO

Keith Collins, chief information officer at data-software company SAS Institute Inc., says that while it’s up to the CEO to determine the big-data strategy, the CIO is best positioned to bring together all departments and to best understand what data is being collected and how it flows throughout the organization.

“Innovation is going to come from the edges of an organization, to find new opportunities and bring two different business units together,” he says. “Who has better ability to see that than the CIO?”

Wayne Adams, chairman emeritus of the Storage Networking Industry Association, which works with companies to design best practices for big data, says that whoever gets responsibility, it’s important to give them breathing room.

Once a company has decided who is responsible for big data, “the legal people and the compliance people should back away,” Mr. Adams says. “Let the business drivers mine the data once it has been defined what data they can use.”