Trading Winds Blow Cold for Some Hot Stocks; ‘Momentum’ Shares Sell Off; Tesla and Twitter Lose Investor Favor

April 7, 2014 Leave a comment

Trading Winds Blow Cold for Some Hot Stocks

‘Momentum’ Shares Sell Off; Tesla and Twitter Lose Investor Favor

CHRIS DIETERICH and MATT JARZEMSKY

March 24, 2014 7:17 p.m. ET

What goes up must come down, a lesson investors in some of the fastest-climbing U.S. stocks are learning the hard way.

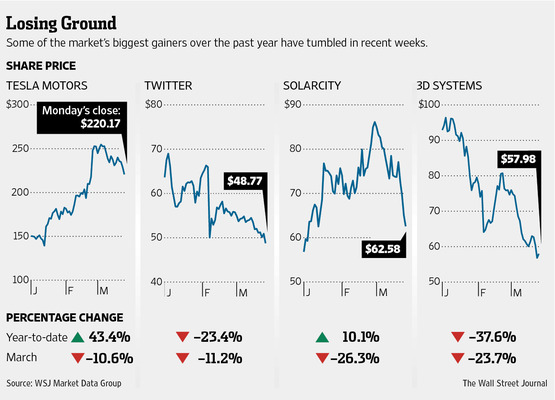

Shares of companies including Tesla Motors Inc., TSLA -3.81% SolarCity Corp.SCTY -3.80% and Twitter Inc. TWTR -4.22% have fallen sharply this month. They are among the most popular “momentum” stocks, favorites of day traders but where profits are sometimes more of a hope than a reality.

For some market watchers, this selloff simply reflects the risks that come with piling into highflying stocks. To others, it is a potential broader warning sign about investors feeling less confident about the outlook for shares.

“It’s really a broad selloff [of momentum stocks], people taking gains just because they might have some questions” about the health of the broader market, said Jerry Braakman, chief investment officer at First American Trust, whose firm oversees about $1.1 billion in Santa Ana, Calif.

To be sure, underlying concerns about valuation, coupled with worries over Federal Reserve policy and corporate earnings, aren’t prompting investors to move broadly out of stocks. On Monday, the S&P 500 dropped 9.08 points, or 0.5%, to 1857.44, but remains just 1.1% below its March 7 all-time high.

But action in some stocks has turned lately. Shares of Tesla are up sixfold over the past year but off 10% in March. SolarCity, a solar-panel financing and installation company whose chairman is Tesla founder Elon Musk, is off 26% this month after booking a 244% price gain over 12 months.

Twitter has slumped 11% in March but has nearly doubled since its November initial public offering. 3D Systems Corp., among the hottest 3-D printer makers, has shed 24% in March but climbed 84% over 12 months. The S&P 500 is down 0.1% this month.

Mr. Braakman sees the turn in go-go names as a signal that investors need to be choosier about finding stocks at reasonable prices. He said he stepped into the market and bought shares of Amgen Inc. AMGN -1.34% on Friday but is avoiding smaller biotech companies with loftier valuations.

The Nasdaq Biotechnology Index is up more than 50% over the past year, more than double the gains for the S&P 500. Because biotechnology stocks carry expectations for fast future earnings growth, they generally have higher valuations than the broader stock market.

Based on earnings estimates for the next 12 months, the price/earnings ratio on the index hit 63.9 in February, up from 51 at the start of the year and the loftiest level since June, when it hit a postfinancial-crisis high of 66.4. The S&P 500 is trading at 15.3 times the next 12 months’ earnings.

“Investors are getting wary of the valuations, given the [tepid] global growth environment,” said Jeff Yu, head of U.S. single-stock derivatives trading at UBS AG. Mr. Yu said he saw hedge funds sell winning positions in industries like biotechnology, 3-D printing and solar energy on Monday, the very sectors at the forefront of the bull market through the end of last month.

Until late February, the Nasdaq Biotechnology Index had surged nearly unimpeded over a year, pushed higher by swelling demand for stocks like Intercept Pharmaceuticals Inc., which in January nearly quadrupled in one day after reporting results of an upbeat clinical trial.

Since hitting an all-time high on Feb. 25, however, the biotech index is down 12%.

Analysts and traders said some of the selling could be attributed to news about a letter sent by three congressional Democrats to Gilead Sciences Inc., GILD +0.08% criticizing the high price of the firm’s Sovaldi hepatitis C drug.

Meanwhile, the losses in shares of some upstart 3-D printer companies has come as traders speculate that Hewlett-Packard Co. HPQ -1.00% is getting into that business. The company has a 3-D printing-related announcement planned for June, Chief Executive Meg Whitman said at the company’s annual shareholder meeting last week.

Still, many traders said the selloff is a function of the lofty valuations.

Biotech “has been a sector that’s been on fire,” said David Seaburg, who helps fund managers trade stocks as head of equity sales trading at New York brokerage Cowen & Co. But as these shares have gotten pricier, relative to the companies’ sales and earnings, they are apt to see bigger day-to-day price swings, he said. Mr. Seaburg said some of his clients were looking to buy these shares but wanted to see them start to reverse declines.

Money has been coming out of the biggest biotech exchange-traded fund by assets during the recent selloff. The $5.5 billion iShares Nasdaq Biotechnology ETF brought in $631 million from the start of 2014 through Feb. 25, according toETF.com. Since then, some $166 million, or roughly one-quarter of 2014’s total influx, has walked out the door.

Broad selling has hit other companies, including social-media firm Facebook Inc.FB -4.67% and cloud-computer software maker Workday Inc., WDAY -1.57% with seemingly little in common except for being fast-moving, growth-heavy targets for speculative investors.

“When there’s confidence, people tend to go into riskier names,” said Randy Frederick, managing director of trading and derivatives at Charles Schwab Corp. “This selloff tells me there’s some booking of profits.”