5 Reasons Why Chinese “Stimulus” Hopes Are Overdone

April 8, 2014 Leave a comment

5 Reasons Why Chinese “Stimulus” Hopes Are Overdone

Tyler Durden on 03/25/2014 10:36 -0400

A surprise (to some) drop in China’s PMI was just enough bad news to prompt the good-news-seeking BTFD’ers into expectations of additional stimulus from China. Despite ‘PBOC advisors’ (implictly the mouthpiece of official policy strawmen) stating openly not to expect stimulus and confirming that China will see a “crisis” in local-government financing “but not as expolosive as the 2008 crisis”, and that “China must face the moral hazrd issue“, investors are buying CNY, copper, Chinese stocks, and practically everything else on the back of hopes for moar money. However, as Bloomberg’s Tom Orlik explains, with the government facing conflicting pressures an abrupt about-face in policy is unlikely.

1. A significant step toward stimulus would be a step back from reforms intended to control runaway corporate credit and local government debt. Doing so might risk a sharper correction down the road.

2. The State Council’s statement suggests little in the way of new government spending. It promises to accelerate existing projects rather than to start new ones, indicating little additional impetus from the public purse.

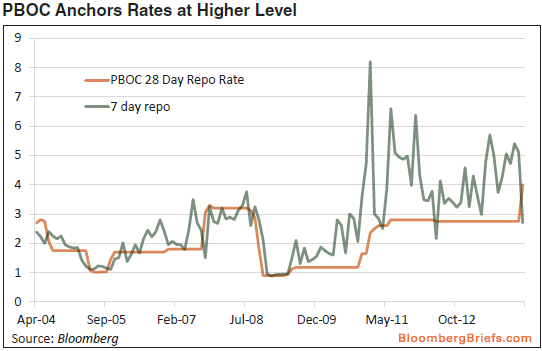

3. Similarly, the People’s Bank of China’s recent reintroduction of the 28-day repo at a rate of 4 percent suggests the central bank wants to re-anchor rates at a higher level. At the recent National People’s Congress, PBOC Governor Zhou Xiaochuan said interest rate liberalization is on an accelerated track and is expected to push rates higher.

4. A growing number of analysts expect a cut in the reserve requirement ratio, which would boost bank lending. The reserve requirement ratio is a blunt instrument, and a cut would signal to the markets that the central bank is stepping back from its deleveraging agenda.Finetuning liquidity via open-market operations may be a preferable alternative at this point.

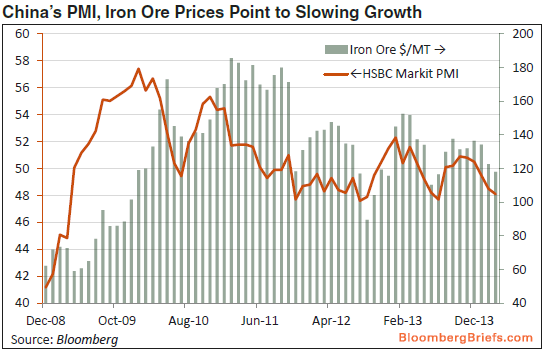

5. In the details of the PMI release, deteriorating output and new orders paint a bleak picture of domestic demand. Rebounding export orders suggest February’s pronounced drop might overstate the weakness of foreign sales. Employment showed signs of stabilizing. Labor markets are a primary focus for China’s policy makers, and that’s another reason to think a wholesale shift to stimulus may not be in the cards.

But apart from that… we must buy because the Central Banks have taught us that is the right thing to do…