Purifying Air for China’s Car Makers

April 8, 2014 Leave a comment

Purifying Air for China’s Car Makers

ABHEEK BHATTACHARYA

March 25, 2014 5:28 a.m. ET

In this Dec. 9, 2013, file photo, the skyline of Shanghai’s Lujiazui Financial District is covered with heavy smog. China’s Premier has declared that smog is as big a problem as poverty. Associated Press

China is declaring war on pollution. And it’s extending the battlefield to the world’s biggest car market.

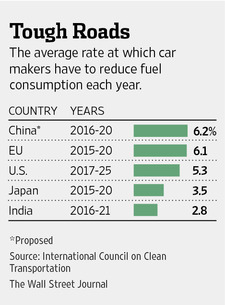

Chinese Premier Li Keqiang has declared that smog is as big a problem as poverty. One solution: new proposed fuel-economy standards for passenger cars. These rules would require car makers to reduce fuel consumption by 6.2% on average every year between 2016 and 2020, the most ambitious rate for that period among major markets, according to the International Council on Clean Transportation, an environmental research group.

Some auto makers will be hit harder than others. Take Tata Motors 500570.BY -0.17% -owned JaguarLand Rover, which has profited from selling SUVs, the fastest-selling passenger segment in China. The previous round of targets for 2015 gave heavier cars extra leeway. Under the new proposal, they have to play catch-up. A hypothetical car maker that sells 2.5-ton SUVs has to cut the amount of gas needed to travel 100 km by up to 40% between 2016 and 2020, compared with 31% for a maker that produces only one-ton sedans.

Foreign luxury car makers such as BMWBMW.XE +1.87% and Audi NSU.XE -0.49% face a new challenge. Currently they calculate a combined fuel-economy average for the big models they import and the small ones made locally. Now imports have to be compliant on their own, says Sanford C. Bernstein’s Max Warburton. Another rule takes away allowances for gas-guzzling automatic-transmission cars, hurting foreign brands’ automatic-heavy fleets.

There’s a good chance most of the 2020 recommendations will be implemented, just as most of the 2015 proposals were. An exact time line for the final rules isn’t clear. The car makers with the farthest to go to lift fleet average to the proposed new target are Toyota,7203.TO +0.78% JLR and Daimler’s local venture, according to Mr. Warburton. Still, foreign makers are well positioned to inject new technology, since they’re making similar improvements in other markets like the U.S. That leaves locals such as Great Wall and Geely with the most work to do.

There are winners, too. Brilliance China Automotive‘s CAAS -8.49% joint venture with BMW and Ford’s local venture sport relatively efficient fleets. Then there are the companies that help car makers save fuel. Hong Kong-listed auto-parts supplier Nexteer makes electrical power-steering systems that are more efficient than the hydraulic kind.BorgWarner BWA -1.64% makes powertrains, including the engine, more efficient. And the use of aluminum to reduce vehicle weight should give that metal a boost.

The new fuel standards are ambitious, and could become even stricter should pollution worsen. Car makers that can easily adapt stand to prosper the most from China’s cleaner future.