Zombie hordes thrive, await further hedge fund corpses

April 8, 2014 Leave a comment

Zombie hordes thrive, await further hedge fund corpses

Dan McCrum | Mar 25 10:14 | 4 comments | Share

Part of the NO ALTERNATIVE: THE ZOMBIE HEDGE FUND INDUSTRY SERIES

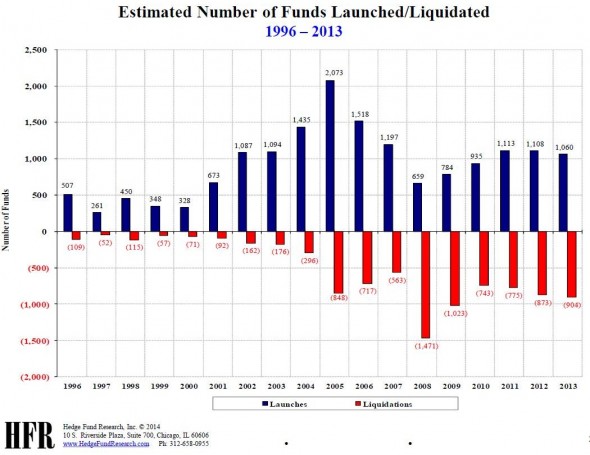

Close to a tenth of all hedge funds tracked by HFR succumbed to the inevitable last year as 904 hedge funds liquidated.

Their historic performance will live on in the databases of hedge fund returns, but like more than two-thirds of all hedge funds that have ever existed, they are dead, defunct and arguing with their investors over valuations for those lingering illiquid assets.

To put that in perspective, half of all individual hedge funds have closed in the last five years. It is exactly what should be expected, given that the average life of a hedge fund which makes it past the 12 month mark is just over five years, but it is a salient fact that seems to escape the promotion of hedge funds as an asset class, a diversifier or a handy set of uncorrelated investment returns.

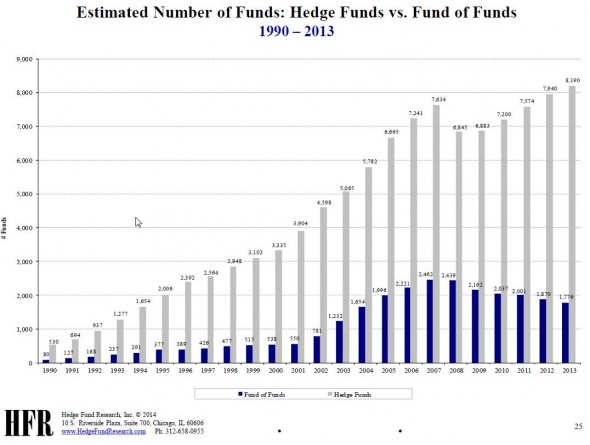

The overall number of hedge funds reporting to HFR has grown, to 8,190 last year from 6,895 at the end of 2008, but only because new funds constantly spring into life.

In the last five years 4,318 hedge funds have closed. If we add on the 1,471 zombies added to the hoard in 2008, that is 5,789 dead funds, set against the 7,634 live hedge funds and 2,462 fund of funds that existed at the end of 2007.

That total of closures includes fund of fund numbers that have shrunk by 686 over the same period, very slim times for fund of fund launches, so the number for individual fund closures looks to be in the 4,000 to 5,000 range.

All of which surely makes the selection problem insurmountable for any pension fund of size. To invest in hedge funds given such turnover means selecting a fresh portfolio of funds every single year. There is a small window after a fund has proven itself (say two or three years) and grown to sufficient size, but before the five year mark at which the average fund becomes a zombie.

Remember also that there is no persistence in returns – good investment performance in one year really has no bearing on investment performance in following years. Oh, and the hedge fund industry as a whole hasn’t produced alpha/added value to simple portfolios for years, since its assets under management ballooned.

But lets say you are an investment consultant paid to advise pension funds on manager selection. One solution would be to focus on the quality of a hedge funds infrastructure as big solid asset gathering funds funds are less likely to become zombies.

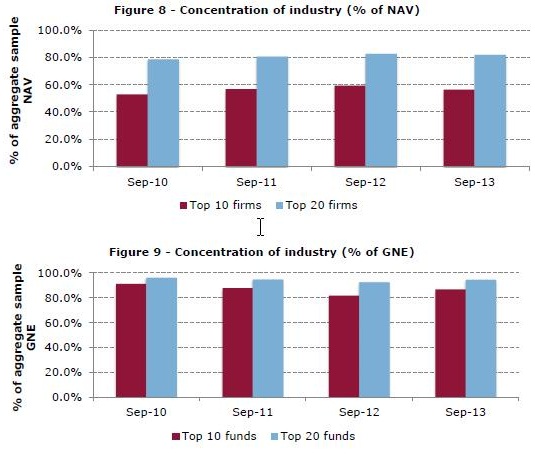

Hence, perhaps, what the Financial Conduct Authority reports in its latest survey of the UK hedge fund industry, capturing 49 firms offering 106 individual funds:

Over time, the industry has become more concentrated. The survey shows that the 20 largest firms control 82% of the sample’s NAV(net AUM). The concentration ratio rises significantly when considering gross notional exposure (GNE) at the fund level. The 20 largest funds account for 94% of the sample GNE. These 20 funds are managed by 12 different firms.

We would be very interested to hear how a portfolio made up of large, broadly based asset gathering hedge funds has fulfilled the promise of diversification, alpha and low correlation (at a portfolio level) on which hedge funds are sold. Given the size of institutional allocations to hedge funds there should be plenty of evidence for this, right?

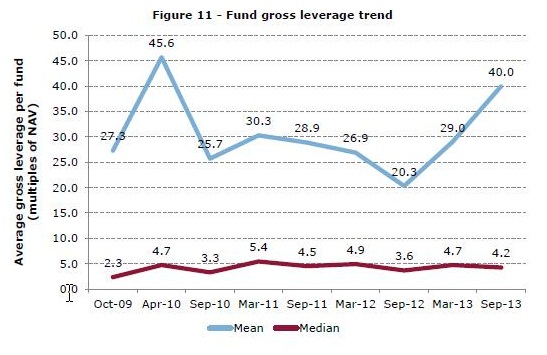

But on that question of survivability, the FCA paper is also interesting for highlighting the very high levels of gross leverage related to interest rate derivatives held by a small number of very large hedge funds.

As shown in the chart above, previous editions of the survey had highlighted a notable deleveraging since 2010-2011 by a small number of large users of leverage – mostly macro funds.

While the median leverage has remained relatively stable on six months ago, the largest funds have increased leverage thus pulling the mean higher. The high speed with which funds can alter their market exposure is an important part of our assessment of the systemic risk posed by this sector.

The increase in leverage at the largest funds over the course of 2013 is mostly due to an increase in Interest Rate Derivative (IRD) positions.

As with derivative books at banks, the gross exposure number is too high, due to contract netting, while the net number is probably too low as an indication of risk.*

What will be very interesting is if there are any shocks to interest rate markets – either one-offs or a faster than expected tightening cycle as in 1994. Zombie-proofness might be tested.