Accounting Trick Helps Banks Dodge Capital Pain

April 11, 2014 Leave a comment

Accounting Trick Helps Banks Dodge Capital Pain

JOHN CARNEY

March 28, 2014 2:43 p.m. ET

Wall Street is a romantic place these days.

Last year, many banks, especially big ones, entered into long-term relationships with their securities portfolios, promising hundreds of billions of dollars of assets will be “held to maturity.” As a result, the banks may appear to have higher book values and be better capitalized in the eyes of regulators even if the value of these securities declines.

That should make investors wary.

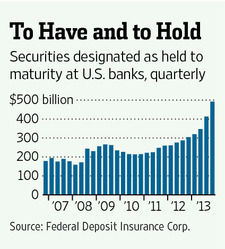

The amount of securities banks pledge to hold to maturity rose last year by 61%, to $492.3 billion. J.P. Morgan Chase increased the amount of securities it designates this way by nearly $20 billion in last year’s fourth quarter.

When securities are classified as held to maturity, they are carried at their original cost, typically face value. Declines in market values hit neither book value nor earnings. Their value is written down only if they are considered to be permanently impaired.

It’s no coincidence this occurred as long-term interest rates started rising, which sends bond prices lower. The greater use of the held-to-maturity classification helped banks to potentially avoid billions of dollars in losses.

That is because most securities held by banks are designated as trading instruments or as being available for sale. In the former instance, gains and losses are based on market values and flow through earnings. In the latter, bonds are marked to market prices, but the change runs through shareholders equity; while earnings aren’t affected, book values are.

But the embrace of held to maturity wasn’t just caused by rising rates. It was also a response to changing capital and liquidity regulations.

Under older rules, unrealized losses on available-for-sale securities didn’t hit capital ratios. Starting in 2015, that will no longer be the case for banks with more than $250 billion of assets.

New liquidity rules add another wrinkle. They will likely require the largest U.S. banks to collectively hold about $2 trillion of liquid assets. So while banks will have to hold additional securities to meet the new requirements, volatility could cause swings in capital ratios. Shifting assets into held-to-maturity buckets helps banks sidestep this problem.

But that isn’t without its own hazards. Ironically, given the liquidity rule is partly driving this, such a shift may actually reduce bank liquidity. That is because accounting rules penalize a company for selling anything deemed held to maturity; so such securities may become less liquid. What’s more, if the value of the assets has declined, the bank would incur sudden losses by selling them. That would be an unwelcome shock to investors and capital ratios.

The bigger problem is that the rise of held-to-maturity holdings risks reviving the old problem of gaps between a bank’s regulatory capital position and its actual financial strength. In a time of market stress, investors might once again start to doubt regulatory measures. That can be lethal for a bank, as many found in the last bout of market turmoil.

Investors, in other words, should be concerned if banks become too infatuated with this form of accounting arbitrage. Playing games like this can lead investors to one day break up with them.