Malaysia’s Asia File zooms in on M&A potential; “We are more of a European business than a Malaysian one now, as two-thirds of our turnover comes from the European market.”

April 11, 2014 Leave a comment

Published: Saturday March 29, 2014 MYT 12:00:00 AM

Updated: Saturday March 29, 2014 MYT 7:23:45 AM

Asia File zooms in on M&A potential

BY LIZ LEE

Lim: ‘We are quite integrated now.’

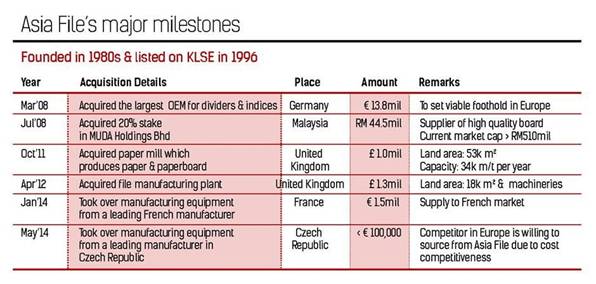

FIVE years since it first went into the European market, stationery maker Asia File Corp Bhd continues to be bullish on the potential for growth there, whether organically or through acquisitions, and its focus now is in continental Europe.

Executive chairman Michael Lim Soon Huat says there were two European manufacturing companies that have piqued Asia File’s interest but any decision to acquire more companies will fall back on synergistic potential.

“We are still looking at more acquisitions and there is one or two manufacturing companies that we are keen on, but we have to see whether they make synergistic sense in our group,” he tells StarBizWeek, noting that the group is concentrating on growing its core business – filing.

Asia File’s target is to make at least one acquisition this year “but the price must be right, too”.

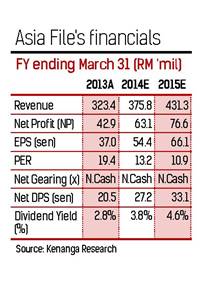

Lim says the group has no plans to raise funds for its European acquisitions as Asia File is in a comfortable position, sitting on a cash reserve of RM65mil.

“We didn’t need to raise capital for our previous acquisitions in the UK and Germany either,” he says of the internally-financed growth, a sign that the company is backed by a healthy balance sheet.

To illustrate the group’s appetite for growth in continental Europe, it wants to expand beyond the two European countries it is already in – the United Kingdom and Germany – where it has three and two manufacturing plants respectively.

On the contrary, the group expects its revenue pie to show domestic sales shrinking over time as more effort is put into growing its international business.

The integrated stationery group, which has been listed since 1996, has evolved its business from a domestic files producer into an international stationery supplier.

“We are more of a European business than a Malaysian one now, as two-thirds of our turnover comes from the European market.”

Asia File manufactures files, dividers, indices as well as waste paper and manila cardboard. It sells mainly to office supply distributors, bookshops, wholesalers, retailers and hypermarkets.

Lim says: “We are quite integrated now as we have established good supply chain management, distributorship, and created value for our customers. The next stage is to utilise our current structure to expand.”

In the United Kingdom, where Asia File first set up base internationally in 1999, the group is now making £31mil (RM169.4mil) in revenue from its UK plants, compared with a mere £400,000 (RM2.19mil) in its 1999 financial year.

Its aggressive overseas expansion only began in recent years as prices fell in the industry, setting a low barrier of entry for the Malaysian company. Asia File’s crowning glory was perhaps its acquisitions of a UK paper mill in 2011 and a manila cardboard plant in 2012 that gave the group a firm grasp on the UK supply and distribution chain.

As Asia File thrived in a market where competitors were reduced from six to one, it also became a valuable supplier to all major filing players in the market.

He adds that expanding into different countries is an important strategy as the group wants to be near its markets, to supply its products efficiently with a just-in-time inventory.

Asia File’s international business now includes exporting to the Netherlands, Belgium, France, Italy, Spain, Germany, Austria and Switzerland.

Domestically, it has three big production plants in Penang, totalling 60,000 sq m, and a smaller plant in Kuala Lumpur with a floor space of 2,300 sq m. These plants supply mainly to the local market.

All Asia File plants always run at 70% capacity.

With a market share of 60% in Malaysia, Lim says he does not want to expand further domestically because “any more and we will hurt our friends in the business. That is precisely what I do not want to do.”

Lim believes in conserving competition in the markets Asia File operates.

No sunset yet

Not many businesses in Europe were spared the impact of the eurozone and global financial crises post-2008; certainly not the stationery industry which was drawn to a near stationary state in their struggle to stay above water.

But as in all crises, there were opportunities and Malaysian-grown stationery maker Asia File had been one to spot the silver lining and seized a golden chance to expand into the European market, despite what people deemed a sunset industry in a digital age.

“Everyone thinks this is a sunset industry but it is not,” Lim said. He would be the first to defend the stationery industry, and let Asia File’s steady growth speak for itself.

“People still use paper, hence filing. Children in their learning stage will always need paper as they can’t completely rely on tablets to develop basic skills,” he says.

In fact, the desktop computer business is more affected by the rise of mobile devices than paper and files are, Lim believes.

Citing global industry outlook, Lim says that the world stationery market will reach US$155.4bil by 2015 what with improving economies in Europe and the United States, which are biggest markets for stationery.

While Asia File has been able to grow through its European acquisitions, this move had proven unfruitful for some other players.

Pelikan International Corp Bhd, which bought German-based stationery companyHerlitz AG in 2010, saw its financial performance dragged down by the subsidiary, making it difficult for the company to return to profitability.

Pelikan subsequently sold off its office product unit Falken Office Products to Swiss manufacturer Biella in 2012.

Biella and Esselte are two major competitors in Europe at this juncture. However, they are not profitable. Pelikan used to be Asia File’s competitor in the European market.