China’s first lady Peng wrote four Chinese characters to Michelle Obama – hou de zai wu – meaning “deep grace and generosity” which sound almost the same as “debt-ridden.” Was Peng trying to remind that America still owes Chin

April 15, 2014 Leave a comment

Debt snub in first lady write-off

Mary Ma

Tuesday, April 01, 2014

US First Lady Michelle Obama has concluded her official visit to China, winning praise from the Western media.

During her week-long trip, she toured Beijing and other major mainland cities with her mother and two teenage daughters. There was even a face-to-face encounter with the terracotta warriors in Xian.

Journalists following Obama’s itinerary called it a subtle success, as she was able to impart insights into American values during many of her activities.

Forgive me for failing to catch the subtlety of such first lady diplomacy – what I see here is a different story.

At the start of her visit, Obama was accompanied by her Chinese counterpart, Peng Liyuan, but only for one day. For the rest of the week, she was left to hop around with her family.

Perhaps her hostess was too busy to spend more time with her because Peng had to accompany her husband, President Xi Jinping, to make friends on an European tour.

It was like a subtle expression, telling the US first lady “be my guest, make yourself at home.”

That’s hardly pleasant. Imagine traveling a long distance to see a friend and wind up being left to go around on your own most of the time. Is that friendship? To an extent, it’s an outright snub.

On the only day that Peng was free to escort Obama around the Forbidden City and a high school in Beijing, the highlight must be the calligraphy session, in which they demonstrated their vastly different brush stroke skills.

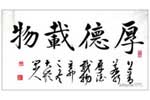

Peng wrote four Chinese characters – hou de zai wu – literally meaning “deep grace and generosity” for the photo op.

But for anyone sensitive enough to detect, Peng’s chosen words were full of double meaning. In Putonghua, they sound almost the same as hou de zhai wu which means “debt-ridden.”

Was Peng trying to give her counterpart a subtle reminder that America still owes the Middle Kingdom a fortune, since the Chinese government is one of biggest buyers of US government bonds?

It can’t be accidental when Obama wrote the Chinese word yong – meaning “eternal.” Was the US first lady informing Peng equally subtly that the Americans would never repay?

Tongue in cheek, it was probably a win-win visit for the Obama couple. Michelle – without her husband Barack Obama around – was able to travel with family, while President Obama may also be happy to be on his own.

While “first lady diplomacy” is common in the West, it was virtually non- existent in China until now. If former presidents Jiang Zemin and Hu Jintao were also accompanied by their wives during overseas visits, they would hardly be regarded as playing the “first lady” functions as normally defined.

Peng, a famed folk and opera singer, is also active in promoting rural education at home, and participating in campaigns against tuberculosis for the World Health Organization, in addition to possessing a sharp fashion sense.