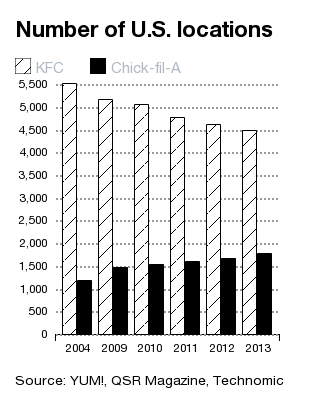

How Chick-Fil-A Is Outselling KFC With A Fraction Of The Restaurants; Chick-fil-A’s sales in 2013 passed $5 billion, compared with KFC’s $4.2 billion; Chick-fil-A has 1,775 U.S. stores, while KFC has 4,491

April 15, 2014 Leave a comment

How Chick-Fil-A Is Outselling KFC With A Fraction Of The Restaurants

ASHLEY LUTZ RETAIL APR. 1, 2014, 1:26 AM

Chick-fil-A has surpassed KFC as the top chicken fast food chain.

Chick-fil-A’s sales in 2013 passed $5 billion, compared with KFC’s $4.2 billion, reportsVenessa Wong at Bloomberg Businessweek.

Chick-fil-A has 1,775 U.S. stores, while KFC has 4,491. Despite a smaller footprint, Chick-fil-A’s average sales are more than triple those of its larger competitor, Wong writes.

And Chick-fil-A achieves these results despite being closed on Sundays for religious reasons.

Wong illustrates a couple of reasons for Chick-fil-A’s success.

1. Breakfast business. Chick-fil-A has a popular breakfast menu that helped elevate sales by 3.6% last year. This is crucial at a time when demand for breakfast is at an all-time high. While KFC also offers breakfast, sales sunk 2% at its locations.

2. Differentiated menu. Chick-fil-A has a menu that is different enough to set it apart from fast food competitors. Popular items include its signature chicken sandwich and waffle fries. However, Chick-fil-A also offers ice cream, milkshakes, and wraps. Long known as a carry-out dinner option, KFC has struggled to find its footing in the fast food space.

Chick-fil-A Stole KFC’s Chicken Crown With a Fraction of the Stores

By Venessa Wong March 28, 2014

The days when fried chicken was synonymous with a certain white-haired southern gentleman are over, at least in the U.S. A new champion has claimed the chicken crown: Chick-fil-A. The Atlanta-based chain has surpassed KFC in total U.S. sales, taking in $5 billion last year to KFC’s $4.22 billion, according to Technomic.

The change atop the leaderboard appears undisputed: Yum! Brands (YUM), which owns KFC and has for years prided itself as “the leader in the U.S. chicken [quick-service restaurant] segment,” removed that very phrase from the company’s most recent annual report. But anyone in the northern half of the U.S. is likely scratching her head and wondering why she hasn’t seen Chick-fil-A outlets opening in the neighborhood. Check out the map below of Chick-fil-A locations, with a heavy concentration in the South.

Source:www.chick-fil-a.com

Last year Chick-fil-A only had about 1,775 U.S. stores to KFC’s 4,491. Yet in dollar terms the Colonel is coming up short even with that much larger footprint: Chick-fil-A’s 2013 sales exceeded its larger rival’s by nearly $800 million in the U.S. in 2013. And that’s with zero dollars coming in to Chick-fil-A on Sundays, when every restaurant is closed.

What Chick-fil-A lacks in store count, it makes up for in traffic. Each restaurant madeabout $3.2 million in 2013, more than three times as much as the average KFC at $938,000. Average sales at KFC restaurants have remained largely unchanged over the past decade, while they have climbed steadily at Chick-fil-A. Same-store sales climbed by more than 3.6 percent at Chick-fil-A last year; KFC’s fell by 2 percent.

KFC hit its U.S. peak by store count around 2004, when it had more than 5,500 restaurants—over four times the number of Chick-fil-A locations—and claimed 46 percent of the fast-food chicken market. But over the past decade the gap between the two narrowed as KFC closed stores and Chick-fil-A added more. Now, KFC’s storefront advantage is just 2.5 times more than its rival, and Chick-fil-A plans to chip away with more than 100 new locations opening this year. (A representative for KFC did not immediately respond to a request for comment.)

Darren Tristano, an executive vice president at consultancy Technomic, called Chick-fil-A one of the most successful fast-food chains. He cited the sizable breakfast business, an average check slightly higher than competitors’, and a menu that differentiates it from the big burger chains.

And fast-food chicken fans outside the South may not be puzzled by Chick-fil-A’s hegemony for long. A spokesman mentioned plans for locations in the “northern, Midwest, and western states,” where the company is now focusing its growth plans.