Lotte Group’s move to enter the beer market will challenge Oriental Brewery (OB) and HiteJinro and bring stiffer competition

April 15, 2014 Leave a comment

Posted : 2014-03-31 15:20

Lotte to challenge OB, HiteJinro

By Choi Kyong-ae

Lotte Group’s move to enter the beer market will challenge Oriental Brewery (OB) and HiteJinro and bring stiffer competition, analysts said Friday.

Lotte Chilsung, the liquor and beverage affiliate of the retail giant, said it will jump into the beer market this month not only to compete with the two dominant beer companies in Korea but also to diversify its business portfolio.

“We will make our entry with a lager-type beer in late April or early May,” an official at Lotte Chilsung said. “As beer will be distributed through our countrywide sales networks for soju, we expect the established supply chain will help boost sales.”

Soju is Korea’s traditional distilled liquor. Lager is beer made with a bottom-fermenting yeast that can withstand cold temperatures, creating beer that is clearer and crisper than ale. Ale is beer made with yeast that thrives at warmer temperatures, producing complex fruity flavors.

To start beer production, Lotte Chilsung has invested 200 billion won ($187 million) to build a 50,000-kiloliter-a-year plant last year in Chungju, 140 kilometers southwest of Seoul. It plans to spend an additional 700 billion won by 2017 to expand the annual capacity to 500,000 kiloliters, the official said.

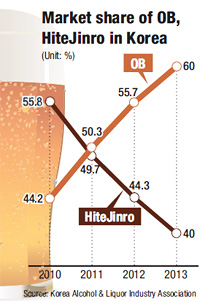

Lotte’s initial output volume will not be big enough to reshape the domestic beer market controlled by OB and HiteJinro. But its expansion may pose a threat to the two bigger rivals in the long term, analysts said.

“Lotte’s entry could help increase the size of the beer market,” OB President & Chief Executive Jang In-soo said in a press event held Wednesday.

HiteJinro Managing Director Mickey Lee said Friday that the company will strengthen its product lineup by launching a new lager-type beer soon and boost sales networks to consolidate its market share.

“Focusing on profitability is important because competition is getting tougher among beer makers to lure price-sensitive consumers,” Lee said by phone.

For continued growth, OB and HiteJinro said they will make inroads into new markets, particularly Southeast Asia. Their overseas business operations have yet to contribute much to their bottom lines.

Korea is a 2 trillion won beer market which sells 2 million kiloliters a year of beer. In 2013, OB and HiteJinro took a combined 95 percent of the market, with the remaining 5 percent claimed by import beer brands, according to KDB Daewoo Securities.

Lager makes up 94 percent of the beer sold in Korea, followed by ale with two percent and the remainder by other kinds, the brokerage said. HiteJinro launched the “Queen’s Ale” here in September and OB’s “Aleston” will go on sale today.

“Faced with consumers’ growing appetite for premium import beers, OB, HiteJinro and Lotte are moving to cement leading positions, upgrade existing lineups and entering the market, respectively,” KDB Daewoo analyst Baek Woon-mok said.

Beer consumption has risen sharply at the expense of whiskey in recent years. Whiskey imports fell by more than 18 percent in 2013 compared to 2010, but beer imports soared 95 percent during the same period, Korea Customs Service said.

“Import beer has posted an annual sales growth of more than 20 percent in the three years through 2013,”said Park Sun-hyun at Hana Daetoo Securities. “Its market share likely rose to over 10 percent last year from 3 percent a year earlier on premium quality, lower prices and aggressive promotions.”

In Korea, HiteJinro has three beer plants that produce 1.6 million kiloliters a year and two soju factories.

OB runs three plants here to annually produce 1.4 million kiloliters of beer. The two earn more than 90 percent of their sales from the domestic market.

HiteJinro Holdings owns 54 percent in HiteJinro and OB is wholly owned by Belgium beer giant Anheuser-Busch InBev.

Meanwhile, Shinsegae Group said last week it was considering producing beer in small volumes.

“We don’t have any immediate plan to build a beer plant. We will produce beer not to compete with OB and HiteJinro but to provide it to our affiliates for their own business purposes,” a Shinsegae official said.