Posted : 2014-03-31 18:51

Time bomb ticking on local government debt

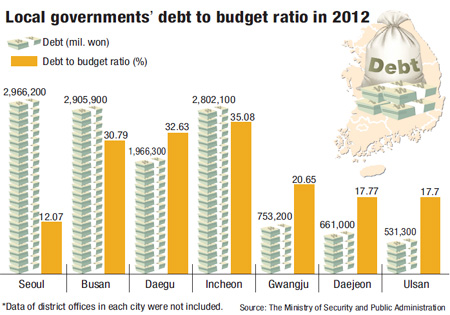

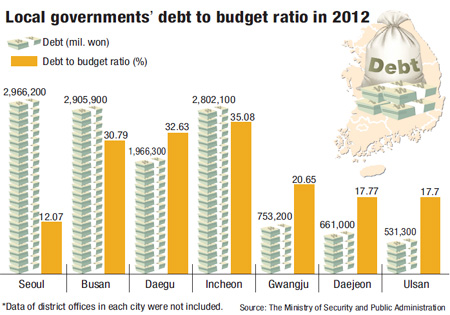

This is the last of a three-part series ana- Local governments’ debt to budget ratio in 2012 lyzing the seriousness of Korea’s debt problem and suggesting recommendations to address the issue. — ED.

By Nam Hyun-woo

Incheon and several other local governments are on the verge of bankruptcy as they are sitting on record debt from heavy borrowing to fund various construction projects.

This poses a grave threat to the fiscal soundness of the entire country, reaching a point where they cannot service the debt on their own.

Still, heads of local governments and candidates bidding for June 4 local elections are competing to make rosy, unrealistic campaign pledges, dimming prospects of addressing the snowballing debt.

“It’s a ticking time bomb for some administrations, such as Incheon and Gyeonggi Province,” said Lim Suhng-bin, a professor at Myongji University.

Lim said many local governments’ debts have reached a “dangerous level.”

He said if the debt exceeds 15 percent of their annual budget, it is a warning sign.

“The issue is more serious than it appears, when you look at Incheon,” he said.

Analysts said that the ultimate victims of local governments’ shaky finances are taxpayers as they will be forced to pay more to fill empty coffers.

As of 2012, the total debt of local governments reached 47.7 trillion won ($44.2 billion), according to the Ministry of Security and Public Administration (MOSPA). However, this tops 100 trillion won, if the 52.4 trillion won owed by public companies run by them is added.

The central government is well aware of the “100 trillion won ticking time bomb,” and seeks to address it. However, central and local governments differ widely on how to solve the problem.

Incheon ― a bottomless pit

“Most local governments’ fiscal condition is very bad as a result of unnecessary and redundant projects which wasted a massive amount of taxpayers’ money,” the Board of Audit and Inspection (BAI) said in a recent report.

Incheon, the nation’s second largest port city, has fallen into a bottomless pit of debt after years of issuing bonds to raise funds for loss-making development projects.

According to MOSPA, the city‘s debt stood at 2.8 trillion won against its 8 trillion won fiscal budget in 2012, resulting in a debt-to-budget ratio of 35 percent. This is the highest among all cities in Korea, except for Sejong, a newly-built city for a government complex.

Due to the debt, the city government had to delay paying parts of monthly salaries to 6,000 of its employees in 2012.

Last year, it also postponed 1.9 billion won in salary payments. This time, it blamed a “systematical error,” but many are suspicious that the city is slipping deeper into a financial abyss serious enough as to make it unable to pay employees.

The city was not in the worst fiscal condition from the beginning. In 2003, the debt-to-budget ratio was 17.5 percent. It jumped to 29.8 percent in 2009 and 35 percent in 2012.

Former Incheon Mayor Ahn Sang-soo, who took the helm of the city from 2002 to 2010, is deemed responsible for this. Under his leadership, the city government, led by the IDTC, aggressively issued bonds to develop a free economic zone in Songdo beginning 2003, which houses some 510,000 people and infrastructure worth 21.4 trillion won. It also launched a new town project near Geomdan-dong and refurbishment plans for some 220 areas in old downtown.

Furthermore, for the Incheon Asian Game, scheduled this summer, the city issued nearly 1 trillion won of bonds to fund the construction of the main stadium and other preparations.

Officials from Incheon say that the central government should also take responsibility for its debt problems.

“There were bonds that we had to issue to help the central government boost the overall economy,” an official said. “During the past several years, we also had to issue bonds because of the Asian Games and building another subway line.”

The official said that Incheon will curb issuing bonds from this year and reimburse debt by selling city-owned properties.

Despite growing debt, many other local governments are carrying out massive building projects.

The southern city of Cheongju, North Chungcheong Province, recently tried to push forward with a 644 billion-won plan to build a high technology industrial complex in the city.

The state auditor, however, issued a warning to the city government for its “clumsy” feasibility study for justifying the “unnecessary” project.

The Seoul Metropolitan Government, sitting on a 2.9 trillion won of debt, was also stopped by the auditor in its attempt to create a 34 billion won park on Mt. Soomyung, which was deemed an “unnecessary project.”

Bankruptcy system for local governments

As local governments’ debt keeps swelling, the central government is belatedly attempting to tackle the issue.

President Park Geun-hye’s latest pledge to rationalize state-invested public companies is also aimed at reducing their debt before it is too late.

The Park administration is considering introducing a bankruptcy system for debt-ridden local governments to hold them responsible for fiscal deficits and force them to take steps to cut their debt.

Under the paln, such administrations would be declared bankrupt when they are unable to pay their debt. The central government will pay off their debt instead and take control of their budget execution.

Some analysts expect that this will help tighten lax management in local administrations. But others are strongly opposed to it.

Professor Lim urged the central government to introduce the bankruptcy system because it is aimed at reviving local administrations through programs similar to court receivership.

He said local governments must be stopped from continuing their reckless investments in non-profitable projects.

“Many local administrations push for irrational projects and run up a massive amount of debt. The central government should stop them from conducting such projects, otherwise their debt could deal a huge blow to the fiscal soundness of the whole country,” Lim said.

Some analysts, however, expressed concerns that the central government should consider structural problems such as the tax system before enforcing the bankruptcy plan.

They say local governments’ tax revenue sources are too small to strike a balance between development and fiscal soundness. Of the nation’s total tax revenue, comprised of national and local tax, local governments make up only 20 percent and the central government 80 percent.

“Introducing the bankruptcy system without considerations of systematic shortcomings would deal a serious blow to local government autonomy,” said an official from the National Council Association of Chairmen, a group of local council chairmen. “Under the current system, local governments have to rely on debt.”

The central government’s efforts to promote social welfare services is also a burden, because extra costs needed for expanded services have to be shouldered by local administrations.

“Before denouncing lax management, the central government should revise the taxation system, or at least come up with other measures that can raise local governments’ financial independence,” said the official. Read more of this post