China Banks Manage Debt Levels With Loan Rollovers; China’s banks are among the world’s healthiest and most profitable, based on their financial statements. But investors aren’t convinced; Hands-On Bavarian Count Presides Over a Pencil-Making Empire

December 5, 2013 Leave a comment

China Banks Manage Debt Levels With Loan Rollovers

Regulators Discourage Banks From Rolling Over Troubled Loans

CYNTHIA KOONS

Updated Dec. 3, 2013 5:32 a.m. ET

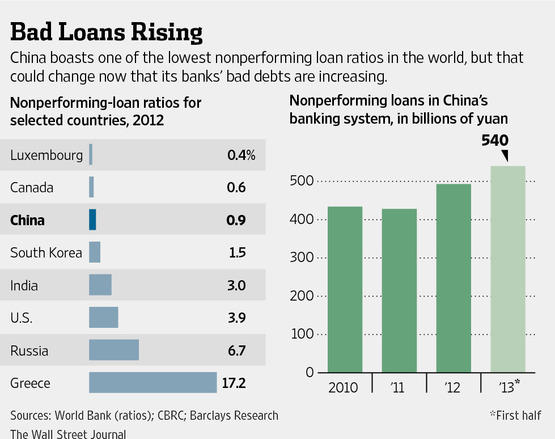

China’s banks are among the world’s healthiest and most profitable, based on their financial statements. But investors aren’t convinced. Nonperforming loans account for less than 1% of total loans, a ratio that has been falling in recent years and is now one of the lowest in the world, according to World Bank data. Despite this, price-to-book values of the country’s leading banks have been declining over the past few years, reflecting worries about deteriorating credit quality in China.“People are very skeptical about the [nonperforming loan] ratios,” said Jim Antos, a banking analyst at Mizuho Securities. “The market is saying: ‘We just don’t trust the credit quality trends in China.”

The reason China’s bad debt levels are so low boils down to the tendency of the country’s banks to routinely extend and restructure loans to borrowers, or sell them off, rather than admit they’ve gone bad, analysts say. While that practice is common in the west and was a major source of concern during the financial crisis, it is increasingly prevalent in China, where lending has been booming over the past five years. In the U.S., bad loans are 3.9% of total loans.

“There is a culture of rolling things over when they come due at least once, often more,” Fitch analyst Charlene Chu said. In rolling a loan, a bank can renew the debt or push out the repayment deadline. “In fact, one of the main functions of China’s shadow finance system is to provide temporary credit to facilitate rollovers and interest payments,” she added.

The country’s regulators discourage banks from rolling troubled loans, in an effort to ensure that asset-quality data accurately reflects reality. But the sheer volume of loans this year indicates much of the debt in the system is being rolled over, according to Ms. Chu. In China’s banking system, 9.5 trillion Chinese yuan ($1.6 trillion) of new loans will have been given out this year, even after repayments are taken into account, by Fitch’s estimates. Fitch predicts that this year, more than 10 trillion yuan of additional credit will be extended through shadow banking, a system of loosely regulated nonbank lenders like trust companies and pawnbrokers. Banks don’t disclose data on rolled-over loans.

Banks need a reason to roll over a loan, particularly if a company can’t repay it. But there are ways around the hurdle. “If you can demonstrate other banks are willing to provide the loans to repay yours, then that’s a justification for a bank to continue giving a loan,” Barclays analyst May Yan said.

Take China’s Yingli Green Energy Holding Co., the world’s biggest solar panel maker by sales, which managed to roll over debt even as a glut of solar panels from China has pushed down prices. The company successfully rolled about $1.3 billion of debt that was due in 2012, most of which was owed to Chinese banks, according to filings. The company has been able to extend its debt despite reporting losses for more than two years, and it had $1.2 billion in short-term debt outstanding at the end of September. A company spokesman said management is confident they will be able to roll over its debt this year with Chinese banks.

When they do roll over loans, Chinese banks do it in creative ways. They use the funds raised through the sale of bonds and trust products to repay bank loans, analysts and industry players say. And to avoid restrictions on rolling over loans, banks cooperate with informal lenders which provide bank customers with short-term loans with high interest rates that are used to repay the bank loan on the understanding that the bank will issue a new loan two or three weeks later. Such behavior can, in some instances, lead to bigger corporate debt burdens.

“You look at the data and it just starts to get ridiculous how high some of the debt burdens are and that can’t go on into infinity,” Fitch’s Ms. Chu said. “But over the short-term there’s nothing to say that this has to end right now and a lot of it comes down to banks’ willingness to continue to extend and rollover credit.”

China’s economic slowdown has started to hurt industries like shipbuilding, steel and solar power, as well as the more developed east coast, home to major urban centers like Beijing and Shanghai. Nonperforming loans in the first six months of 2013 rose 22% on the east coast from the final six months of 2012, while nonperforming loans in the rest of China declined 5%, according to Bernstein research.

Nonperforming loan ratios, which have been falling since the late 1990s, are starting to rise. Total NPL formation shot up 70% in the first half of 2013 and maintained that pace of growth over the third quarter, according to Barclays’ Ms. Yan. This comes as the government is working to rein in lending: In October, net local currency loans extended in China totaled $83 billion, down 36% from the month prior and the lowest monthly figure all year.

Apart from rolling over bad debt, banks have also successfully sold off soured loans to keep their NPL ratios low. For instance, in the first half of this year, China’s fifth-largest listed bank, Bank of Communications Co. 3328.HK -1.55% , sold 5.1 billion yuan (US$837 million) of bad loans to an asset-management company that is designed to buy nonperforming loans from banks. The bank’s NPL ratio would have climbed to 1.15%, rather than the 0.99% the bank ended up reporting, had they not done that, Bernstein analyst Mike Werner said, adding: “NPL disposals were the key for Bank of Communications to keep NPL balances in check.” Bank of Communications declined to comment on this matter.

There have been other examples of banks that have sold off bad loan books but information is sparse, Ms. Yan said.