Dollar-and-Cents Secrets of Music Streaming; Staying Power Is More Important Than Bursting on the Scene

December 25, 2013 1 Comment

Dollar-and-Cents Secrets of Music Streaming

Staying Power Is More Important Than Bursting on the Scene

ETHAN SMITH

Dec. 23, 2013 7:29 p.m. ET

In the good old days of the CD boom, the music industry was all about the first week. Prime the pump with endless airplay on pop radio and MTV, blanket major markets with billboard ads and buy acres of promotional space in big record stores, with a crescendo toward the release date.Even as digital downloads have started to supplant CD sales, a strong debut remains critical, particularly for the big stars. Witness Beyoncé’s recent coup selling more than 1 million copies of her latest album during its first week in Apple Inc. AAPL +3.84% ‘s iTunes Store—using strong online buzz in place of normal promotion.

But as the industry starts to embrace digital services that let fans rent access to vast libraries of songs for a flat monthly fee, major labels may need to adjust their approach to marketing music, and perhaps to which artists they sign, Spotify AB, Pandora Media Inc. P +5.64%and a host of less-known competitors pay record labels and artists every time a user listens to one of their songs. So instead of trying to sell a $15 CD at Tower Records, or even a 99-cent download on iTunes, labels need to get fans listening to a given song or album for years to come. Spotify set off a flurry of back-of-the-envelope math when it recently disclosed on its website that its average payments amount to tiny fractions of a cent per song. Some pundits quickly concluded that a Spotify user could never listen to a song or album often enough to generate the same revenue that a download sale would. But that missed the point. Data reviewed by The Wall Street Journal showed that one major record company makes more per year, on average, from paying customers of streaming services like Spotify or Rdio than it does from the average customer who buys downloads, CDs or both.

The average “premium” subscription customer in the U.S. was worth about $16 a year to this company, while the average buyer of digital downloads or physical music was worth about $14.

Other data from the same company showed that in the long run, even many individual albums eventually make more money from streaming services than they do from downloads.

Underscore that phrase, in the long run.

The acts were identified in the data only with generic descriptors. When they first hit the market, all the acts’ albums made more money from download or physical sales than from streaming.

It took 34 months for an album by an “indie rock/pop group” to make more money from streaming than from sales. An album by one “modern male R&B rapper” reached that juncture after just four months.

In both cases download revenue flattened as sales flagged, while streaming revenue continued to climb as people kept listening to the music.

Notably, pop acts, which tend to rely on heavy marketing, were the least likely to see the revenue from streaming services exceed sales revenue. That is because online listening—and therefore revenue—tended to level off for those types of acts at about the same rate as their sales.

In Sweden, where streaming subscription has overtaken downloading as the most popular method of acquiring music, the difference is more pronounced.

An average premium subscriber there is worth about $17.75 to the company, versus less than $4 for the handful of people who still buy music.

The lesson for record companies and artists appears to be: making disposable hits may once have been a viable business, but new technology could demand tunes built to last.

—Ethan Smith is The Wall Street Journal’s bureau chief in Los Angeles. The Upshot is a business column by bureau chiefs around the globe that offers timely analysis of the industries they cover.

Scores of Music Services Stream Into Crowded Field

Many of the New Models Will Focus on Genre

HANNAH KARP

Dec. 23, 2013 7:21 p.m. ET

The number of music-streaming services is set to explode next year, as record labels have warmed up to the idea of renting consumers access to a vast collection of tunes, rather than selling them individual albums or songs.

Dozens of companies—from household brands to music-focused startups—plan to begin offering new services in 2014, according to companies that they have hired to help launch and operate them.

In some ways, the new crop will differ from Spotify AB and its existing competitors, most of which provide unlimited access to 20 million tracks for about $10 a month. They also will differ from custom radio services like Pandora Media Inc. P +5.64% and iHeartRadio, from Clear Channel Communication Inc., that let users create “stations” based on their own taste.

Next year’s models will feature more genre-focused services, which can bring down the subscription price because of the narrower catalog.

A niche service could charge as little as $2.99 a month, while others might allow fans to subscribe for just a week at a time. Some may offer discounted access to music catalogs by not including new releases, said Frank Johnson, chief executive of MediaNet Digital Inc., a Seattle company that will help bring more than 50 new streaming services to market next year.

The aim is to bring a wider range of consumers into the world of music streaming, which remains far less popular than downloading music from online stores such as Apple Inc. AAPL +3.84% ‘s iTunes or Amazon.com Inc. AMZN +0.18%

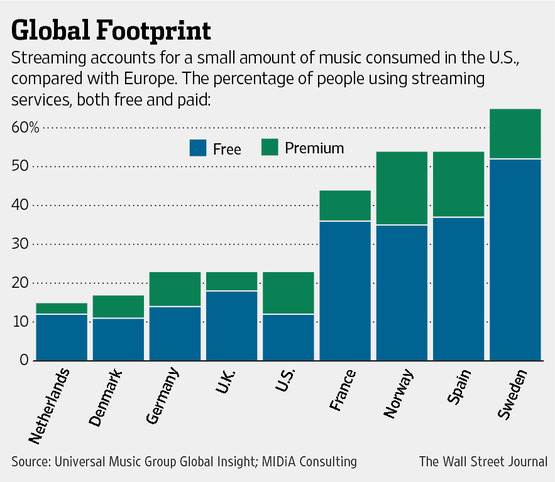

About one-third of the world’s music consumers have used music-streaming services of some kind, but only around 10% of music consumers have paid for such a service, according to a recent report commissioned by Vivendi SA VIV.FR +0.11% ‘s Universal Music Group and conducted by Midia Consulting.

The total U.S. retail market for music is about $7 billion annually. In 2012, subscription streaming accounted for $571 million, according to the Recording Industry Association of America. (That streaming figure doesn’t include Internet-radio services like Pandora that use blanket licenses.)

While Spotify and Pandora have built sizable followings, many of the other existing competitors in subscription-based music-streaming services have failed to gain significant traction, and few disclose subscriber numbers. Current services include Rdio, Sony Corp.’s 6758.TO -1.26% Music Unlimited, Rhapsody and Rara, a London-based service that entered the U.S. in 2011 and is now integrated into a range of BMW cars.

That is an encouraging fact for new music-streaming startups. “The percentage of the population that uses these is still really small,” said Mr. Johnson of MediaNet. “There’s a long way to go before you saturate the market.”

Of course, down the road there could be a painful shakeout. Meanwhile, the flood of new entrants highlights how record companies have embraced the business of renting music to people online, even though some believe the new approach could cut into sales of downloads.

By giving so many newcomers the rights to use their music, the labels are betting that subscription services can help return the industry to prosperity and attract fresh investment with more predictable, if modest, returns that come from reliable monthly fees instead of volatile record sales.

It has the makings of a monumental shift for an industry known for clinging to its old ways, and one that notoriously failed to create a sustainable digital business model when fans starting sharing music on sites like Napster more than a decade ago. Since then, U.S. recorded music sales have plunged nearly 43%, according to Nielsen SoundScan. Revenue from streaming and subscription services—$1.25 billion world-wide last year—has helped to curb further declines since 2011.

Music executives expect revenue growth from subscription services to quicken if more wireless carriers and cable-TV providers start bundling music subscriptions into customers’ monthly plans. Such bundling has been attempted around the world with uneven success. About a quarter of Leap Wireless International Inc. LEAP +0.12% ‘s Cricket Wireless customers subscribe to a plan that includes a subscription to Muve Music, for example—but it is still challenging to convince telecoms that adding music will reduce customer defection rates.

Despite their enthusiasm, big record labels don’t always make it easy to license their music. The process can still take at least a year, technology executives say, and they often demand large, upfront guarantees. But there are now a handful of companies that help aspiring music streamers navigate the process.

London-based 7digital Ltd. has launched music-streaming services for Samsung Electronics Co. 005930.SE -1.26% and Pure, a British consumer-electronics maker owned by Imagination Technologies Ltd. IMG.LN +1.83% that began selling its new sound systems—embedded with on-demand streaming—last month in U.S. stores.

Vickie Nauman, president of 7digital, expects to bring at least three more services to market next year. Ms. Nauman, who negotiates with record companies on clients’ behalf for the rights to use their music, declined to name them but said that one was focused “on a very specific type of audience” and another on a particular type of music.

Fans of country music, blues and jazz, classical and opera have been particularly underserved by streaming services so far, said Ms. Nauman, as has “the casual music listener—the person who really just wants a button and doesn’t want to make a playlist.”

“You look at all of these services, they’re almost all exactly the same, targeting exact same consumers. You don’t have to be a genius to say, what sense does it make to try to do the same thing? We’re trying to filter companies by how they’re bringing audiences into the market that aren’t already on these.”

The risk, she said, is that “if a person subscribes to a service and it fails a year later,” sites that offer free music could begin to look more attractive, and streaming could lose its momentum.

Beats Electronics LLC, the headphone maker founded by music mogul Jimmy Iovine and rap star Dr. Dre, aims to address that issue with the January launch of a service called Beats Music. It will focus on guiding mainstream audiences to music they know and helping them discover new music.

Google Inc. GOOG +1.32% ‘s YouTube is planning to roll out its own music-streaming service that will let paying subscribers watch music videos without ads. The YouTube service also will serve up music without video and allow mobile users to stream tunes while texting or surfing the Web. Google launched another, music subscription service, Google Play All Access, earlier this year. Subscribers will automatically get access to the forthcoming YouTube service as well.

Another service, France’s Deezer, plans to launch in the U.S. next year.

I think all these new services just mean there will be an eventual die-off of most of them. Just the strongest will survive in the end. Even some of my favorites like torch music probably won’t make it in the end. But all this competition means great deals for us the consumers, so I guess we should be happy for that.