The Hazards of Betting on M&A in Asia

April 10, 2013 Leave a comment

Updated April 9, 2013, 2:14 p.m. ET

The Hazards of Betting on M&A in Asia

By ISABELLA STEGER And CYNTHIA KOONS

The collapse of Sichuan Hanlong Group’s acquisition of Australia’s Sundance Resources SDL.AU -2.73% —news that sent the iron-ore miner’s share price tumbling—has highlighted the challenges faced by hedge funds seeking to bet on such deals in Asia.

“The market has been saying for some time that the deal is probably off,” said Tom Elliot, chief investment officer at Beulah Capital. On Monday, Sundance said it terminated an agreement to be acquired by Sichuan Hanlong.

The collapse of the deal has burned hedge funds that have bought into Sundance, people with knowledge of the funds’ positions said, without identifying them. Hedge funds use merger-arbitrage strategies such as buying shares in a company that is being taken over at below the offer price, in hopes that the deal will be completed, yielding a profit.

“As far as I can tell, the hedge funds have not been able to fully exit the stock,” Mr. Elliot said.The deal fell apart following the arrest in late March of Liu Han, owner of Sichuan Hanlong, a Chengdu-based conglomerate, in connection with allegations by police that he harbored a younger brother, Liu Yong, who Chinese authorities suspected of murder. Liu Han’s situation since his arrest, and his whereabouts, are unclear. Liu Yong, who has also been arrested, couldn’t be reached following Liu Han’s arrest.

Hanlong hasn’t responded to requests for comment about the elder Mr. Liu’s arrest. Company staff didn’t return a call seeking comment on the collapse of the Sundance deal.

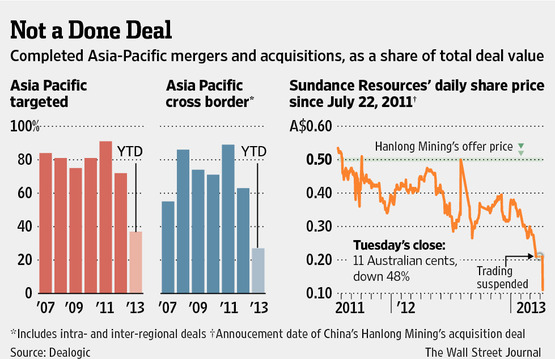

Sundance’s shares fell 37% even before the deal collapsed, pressured by the renegotiation of the deal to 45 Australian cents a share in late August. Only in late November and on one day in January did the stock trade within 15% of the offer price. When Sundance’s shares resumed trading Tuesday, they tumbled to 11 Australian cents, roughly half their price before trading was halted on March 19.

Hedge funds haven’t found it easy to profit from merger-arbitrage strategies in Asia. Unlike developed economies with established rules governing cross-border deals, the region is home to developing economies that are still fine-tuning economic regulations. Patience is also essential in much of the region: Some deals in Asia can take more than a year to complete.

Australia, however, has historically been the dominant market in the region for hedge funds betting on mergers because of its consistent rule of law, deep capital markets and mature industries. But the rise of investment from Chinese buyers has introduced a new element of risk.

“Execution risk is higher on cross-border deals in certain Asia jurisdictions, particularly if there is some level of government involvement,” said Ben Williams, Asia-Pacific head of financing sales at Bank of America Merrill Lynch.

There is a growing roster of transactions that are dragging on in Asia. The completion rate of deals in the Asian-Pacific region fell to 72% last year, down from 91% in 2011, according to Dealogic. It was the lowest completion rate in the region in more than 10 years.

Sundance and Hanlong’s deal isn’t the only one to fall apart this year. A consortium that had lined up to buy Hong Kong-based Next Media Ltd.’s 0282.HK -1.18% Taiwan television and print operations for $540 million let the agreement lapse ahead of a deadline late last month.

Other high-profile deals have been slow to close. Singapore’s DBS Group HoldingsLtd. D05.SG -0.13% unveiled plans to acquire Indonesia’s PT Bank DanamonBDMN.JK 0.00% for $7.3 billion more than a year ago, but that deal has been held up by regulators due to cross-border politics.

Another long-running deal is the proposed merger of two chip makers in Taiwan,MediaTek Inc. 2454.TW +0.43% and MStar Semiconductor Inc. 3697.TW -0.80% The deal was unveiled about nine months ago, but encountered concerns over competition issues. Having recently received regulatory approval in South Korea, it still awaits approval from China’s Ministry of Commerce, forcing MediaTek to push the completion date to Aug. 1 from May 1. The date had already been pushed back from Jan. 1.

That isn’t to say hedge funds have been scared away from betting on mergers altogether. “If an attractive deal was announced tomorrow, would hedge funds be in it? Yes. But would they put a significant percentage of the portfolio into any one deal? No, I don’t think so.” Mr. Williams said before the Sundance deal fell through.