China’s New Leaders, New Credit Binge; China’s economy has new leaders, not yet new ways. A surge in lending and capital inflows in the first quarter may be a precursor for tightening down the road.

April 11, 2013 Leave a comment

April 11, 2013, 3:13 a.m. ET

China’s New Leaders, New Credit Binge

By TOM ORLIK

China’s economy has new leaders, not yet new ways.

The first quarter brought a surge in credit creation. Total social finance, a measure that includes new loans as well as bond issuance and other forms of credit, increased 6.2 trillion yuan ($1 trillion)—a record high. China’s stash of foreign exchange came in at $3.44 trillion at the end of March—up $128.4 billion for the quarter after tepid increases in 2012.

It all looks like a throwback to China under its previous set of leaders. The People’s Bank of China is in the markets buying dollars, resulting in larger foreign-exchange reserves and more liquidity in the financial system. That should certainly allay fears about China’s growth. A 58% year-on-year increase in new finance will surely prop up an expansion in output above the government’s 7.5% target.

By extending the policies of previous Chinese leaders, though, Beijing exacerbates the risk of inflation and asset-price bubbles. Consumer price inflation for March came in at a moderate 2.1% year on year. But massive increases in credit can only add to the upward pressure on prices.

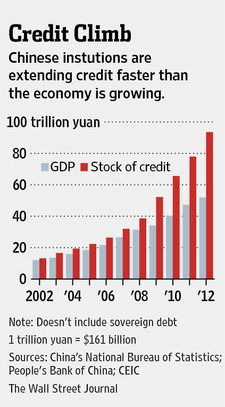

Equally worrying is the rapid rise in the ratio of credit to gross domestic product. That measure has moved from 120% in 2007 to about 180% at the end of 2012. On the current trajectory, it will end 2013 at 200%. Such a sharp shift raises concerns about the possible misallocation of credit on a grand scale, and a buildup of bad assets in the banking sector.

The central bank’s recent efforts to restrain credit growth have been limited to timid attempts to drain liquidity from the financial system. To head off problems down the road, much more aggressive moves will be required. A surge in lending and capital inflows in the first quarter may be a precursor for tightening down the road.