The True Chinese Credit Bubble: 240% Of GDP And Soaring

April 12, 2013 Leave a comment

The True Chinese Credit Bubble: 240% Of GDP And Soaring

Tyler Durden on 04/11/2013 15:54 -0400

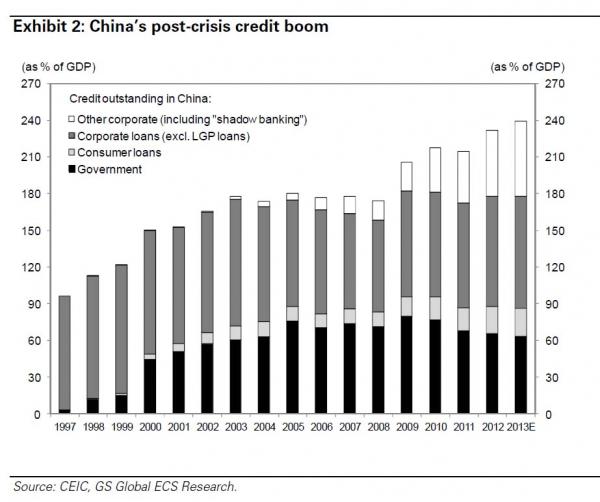

Several months ago we pointed out something not fully grasped by the broader public: the Chinese corporate debt bubble is the largest of any developed and developing country, and at 151% of GDP (and rising rapidly) is the biggest in the world. What is better known is that corporate debt is just one part of the total debt picture, which also includes consumer loans, government debt and other “shadow debt” credit in the case of China. So how does China’s true debt picture as a percentage of debt look? As the chart below from Goldman shows, in 2013 the total credit outstanding in China is expected to rise to a whopping 240% of GDP, and continue rising from there at an ever faster pace. What is even more concerning is that in order to maintain its breakneck economic “growth” of ~8% per year, China has to continue injecting massive amounts of debt, the so called “credit impulse” or “flow” which according to assorted views, is what is the true driver of an economy, and where GDP growth is merely a reflection of how much credit is entering (or leaving) the system. The chart below shows that total Chinese social financing flow just hit a record for the month of March. Completing the picture is the estimated economic response to a surge in credit. As the last chart shows, in China the biggest benefit to a surge in flow is felt in the quarter immediately following the credit injection, as one would expect, with the effect tapering off and even going negative in future quarters, thus requiring even more debt creation to offset the adverse impacts of prior such injections. What should become obvious is that in order to maintain its unprecedented (if declining) growth rate, China has to inject ever greater amounts of credit into its economy, amounts which will push its total credit pile ever higher into the stratosphere, until one day it pulls a Europe and finds itself in a situation where there are no further encumberable assets (for secured loans), and where ever-deteriorating cash flows are no longer sufficient to satisfy the interest payments on unsecured debt, leading to what the Chinese government has been desperate to avoid: mass corporate defaults. At that point it will be up to the PBOC to do what the Fed, the ECB, the BOE and the BOJ have been doing: remove any pretense of money creation via the commercial bank complex (even if these are merely glorified government-controlled entities), and proceed to outright monetization of de novo created assets, thus flooding the system with as much money as is needed to preserve the illusion of growth. Naturally, with the Chinese stock market having proven itself to be a horrible inflation trap (and as a result the bulk of new levered money creation goes into real estate), the inflation explosion that would result would be epic. At that point the chart of the price of gold (in any currency) due to on the ground demand for capital preservation will make the Bitcoin chart pre-bubble pop, seem outright flat.