TIPS Investors Rush for Exit

April 17, 2013 Leave a comment

April 16, 2013, 8:48 p.m. ET

TIPS Investors Rush for Exit

Treasury Inflation-Protected Securities Lose Favor as Fears of Rising Prices Ease

By CAROLYN CUI

A surprise drop in gasoline prices has jolted a corner of the bond market, easing investors’ inflation fears and triggering an exodus from a popular form of Treasury securities.

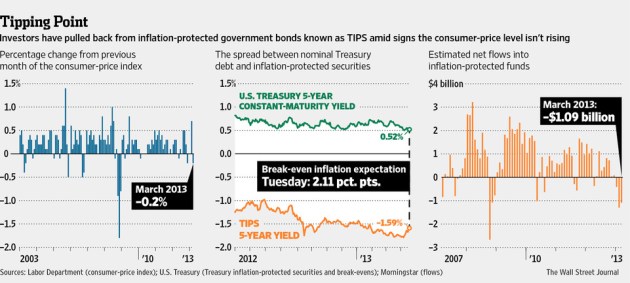

Bond investors have been pouring into the $883 billion market for Treasury inflation-protected securities, or TIPS, over the past year, in a bid to protect their purchasing power in case of rising prices. TIPS holders receive adjustments to the principal value of their bonds tied to the rate of inflation, protecting their holdings from being eroded by rising price levels.But on Tuesday, the Labor Department reported that March’s consumer-price index fell 0.2% on a seasonally adjusted basis, compared with a flat reading the market had expected. The main contributor was a 4.4% drop in gasoline prices.

“We anticipated a decline,” said Millan Mulraine, director of U.S. rate strategy at TD Securities, but the gas price “fell more than people expected.”

The recent drop in commodities prices sent investors streaming out of TIPS. While tame inflation brings relief to consumers, it is typically bad news for TIPS investors. Their bond portfolios will lose in prices as inflation expectations subside. Bond prices move inversely to yields.

The yield spread between five-year TIPS and the comparable regular Treasury note had narrowed to 2.1 percentage points on Monday, down from this year’s peak of 2.34 percentage points in mid-March, according to Tradeweb.

The difference, also known as the break-even rate, rebounded slightly to 2.11 points on Tuesday, a signal that investors now expect inflation in the U.S. on average in the next five years to be about 2.1%.

To be sure, the recent pullback of break-even rates is a correction from “what have been elevated levels,” said Chris McReynolds, head of U.S. Treasury trading atBarclays BARC.LN -0.66% .

The move was triggered by a deterioration in the economic outlook.

“People are feeling less positive, so they’re taking that out in inflation expectations,” he said.

Some investors rushed into TIPS last year, after the Federal Reserve announced a new round of bond-buying programs.

Demand for the securities further surged early this year when gasoline prices jumped on supply concerns.

However, the fears have abated quickly, largely thanks to a slump in gasoline prices. Recent disclosures that Fed officials were seeing a gradual exit strategy from their quantitative-easing policies also have helped guide down investor expectations for further expansion of its monetary base.

In addition, analysts noted that the selloff of oil and other commodities have continued lately, suggesting people’s expectations for future inflation will be even lower. Gold is down 13% this month, while crude oil has dropped 8.8%.

“All those things suggest future inflation over the next month or two may decline from very low levels today,” said Wilmer Stith, co-manager of the Wilmington Broad Market Bond Fund, with $300 million in assets. The fund has been moving assets to high-yielding bonds, as “we do not find that much value in TIPS anymore,” he said.

Lower inflation also suggests the Fed might be able to maintain its accommodative policies longer, keeping a cap on Treasury yields.

On an annualized basis, the consumer-price index was up 1.5% in March, much lower than the Fed’s threshold at 2.5%.

Some bond investors have been lightening their holdings of TIPS.

U.S. Bank Wealth Management made a call on March 13 to its clients to reduce the allocation to TIPS from 4% to 3%, according to Jennifer Vail, head of fixed-income research at U.S. Bank, which oversees $110 billion in assets.

The bank’s decision was mainly driven by a change in tone among Fed officials, who have been discussing the potential costs of its asset purchases and when to taper off the programs, Ms. Vail said.

“Now, the Fed has to become more accommodative than they currently are, then the TIPS can start to perform again,” she said.