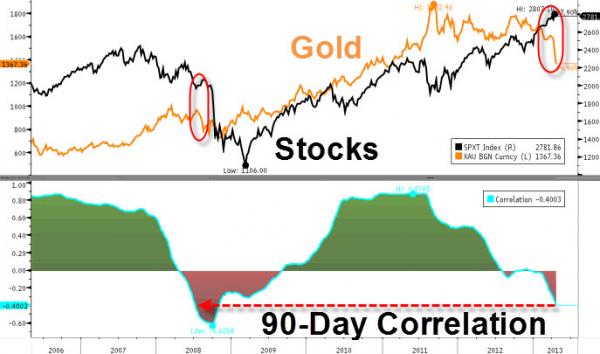

When Gold And Stocks De-Correlate: The last time the commodity/USD relationship broke down to such an extent was just ahead of the 2008 equity market decline

April 19, 2013 Leave a comment

When Gold And StocksDe-Correlate

Tyler Durden on 04/18/2013 13:40 -0400

The structural collapse in paper gold prices has been met a seeming ‘money-on-the-sidelines’ flourish of investors looking to buy the physical asset. However, when asset relationships break-down so significantly, as gold and stocks have in the past 90 days, one has to take a step back and think “what changed?” As the chart below shows, the last time the correlation between stocks and gold was this negative, things did not end so well for the high-valuation equity momentum chasers… And just for fun, from Barclays’ Jordan Kotick, the last time the commodity/USD relationship broke down to such an extent was just ahead of the 2008 equity market decline.