‘Target’ Funds Vulnerable to Rate Rise; “People think this is safe money. Losing money in bonds is a brutal way to lose money.”

April 24, 2013 Leave a comment

Updated April 23, 2013, 8:04 p.m. ET

‘Target’ Funds Vulnerable to Rate Rise

LIAM PLEVEN and JOE LIGHT

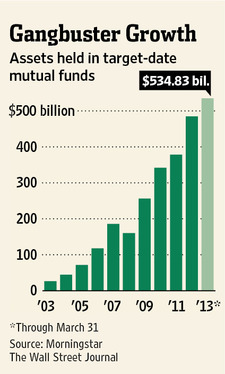

Millions of workers saving for retirement risk losing part of their nest eggs if interest rates jump. The cause for concern: target-date mutual funds, designed for investors who lack the time or expertise to balance their investment portfolios. The funds typically increase their bondholdings with the approach of the target date, which is pegged to the investor’s expected retirement year. In theory, more bonds should make portfolios safer, because bonds tend to be less risky than assets such as stocks. But if yields rise and bond prices slump, as many experts predict, the funds could suffer losses.

“People think this is safe money,” said Dave Scott, chief investment officer of Sunrise Advisors, a registered investment adviser in Leawood, Kan. “Losing money in bonds is a brutal way to lose money.”