‘Target’ Funds Vulnerable to Rate Rise; “People think this is safe money. Losing money in bonds is a brutal way to lose money.”

April 24, 2013 Leave a comment

Updated April 23, 2013, 8:04 p.m. ET

‘Target’ Funds Vulnerable to Rate Rise

LIAM PLEVEN and JOE LIGHT

Millions of workers saving for retirement risk losing part of their nest eggs if interest rates jump. The cause for concern: target-date mutual funds, designed for investors who lack the time or expertise to balance their investment portfolios. The funds typically increase their bondholdings with the approach of the target date, which is pegged to the investor’s expected retirement year. In theory, more bonds should make portfolios safer, because bonds tend to be less risky than assets such as stocks. But if yields rise and bond prices slump, as many experts predict, the funds could suffer losses.

“People think this is safe money,” said Dave Scott, chief investment officer of Sunrise Advisors, a registered investment adviser in Leawood, Kan. “Losing money in bonds is a brutal way to lose money.”

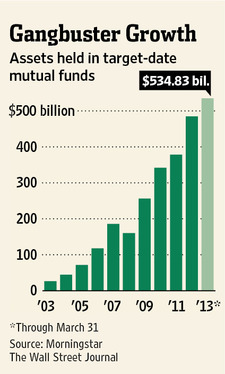

Some employees might be invested in target-date funds without realizing it. That is because many companies use the funds as a default option in their 401(k) plans. A 2006 federal law designed to boost employee participation in 401(k) plans fueled rapid growth in target-date funds, which now hold about half a trillion dollars.

Some employees might be invested in target-date funds without realizing it. That is because many companies use the funds as a default option in their 401(k) plans. A 2006 federal law designed to boost employee participation in 401(k) plans fueled rapid growth in target-date funds, which now hold about half a trillion dollars.

The concerns over potential bond losses underscore the risks of do-it-yourself retirement saving. A growing number of companies in recent decades have frozen or eliminated traditional pensions and pushed the responsibility for retirement saving onto workers.

The risks also highlight the limited options investors have to protect themselves. Bulking up on stocks rather than bonds, for example, would only increase the risk of losses. Exiting from stocks and bonds altogether potentially trims growth.

The risk in stocks came into sharp focus in 2008, when funds with a target retirement date of 2010 suffered losses of 9% to 41%, depending on the balance of stocks and bonds in each fund, according to the Securities and Exchange Commission.

The losses sparked a Senate hearing and proposals, still pending, from the SEC and the Labor Department to improve investor disclosures regarding what is in target-date funds.

Now some market strategists are worried about the bond market. Bond prices, which move in the opposite direction of yields, sit near record highs. Since the financial crisis, Federal Reserve Chairman Ben Bernanke has championed a policy of buying bonds that has kept prices elevated. The yield on the 10-year Treasury, at 1.70%, is near its lowest level ever, prompting some to question whether it can fall much further.

While the bull market for bonds could continue, “The potential for negative return in fixed income has never been higher” in recent decades, said Fran Kinniry, who helps oversee target-date funds at Vanguard Group Inc., the second-largest provider of target-date funds by assets.

Virginia Blum, a 55-year-old computer programmer in Silver Spring, Md., has some of her 401(k) assets in a target-date fund offered through her employer that is targeted to a retirement year of 2020. She said she is worried about higher interest rates hitting the fixed-income side as she gets closer to retirement. “I don’t want to be too heavily in bonds,” she said.

Most funds targeted to 2015 and 2020 hold between one-third and one-half of their assets in bonds—much more than the 10% to 20% bond positions in some 2040 funds.

The simplest way to gauge the risk of bond losses is by a measure called “duration,” which tracks a bond’s sensitivity to interest rates. The value of a bond portfolio with an average duration of five years, for example, would sustain a loss of 5% if interest rates rose by one percentage point immediately.

The magnitude of any bond losses in target-date funds would depend on many factors, including the size and speed of an interest-rate increase, the percentage of bonds held in the portfolio and the types of bonds held.

All else being equal, if interest rates were to double, the bond portfolios in many 2015 and 2020 target-date funds could lose as much as 8% to 10%, depending on which bonds the funds hold, based on a Wall Street Journal analysis of recent data. Even a relatively modest rise in rates could produce losses. In a more extreme scenario, in which rates took an immediate 4.7 percentage-point jump—approximating the biggest 12-month rise in the 10-year Treasury rate in the past 50 years—bond holdings in those funds could suffer losses of 12% to 28%, the analysis shows.

Such a steep rise is unlikely now because rates are at a much lower base, and there is no precedent in recent decades for an increase that big in percentage terms. But even a relatively modest rise in rates could produce losses for target-date investors.

Take the $19 billion Vanguard Target Retirement 2015 fund. It held 42% of its assets in bonds as of the most-recent date for which Vanguard reported its holdings, according to data from Morningstar, which counts bonds maturing in a year or more. If interest rates jump by one percentage point, the fund’s bonds would drop 5.4% in value, based on the fund’s duration of 5.4 years as of the end of 2012. For an investor with $500,000 in the fund, that would translate to a loss of more than $11,000 in the bond portion.

The $7 billion Fidelity Freedom K 2015 fund, managed by Fidelity Investments, the biggest target-date-fund provider, has 40% of its portfolio in bonds. Its bond portfolio would lose about 4% if interest rates were to jump by one percentage point. Likewise,T. Rowe Price Group Inc., TROW +1.73% the third-largest target-date provider, would see losses of 4.4% in the bond holdings of the $8 billion T. Rowe Price Retirement 2015 fund, which has 33% of its portfolio in bonds, if interest rates jumped a point.

Fund companies say several factors could offset some or all of the bond losses. Income from interest payments on the bonds would continue to flow to investors, says Vanguard’s Mr. Kinniry. And if rates rise because of a strong economy, stocks and higher-yielding bonds held by the target-date funds could also rise in value, he and others say.

Jerome Clark, portfolio manager for T. Rowe Price Group Inc.’s target-date products, says that, as interest rates rise, funds will benefit from reinvesting the proceeds from matured bonds in new bonds at higher rates. He also points out that bonds with different maturities could react in varying ways to a rate jump.

Some firms could try to defend against an interest-rate spike. Andrew Dierdorf, who helps manage the Fidelity fund, said the firm has adjusted its portfolio in ways that could help protect against rising rates, including adding inflation-protected bonds and adjustable-rate loans. Still, the possibility that target-date funds’ safe-harbor investments could lose value highlights the need for improved disclosure to investors, said Marc Fandetti, a principal at Meketa Investment Group Inc., in Westwood, Mass., who works with firms offering 401(k) plans.

“Education is critical, and probably has to become more sophisticated,” Mr. Fandetti said.