In China, Air Quality Boosts SUVs; The big winners should include domestic players like Great Wall Motor who saw SUV sales volumes jump 90% year-on-year in February

April 26, 2013 Leave a comment

April 25, 2013, 4:50 a.m. ET

In China, Air Quality Boosts SUVs

Following a run of several smog-ridden months in China, investors might be looking to bet on fuel-efficient or electric cars. In fact, it is sales of sport-utility vehicles that are soaring. The number of SUVs sold in China jumped 43.4% in the quarter ended March 31 compared with a year earlier, according to IHS Automotive. Total auto sales volumes were up just 13.8%. China’s middle class consumers see SUVs as a status symbol and view them as a safer option on the country’s notoriously dangerous roads, says China Auto Analyst Michael Dunne.

Ironically, air pollution might be playing a part too. China’s government rolled out new fuel-efficiency regulations last month aimed at the country’s air quality problem. A quirk in those rules could juice the SUV market, says Bernstein Auto Analyst Max Warburton. Fuel-economy targets based on different car weights—including easier targets for heavier vehicles—mean manufacturers have an incentive to make more SUVs, Mr. Warburton says. Something similar occurred in the U.S. in the 1980s, when more relaxed fuel-efficiency standards for heavier cars saw the big auto makers invest heavily in minivans and SUVs. The big winners should include domestic players like Great Wall Motor2333.HK +2.99% and foreigners like Jaguar-Land Rover, owned by India’sTata Motors 500570.BY +4.19% . Great Wall Motors saw SUV sales volumes jump 90% year-on-year in February, more than twice the increase in overall vehicle sales. The company boasts 35-40% of the low-end SUV market and 8% of the market overall, Nomura says.For pricier vehicles, foreign manufacturers dominate. Jaguar-Land Rover says overall sales volumes in China jumped 48% year-on-year in the 12 months ended March 31, 2013, for instance. JLR will soon start producing vehicles in China, through a tie-up with domestic manufacturer Chery.

One worry is that Beijing could tighten fuel-economy standards down the line. That could cut into margins or reduce sales for SUV manufacturers. The government could also hike fuel prices—as it has done twice recently—which might dent demand for less fuel-efficient vehicles. Competition’s another concern. This week’s Shanghai Auto Show featured a number of new SUV models and domestic manufacturers are planning to launch up to 14 new SUV models in the next two years.

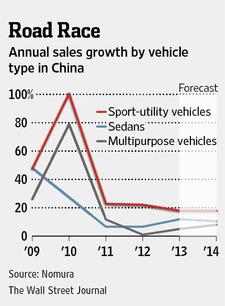

For now, though, Nomura forecasts SUV sales will continue to grow the fastest among all passenger vehicle categories over the next two years in China. Thanks in part to Beijing’s efforts on air quality, SUV makers are in for a fun ride for a while yet.