Perverse advantage; A new book lays out the scale of China’s industrial subsidies

April 27, 2013 Leave a comment

Perverse advantage; A new book lays out the scale of China’s industrial subsidies

Apr 27th 2013 | Shanghai |From the print edition

CHINA is the workshop to the world. It is the global economy’s most formidable exporter and its largest manufacturer. The explanations for its success range from a seemingly endless supply of cheap labour to an artificially undervalued currency. A provocative new book* by Usha and George Haley, of West Virginia University and the University of New Haven respectively, points to another reason for China’s industrial dominance: subsidies.

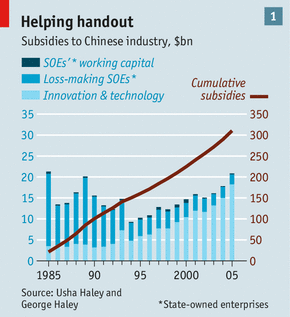

The Chinese government does not report all subsidies made to domestic industrial firms, so the Haleys plugged the holes with information from industry analysts, policy documents, non-governmental outfits and companies themselves. By looking at the gaps between end-user prices and benchmark prices, they have cobbled together numbers on many of the subsidies enjoyed by the biggest industrial state-owned enterprises (SOEs).

On their conservative calculations, China spent over $300 billion, in nominal terms, on the biggest SOEs between 1985 and 2005. This help often came in the form of cheap capital and underpriced inputs unavailable to international rivals. The glass industry got soda ash for a song, for example. The auto-parts business got subsidies worth $28 billion from 2001 to 2011 through cheap glass, steel and technology; the government has promised another $10.9 billion by 2020. The subsidies to the paper industry topped $33 billion from 2002 to 2009. All industrial SOEs benefited from energy subsidies.The harm done by these subsidies to foreign competitors is ably chronicled by the Haleys. Rivals are forced to go up against national champions that enjoy subsidised inputs and seemingly free money in markets that are protected. Worse yet, the bosses of Chinese SOEs are not in business principally to make a profit: they are often encouraged by the government to pursue other goals, such as resource acquisition, foreign policies and technology transfer, regardless of cost.

Less obvious is the fact that these policies harm China as well, by nurturing unproductive and unaccountable behemoths. A recent study by Sea-Jin Chang of the National University of Singapore and Brian Wu of the University of Michigan found that new firms in China are more productive than incumbents but they are also more likely to fail. The authors blame “institutional barriers”.

Indeed, these barriers to creative destruction are even higher than they first appear, because state subsidies extend beyond state firms. Another new study by Fathom China, a research firm, argues that although small and medium-sized private firms are often starved of capital in China, many big private firms are at the official trough. The researchers looked at 50 prominent private-sector Chinese firms, and found that 45 receive subsidies (see table). Top of the list is Geely, an automobile firm that bought Sweden’s Volvo, which on Fathom’s reckoning would lose more than half its net profits without official aid.

Such distortions breed indiscipline and overcapacity. An effort to sponsor clean-energy champions is partly responsible for a global glut of solar panels, for instance, forcing even Chinese manufacturers such as Suntech into bankruptcy. (Suntech has just been bailed out by Wuxi’s city government.) A similar problem looms in the steel industry, where the country’s excess capacity of some 200m tonnes surpasses the entire capacity of Japan’s steelmakers.

Could change be coming? In the past few weeks the People’s Daily, an official paper of the Communist Party, has run several articles discussing SOEs, which is seen by some as a sign that an overhaul may be on the central government’s agenda. But many state-owned firms are powerful, with some of their bosses holding ministerial rank, and resistant to change. Chinese officials have repeatedly and publicly promised to raise the SOE dividend-payout ratio, for example, but SOE heads may have thwarted such efforts.

Leaders in Beijing are trying to encourage consolidation among SOEs but, as the Haleys note, “the central government’s removal of subsidies has often resulted in the provincial governments increasing them.” The unhappiest consequence of China’s subsidy policy may be that it has created beasts too powerful to rein in.

* “Subsidies to Chinese Industry”, by Usha Haley and George Haley. Oxford University Press, April 2013