U.S. taxpayers employ more low-wage workers than Wal-Mart, McDonald’s combined

May 9, 2013 Leave a comment

Study: U.S. taxpayers employ more low-wage workers than Wal-Mart, McDonald’s combined

By Jim Tankersley and Marjorie Censer, Published: May 8

Federal taxpayers employ more low-wage workers than Wal-Mart and McDonald’s combined, a new study calculates.

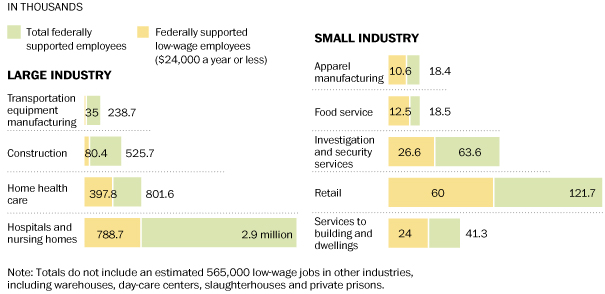

The report from a public policy organization Demos, set to be released Wednesday, estimates that taxpayer dollars fund nearly 2 million private-sector jobs that pay $24,000 a year — about $12 an hour — or less. Those workers owe their incomes to government contracts, Medicare and Medicaid spending, and federal infrastructure funds, among other public sources. In contrast, Demos estimates that about 1.4 million workers earn that amount or less at Wal-Mart and McDonald’s, which are two of the largest employers of low-wage workers.

The findings highlight inequality within the government contracting industry; as chief executives of major contractors rake in millions, many contract employees are struggling to get by, according to the report from Demos, which advocates for worker-friendly policies. It is a situation that could be worsened by the budget pressures of sequestration, which is pushing the federal government to spend fewer dollars and pursue lower-priced contracts.The broader economy is mired in a similar trend; job creation in the recovery from the Great Recession has been bottom-heavy. Most of the 165,000 net new jobs that the Labor Department reports were added in April came in low-wage sectors, such as retail, food service and temp work. A study last year by the National Employment Law Project found that low-wage occupations accounted for one in five jobs lost during the recession — but they accounted for three out of five jobs added in the recovery.

The Demos findings will be announced at an event launching Good Jobs Nation, a group of low-wage workers who are banding together to pressure the Obama administration to take steps to guarantee higher pay for federal contracting workers, possibly via executive order.

“We know that growing inequality and these larger, dead-end jobs are a national problem,” said Amy Traub, a senior policy analyst at Demos who authored the report. “This is just a piece of that. But the key is, this is a piece that we’re responsible for and really that we can do something about” as taxpayers.

The flip side to that argument is obvious: Forcing contractors to raise wages could drive up costs for taxpayers in a time of budget distress. Researchers at Suffolk University calculated in 2008 that laws mandating the government pay competitive wages on construction projects raised the cost of those projects by about 10 percent.

“The federal government should be responsible stewards of tax dollars, paying contractors only what is necessary to ensure quality work,” said Michael R. Strain, a labor economist at the conservative American Enterprise Institute. “Of course, this means paying fair wages to contractor workers — but the market should determine what is a fair wage.”

Advocates counter that paying higher wages will boost spending by those workers, spurring economic activity. “In order to get our economy moving again, low-wage workers need to do better,” said Travis Dupree, an organizer with OurDC, one of the groups behind the worker mobilization effort.

The Demos study calculated the number of workers nationwide who earn $12 an hour or less from jobs supported directly by federal spending. More than half of them — an estimated 1.2 million home health aides and other health-care workers — owe their jobs to Medicare or Medicaid spending. For 200,000 workers, it is Small Business Administration loans.

More than 500,000 are federal contract workers, including people who clean federal buildings, sew military uniforms and serve food in national parks.

Frederick Turner, for instance, spent 13 years at a local hospital, transporting patients to undergo tests such as ultrasounds, while earning $14.35 per hour. The Hyattsville resident said he was laid off in 2009 and took a significant pay cut to work as a contractor at the National Museum of American History, where he cleans up in the cafeteria.

He works every weekend and holiday except Christmas and said he has no health insurance. Two of Turner’s grandchildren live with his family, and he used to be able to treat them to gifts.

“When I was working at the hospital, when they brought me good grades from school I’d just take them to the mall and let them buy what they want,” he said. Now, “I barely have enough money to get to work sometimes.”

Vilma Martinez, an immigrant from El Salvador, earns $8.75 an hour, part time, doing janitorial work for a contractor at Union Station, which is run with federal dollars. She has held the job for 19 years but has no health insurance, and she returns to El Salvador for lower-cost medical treatment. “I live in a very small apartment,” she said through an interpreter, “because that’s all I can afford on earning $400 every two weeks.”

In the Washington area, the inequality of contracting is pronounced. The area is home to many of the highest-paid contracting chief executives — the new Lockheed Martin CEO’s base salary alone is $1.38 million — and about 15 percent of low-wage contract workers, Demos estimates.

Stephen S. Fuller, director of George Mason University’s Center for Regional Analysis, said he has seen lower-wage jobs move over time from the federal workforce to contracted positions, particularly in the Washington area.

“Those were contracted out because they were cheaper,” he said, pointing to security and transportation jobs, among others. “The contract workers get fewer paid vacation days, fewer sick-leave [days]. They often work hourly, so you get what you pay for.”