Amazon Is Developing Smartphone With 3-D Screen

May 10, 2013 Leave a comment

Updated May 9, 2013, 7:02 p.m. ET

Amazon Is Developing Smartphone With 3-D Screen

New Gadgets, Including Audio-Only Device, Is Bid to Expand Beyond Kindle Fire

Amazon is expanding beyond its range of Kindle devices as it aims to compete more directly with Google and Apple. Photo: Associated Press.

Amazon.com Inc. AMZN +0.57% is expanding beyond its range of Kindle devices as it aims to compete more directly with Google Inc. GOOG -0.25% and Apple Inc.AAPL -0.87%

The Seattle e-commerce giant has recently been developing a wide-ranging lineup of gadgets—including two smartphones and an audio-only streaming device—to expand its reach beyond its Kindle Fire line of tablet computers, said people familiar with the company’s plans.

One of the devices is a high-end smartphone featuring a screen that allows for three-dimensional images without glasses, these people said. Using retina-tracking technology, images on the smartphone would seem to float above the screen like a hologram and appear three-dimensional at all angles, they said. Users may be able to navigate through content using just their eyes, two of the people said.Some elements of Amazon’s hardware push have previously become public. Last year, news surfaced about Amazon developing one smartphone. And last month, The Wall Street Journal and other media outlets reported thatAmazon also was developing a set-top box for streaming movies and TV shows.

But the people familiar with the plans said the smartphone and set-top box are just two elements of a broader foray into hardware that also includes the audiostreaming device and the high-end smartphone with the 3-D screen. Inside Amazon’s Lab126 facility in Cupertino, Calif., where each of the devices have been under development, the efforts are known as Project A, B, C and D, or collectively the Alphabet Projects, said the people familiar with the plans.

Though Amazon has goals of releasing some of these devices in the coming months, these people cautioned that some or all of the devices could be shelved because of performance, financial or other concerns.

An Amazon spokesman declined to comment.

In recent years, Amazon has jumped deeper into hardware manufacturing to broaden its ubiquity and compete more directly with Apple and its tremendously popular iPad. The array of planned devices is part of a strategy to widen Amazon’s influence beyond its core e-commerce website and broadly into content distribution.

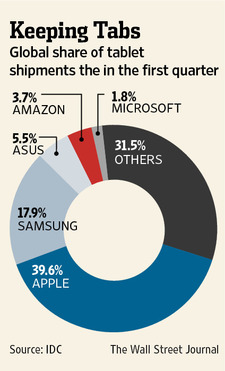

Amazon would be entering a crowded hardware market, however. In smartphones, Apple and Samsung Electronics Co. 005930.SE -2.24% together commanded 61% of the U.S. market in the first quarter, leaving other manufacturers such as HTC Corp.2498.TW -1.58% with less than 10% share each, according to comScore Inc.SCOR -0.47% Once-dominant device-makers like Research In Motion Ltd.BB.T +3.96% and Nokia Corp. NOK1V.HE +0.30% have also failed to keep pace with smartphone innovations and watched their market shares tumble.

Amazon hopes to stand out from the crowd with the 3-D screen, the people familiar with the company’s plans said.Qualcomm Inc. QCOM -0.02% would provide chips for the 4G LTE-enabled phones.

With smartphones, Amazon could collect new data on its users through maps, phone calls and app downloads, and offer them shopping recommendations. There is also the potential for new services like mobile payments.

But Amazon would also have to negotiate contracts with wireless carriers to provide cellular service to the devices and carriers often require complicated device subsidy packages to accompany their two-year service contracts. It is unclear which company may supply Amazon’s wireless service. AT&T Inc. T -1.32% is the provider for wireless-enabled Kindle Fire tablets.

Meanwhile, Amazon’s underdevelopment Wi-Fi device for streaming audio through speakers or a television set is an initial foray into what could be a music-subscription service to compete with Pandora Media Inc. P +5.01% or Spotify AB, said two of the people familiar with the plans. Amazon already sells digital music files to compete with Apple’s iTunes.

And the possible set-top box would help solidify Amazon’s place in the living room, where today it is dependent on other devices, like those from Roku Inc. and MicrosoftCorp.’s MSFT -1.00% Xbox 360, to stream its expanding video library. Amazon’s streaming video library is offered as part of its Prime shipping membership program. The set-top device could be available sometime this year.

Amazon has been bulking up its streaming video content in competition with NetflixInc., NFLX +3.74% Time Warner Inc.’s TWX -0.05% Home Box Office, Hulu LLC and others, and last month it began offering a slate of 14 television pilots it may turn into streaming-only series.

While the streaming-video market is potentially lucrative, Amazon faces stiff competition in video-streaming hardware from Apple, Roku and, particularly, specially-equipped television sets. Intel Corp. INTC +0.45% is working on a video service and accompanying set-top box, expected to be available by this year’s holiday season.

The cost of set-top boxes has been steadily falling. Roku offers some of its devices for as low as $50.

It wasn’t immediately clear what Amazon’s lineup of devices would be called or at what prices the company would sell them. However, the company has said it likes to sell its Kindle e-readers and tablets at cost and profit from the services and content people buy for the devices.