Longer Odds for Short-Selling Success

May 16, 2013 Leave a comment

May 15, 2013, 4:35 p.m. ET

Longer Odds for Short-Selling Success

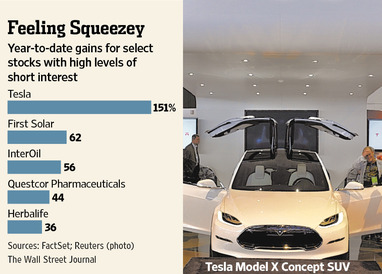

Most investors know that shorting a stock, or betting it will fall in value, entails the chance of huge losses. But knowing that is nothing like seeing it in action. The ramp higher in Tesla TSLA +1.92% shares in the days since the electric-car maker reported a first-quarter profit has served as a vivid reminder of just how dangerous a game shorting stocks can be. It may also signal a shift to a kind of market environment that can prove particularly treacherous for those on the short side. Even before Tesla reported, investors heavily short the shares had to be feeling queasy. In the time since Tesla said in early April that it had beaten its first-quarter deliveries target, its shares had risen 47%. When the stock jumped after the earnings report, the “short squeeze” looks as if it got unbearable. Investors raced to buy back shares they had sold short. That intensified the stock’s move higher, prompting even more pessimistic investors to throw in the towel. Tesla’s shares rose 53% in three trading days, taking its market value to a peak of $10.1 billion, from $6.4 billion. In turn, shares of other heavily shorted companies, likeInterOil IOC +1.39% and Questcor Pharmaceuticals, QCOR -9.46% also rallied. That is an indication some traders are actively looking to buy stocks with high short interest, posing an additional risk for short sellers.

An added twist, squeezes can allow companies to bolster their finances by selling new stock at higher prices. Tesla announced it would do so after the market’s close Wednesday.

Recent years have seen short squeezes, but not like that at Tesla. One reason: It is possible for bullish investors to imagine Tesla becoming a huge company in the way it isn’t for a company like Sears Holdings SHLD +1.82% —the subject of a continuing short fight—to become more than a healthy retailer.

Moreover, threats that have hung over the economy since the recession ended in 2009 have receded, opening up the possibility of more robust growth. That has removed the limits on what investors believe an early-stage company might become. It is an environment more like the mid-1990s than what investors working the short side have more recently been accustomed to.

Indeed, Tesla reminds Marc Cohodes, a former short-selling hedge-fund manager turned chicken farmer, of Iomega in 1996. It was heavily shorted on the (ultimately correct) view the richly valued disk-drive maker would be hit by competition. But Iomega shares shot up 566% in the first half of the year before cresting.

The difficulty with the Tesla short story is it is based on the company’s heady valuation and a belief it will falter in the long term, but lacks an idea of what specifically will make its stock fall in the near term.

That is dangerous in this market, particularly for stocks like Tesla, which had about 40% of its freely tradable shares sold short. Dedicated short sellers active in the 1990s knew this, or learned it the hard way, but many are no longer on the scene.

And many portfolio managers who typically invest across investment products have taken on greater equity exposure. But to make sure returns aren’t too correlated with the stock market, they often take short positions.

That has led investors to crowd into many of the same trades. Whenever that happens, the rush for the exit can get ugly.