Are Japanese Banks On The Verge Of Insolvency? A 100 basis point (parallel) rise in market yields would lead to mark-to-market (MTM) losses of 20% of Tier-1 capital for regional banks and 10% for the major banks

May 17, 2013 Leave a comment

Are Japanese Banks On The Verge Of Insolvency?

Tyler Durden on 05/16/2013 13:13 -0400

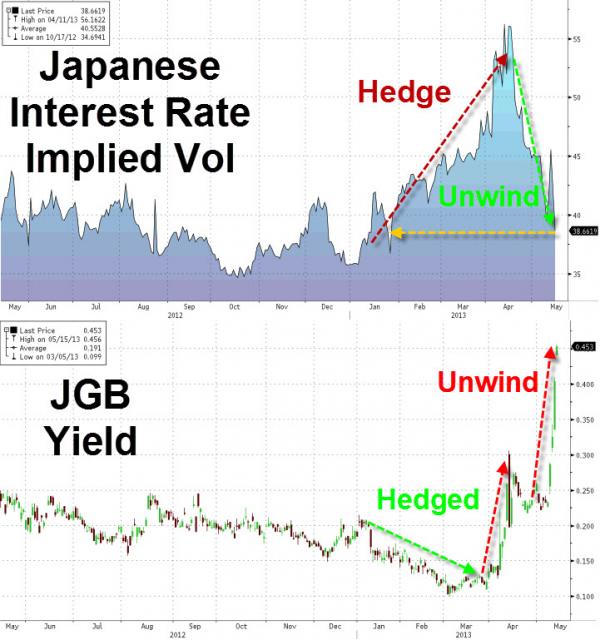

We have long discussed the problem that the Japanese government faces if interest rates in the troubled nation rise (cost of debt financing will swamp revenues in a vicious circle); but now it seems there is another – just as vicious – problem (that the BoJ is set to discuss according to Nikkei). The inability of the BoJ to ‘control’ Japanese interest rates (JGB rates spiking unprecedentedly day after day) has put the banking system in a lot of trouble. As we explained recently the banks appeared to initially ‘hedge’ their huge JGB positions but now appear to recognize that first out wins and are reducing exposure overall (YTD -3.7% according to local data). The reason – simple – as the IMF explains via the BoJ – according to BOJ estimates (footnote 4), a 100bp (parallel) rise in market yields would lead to mark-to-market (MTM) losses of 20% of Tier-1 capital for regional banks and 10% for the major banks. He who sells first wins…

We said previously: This is what is going on in JGBs… JGBs were able to rally since smart money was hedging significantly (and not selling) but once the initial clusterfuck exploded after the BoJ meeting (and protection costs soared), it seems clear that JGBs just became far too expensive to hold given their risk and so protection was unwound and positions were reduced… which is why we are now seeing JGB yields jumping… and as the IMF explains: JGB market exposures represent one of the central macrofinancial risk factors. This risk reflects the possible impact on public debt sustainability of changes in yields and related effects on investor confidence; the increased role of the private financial sector in covering government borrowing needs; the prospect that ongoing demographic shifts will reduce private saving; and growing household interest in investing abroad. Interest rate risk sensitivity is especially prevalent in regional banks and insurance companies (JGBs representing about 70 percent of life insurers’ securities holdings and 90 percent of insurance cooperatives’ securities holdings). In addition, the main public pension scheme, as well as Japan Post and Norinchukin bank, also have large JGB exposures. According to BOJ estimates, a 100 basis point (parallel) rise in market yields would lead to mark-to-market (MTM) losses of 20 percent of Tier-1 capital for regional banks (not taking into account net unrealized gains on securities), against 10 percent for the major banks. Surely all this has been provisioned for somehow. Or not?