Oil Out of Sync With Market Forces; Prices of many commodities are down this year, but U.S. oil futures have rallied. Skeptics say the mismatch is a sign of trouble.

May 21, 2013 Leave a comment

Updated May 19, 2013, 5:58 p.m. ET

Oil Out of Sync With Market Forces

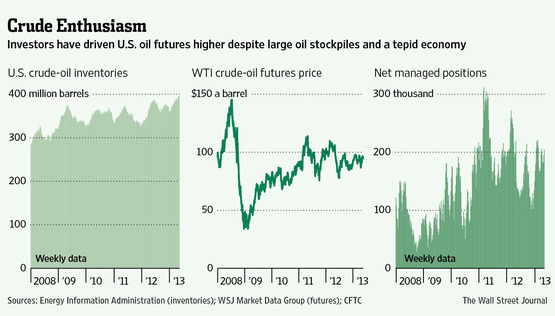

Prices of many commodities are down this year, but U.S. oil futures have rallied. Skeptics say the mismatch is a sign of trouble. U.S. benchmark crude-oil futures ended Friday at $96.02, up 4.6% since the start of 2013. Oil is a standout in a mostly dismal year for commodities, as the Dow Jones-UBS UBSN.VX +1.65% Commodity Index has fallen 5.6%. The decline has been even steeper for gold, copper and other former darlings. Oil isn’t a gusher compared with stocks, such as the Dow Jones Industrial Average, which is up 16% this year. But some analysts and investors say oil’s rise is remarkable because it came despite several factors that often push prices lower. For example, U.S. economic growth is tepid, domestic oil stockpiles are at their highest in more than three decades, the unemployment rate is at 7.5% in the U.S., and inflation is lower than the Federal Reserve’s target of 2%. Meanwhile, domestic oil production is soaring and U.S. fuel demand is soft.

“I think the optimism is a bit misplaced. There’s a significant disconnect between the physical market and the financial market for oil,” says Jaya Bajpai, managing director of Applied Energy Analytics, an oil and natural-gas hedge fund in Boston. The bullish bet on oil is fueled by hopes that “we will get enough economic growth over the next six months that demand will recover,” he says.

Oil’s rise amid a shortage of economic fundamentals partly reflects the scramble for investments that offer the potential for higher returns than those shackled to rock-bottom interest rates.

Hedge funds, index funds and exchange-traded funds remain a large part of the trading picture. As much as 70% of price moves in commodity markets are generated by trading programs reacting to one another, according to a recent study by the International Monetary Fund.

Crude has at times traded in league with other commodities, for instance in the wake of the Federal Reserve’s 2010 decision to open a second round of bond-buying known as quantitative easing that briefly sent commodity prices higher.

Yet even as weak signals on global growth have taken a bite out of copper this year, U.S. oil prices have remained aloft.

Traders, analysts and economists cite the resurgence of the U.S. dollar, growing global energy demand and a steady flow of investment dollars into markets designed to trade and hedge price risks between producers and users of oil.

“It’s this investment demand for exposure to oil prices that is supporting the market,” said Tim Evans, analyst with Citi Futures Perspective, a unit of Citigroup Inc. C +0.97% “It’s not really runaway physical demand growth.”

The number of long and short positions held by banks and hedge funds in the market outweighs those held by producers, merchants and commercial end-users, according to data released Friday by the Commodity Futures Trading Commission. Commercial participants are now 31% of the market, while banks make up 22% and speculators make up 11%.

Questions about the staying power of oil’s rally underscore the dangers for those seeking to play commodity markets that only a few years ago looked like a sure thing. Investors who bought oil and gold futures a decade ago could count on steadily rising prices, pocketing returns that easily outpaced stocks and Treasury bonds over that period.

In the last 10 years, gold futures have gained 285% and U.S. crude futures have risen 230%. The total returns on the S&P 500-stock index, reflecting price appreciation and dividend payments, have been 114%, compared with 71% on the 10-year Treasury.

To be sure, this year’s rise in U.S. oil prices has been an isolated bright spot for commodity bulls. Futures prices for the Brent global benchmark contract have dropped 5.8% this year on fears of falling global demand, led by China’s cooling economy. And though the U.S. benchmark contract has risen, retail gasoline prices continue to decline, largely because oil products in many parts of the country, such as along the coasts, are priced off of Brent.

“I need to see another development, either significantly stronger growth or slower growth in the economy, to get oil prices to go up or down from here,” said Jan Stuart, head of energy research at Credit Suisse CSGN.VX +1.74% .

Some investors are embracing nimble strategies to profit from small short-term price moves. At Pacific Investment Management Co., a unit of Allianz ALV.XE +0.50% SE of Germany, which oversees about $30 billion in commodity holdings across different funds, portfolio manager Nic Johnson said he has been buying oil futures and selling options on them at a higher strike price.

The trade is essentially a bet that the price will remain stable and the funds will be able to keep the premium collected on the options they sold without having to deliver the underlying futures.

“It’s hard to see material upside” in the price, Mr. Johnson said.