Adaro Energy Chief Says Thermal Coal at $100 a Ton Is New Normal, which is half a peak reached in 2008

May 21, 2013 Leave a comment

Adaro Energy Chief Says Coal at $100 a Ton Is New Normal

PT Adaro Energy (ADRO), Indonesia’s second-biggest producer of power-station coal, said miners will have to adjust to prices of about $100 a metric ton, which is half a peak reached in 2008.

“The new normal, I think, would be $95 to $100 a ton, based on the marginal cost of production in the region,” Adaro Energy President Director Garibaldi Thohir said in an interview.

A slump in coal prices will help ease oversupply as it would prompt some small and high-cost miners to reduce output or stop production, Thohir said in his office in Jakarta on May 17. Adaro is expected to report lower net income this year than in 2012, Thohir said, without giving a specific forecast.

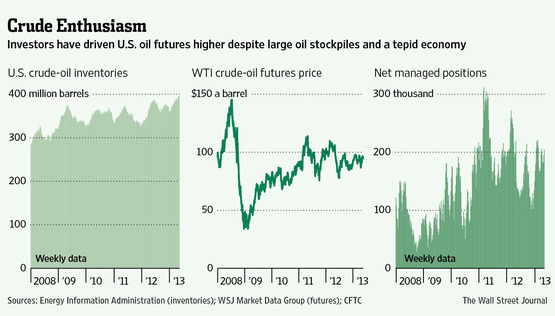

The price of coal has fallen by more than half since a peak in mid-2008 amid slowing Chinese imports and rising output from producers including Indonesia and Colombia. The decline is forcing companies including Adaro to trim costs to safeguard margins. Thohir said the price may have bottomed. Read more of this post