|

Swadeshi Innovators in Asia: Fluid, Fast and Nonlinear to Compound Value

“We need to build up the manufacturing sector. I want to tell the world: Come, make in India, manufacture in India. Sell in any country of the world but manufacture here. Be it plastics or cars or satellites or agricultural products, come make in India. We have the skills, we have the strength, we have the people. Our dream should be to see the ‘Made in India’ signs in every corner of the world.”

– Maiden speech of India’s Prime Minister Narendra Modi at the country’s 68th Independence Day on Aug 15 at the Agra Red Fort, emphasizing the future of India lies in enabling manufacturing and industrial success

“My Swadeshi chiefly centres around the handspun khaddar and extends to everything that can and is produced in India.” – M. Gandhi

“Power is no longer simply the sum of capability and capacity but now, disproportionately, includes speed – speed of action but especially speed of decision making. Countering the need for speed is often paralyzing volumes of information, which often create an illusion of control and optimal decision making. But we may not be considering the very real costs of lengthy deliberation. Being willing and able to make sound decisions faster means that leadership must become more agile and innovative. Our future security will demand it.”

– General Martin Dempsey, Chairman of the Joint Chiefs of Staff

“We believe in being speedy, agile and responsive in coming up with new designs, new products and innovative engineering solutions even before the need exists because of our in-depth research know-how and to gain wide acceptance in the market with our customers,” the co-founder and managing director of Singapore’s largest bus-manufacturer shared with me last week.

She added thoughtfully, “While our on-the-ground engineers may not document and file all of these executions administratively in reporting back, these are the value-added acts of innovations that propel our company ahead of the competition.”

This innovative hidden champion has been able to hold its own when competing with the Chinese giants – Yutong(Shanghai: 600066 CH, MV $3.8bn), King Long (Shanghai: 600686 CH, MV $853m) – Brazil’s Marcopolo SA(Bovespa: POMO3 BZ, MV $1.6bn) owned by the Bellini family, and the divisions of MNCs that include Daimler, MAN AG, Volvo, Scania. The bus market is less cyclical, which makes it a significant vector of growth during economic downturns that dramatically impact other automotive segments such as trucks and passenger cars. We have highlighted the story of Yutong/YX Tang and how Buffett was believed to have considered Marcopolo on his “radar screen” in our previous article “’Must-Have’ Vs ‘Nice-to-Have’: Exploiting the Sector-Company Gap in Asia”.

Other than the chassis, over 95% of the company’s products are designed, engineered, produced and assembled in-house with no sub-contractors. The company also reinvented the production process with its own set of robotic welding arms and CNC metalworking machines to have the capability of assembling a coach in record-breaking seven days.

This self-reliance that stems from a certain deep intangible knowledge reminds us of the principles of Swadeshi. The word Swadeshi derives from Sanskrit and is a sandhi or conjunction of two Sanskrit words. Swa means “self” or “own” and desh means country. Swadeshi, as a strategy, was a key focus of Mahatma Gandhi, who described it as the soul of Swaraj (self-rule). Now, the term Swadeshi has become extinct and is replaced by “inclusive growth”. Interestingly in a positive move, at his inaugural Independence Day speech, Modi talked about abolishing the Planning Commission that was created by Nehru in 1950 to give grand one-size-fit-all plans to guide the economy and replaced it with a new institution that gave more weight to India’s 29 states. Singapore’s founding Prime Minister Lee Kuan Yew had also argued that “India is not a real country. Instead, it is thirty-two separate nations that happen to be arrayed along the British rail line.” India is not a single investment destination or even a coherent, unified economic entity, presenting new insights to rethink about growth and business development. We will elaborate on the relevance of Modi’s “maximum governance, minimum government” later.

This Swadeshi innovator has over 100 designs registered with the Intellectual Property of Singapore (IPOS), including patents on the unique aesthetically-pleasing glass designs; curved windscreens that make buses lighter, more stable and fuel-efficient; and the interior engineering design of the coach to fit in more seats than its competitors with the same chassis. The company had once designed a rear engine cover that could be lifted vertically to allow the mechanic to easily access the inside of the bus to shorten repair time. The design was not patented and competitors rushed to copy.

We mentioned how the joint venture of Tata Motors (TM IN, MV $24bn) with Marcopolo (TTML) since May 2006 was built upon the philosophy of leveraging off one another’s strength to create a unique form of self-reliance. Tata Motors is responsible for…

<Article snipped>

We also briefly talked about the business models of other innovators in different industries that are relevant for them, including the breakthrough strategy of Paccar (PCAR US, MV $22bn) in technology-enabling its entire supply chain-manufacturing process-dealer chain and building a world-class call center to win an entirely new customer segment with the individual ‘truck-preneurs’. When we visited the facilities of this Singapore innovator, we were surprised that it does not have any reception desk and in its place is a customer call center, demonstrating its customer-centricity.

To scale up a SME sustainably requires innovation not just for the product offerings but more importantly in the business model. Since fourth-generation leader Mark Pigott took over as CEO in Jan 1997, Paccar is up nearly 100-fold from $230m to $22bn. To create and sustain long-term profitability within this industry, Paccar chose to…

<Article snipped>

Over the decade plus of interacting with entrepreneurs and innovators in Asia at various stages in their corporate lifecycle, monitoring the consistency of their words and actions, and observing the consequent changes in market valuation, we noticed one hallmark feature that distinguish the true compounders: A sense of urgency that is manifested in the no-nonsense speed to quietly tinker and improve things and an abhorrence for bureaucratic obstacles arising from “positional-based leaders” perceiving their involvement with handling rules, policies and procedures as a form of power.

The Singapore innovator has demonstrated the ability to rapidly take an idea from inspiration to fully formed expression, keeping their people curious, engaged and focused. This gravity force draws together enthusiasm, determination and the ability to solve new problems with original thought. Many companies we have seen over the decade plus do not possess this gravity force and are left in a state of weightlessness, searching for relevance and focus.

When people see the external world clearly because of their deep intangible knowledge, their sense of urgency is increased. They come to work each day determined to achieve something important, and they shed irrelevant and low-priority activities to move faster and smarter, now. There will be no idle time to waste for every moment has a strategic importance. Those with a sense of true urgency are the opposite of complacent. False urgency has a frantic feeling: running from meeting to meeting, producing volumes of paper, all with a dysfunctional orientation that often prevents people from exploiting key opportunities and addressing gnawing problems. Most often people are merely in a hurry, acting and reacting frantically to events, all of which makes them prone to errors and wasting time in the long run.

Urgency is becoming increasingly important because change is shifting from episodic to continuous. With episodic change, there is one big issue, such as making and integrating the largest acquisition in a firm’s history. With continuous change, some combination of acquisitions, new strategies, big IT projects, reorganizations, and the like comes at you in an almost ceaseless flow. With episodic change, the challenge of creating a sufficient sense of urgency comes in occasional spurts. With continuous change, creating and sustaining a sufficient sense of urgency are always a necessity. The role of the leader in this continuous change environment is to enable people experience new, often very ambitious goals, as exciting, meaningful, and uplifting – creating a call to action and a deeply felt determination to move, make it happen, and win, now. The disconnect between the outside and the inside will shrink. Complacency will be reduced.

One of the key to increasing speed and a sense of urgency is removing bureaucracy from creative thinkers. This is not the same as removing rules. It requires leaders to walk through a process to ensure that it satisfies common sense rules of working. If they find they would be annoyed by it, they should fix it or remove it. Improving the process this way engenders respect and fosters exploration over hesitation, a prerequisite to unlocking creativity. When there is a strong culture, there is no need to have prescribed policies for every permutation of a situation. Employees can rely on cultural influences to help determine what they should do – they will act with speed, and they will take initiative.

Talking about bureaucracy, we are reminded of India, which remains a notoriously difficult place to do business. In the World Bank’s most recent ease of doing business survey, India ranked 134th out of 189 countries. Even the most successful industrialists are weary of fighting through the thickets of legislative and bureaucratic obstacles planted in their way by successive governments. Hence, we are positive on Modi’s “maximum governance, minimum government” stand and quiet implementation on…

<Article snipped>

Despite its large domestic market, India’s industrial weakness means it depends on China and other exporters for goods from industrial machinery and mobile phones to more basic products such as lights and toys. The country is largely absent from the global supply chains for mass-produced items. India imported $580bn of capital goods in the past seven years. A National Manufacturing Policy launched three years ago by the Congress-led government has so far failed in its aim to create 100m manufacturing jobs and raise manufacturing as a share of GDP from 16% to 25% within a decade. Instead, the share declined further, to 15% today. Contributing factors include India’s burdensome labour regulations, poor transport and power infrastructure, the difficulty of acquiring land for factories and the failings of its bureaucracy. For instance, the much-feared postwar Industrial Disputes Act requires companies with more than 100 employees to ask permission to lay off workers – permission that is almost never given, making hiring and firing all but impossible for larger enterprises.

The rise of modern facilities in and around Pune in western India – with companies including Germany’s Volkswagen, Indian carmaker Mahindra & Mahindra (MM IN, MV $13.3bn), and autoparts maker Bharat Forge(BHFC IN, MV $2.9bn) helping turn India into a car exporting hub – suggests the industrial success is possible in parts of India. Pune is also the base for niche innovators such as Kirloskar Brothers (KKB IN, MV $353m), one of India’s oldest industrial group and India’s largest maker of pumps and valves, as well as a global exporter of industrial pumps used in everything from nuclear power stations to large buildings such as London’s Shard skyscraper. In Gurgaon and Manesar (New Gurgaon), southwest of New Delhi, this industrialization effort is led by Maruti Suzuki(MSIL IN, MV $13.2bn) and wiring harness and auto parts maker Motherson Sumi Systems (MSS IN, MV $5.1bn).

The story of Bharat Forge, the flagship vehicle of the Kalyani Group founded by Nilkanthrao Kalyani in 1961 and built by Baba Kalyani, has been fascinating and controversial…

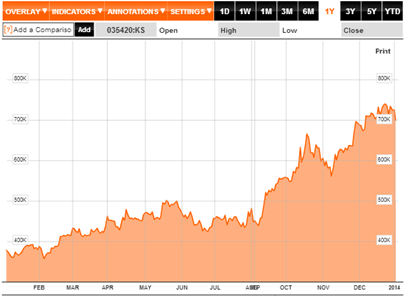

Bharat Forge (BHFC IN) – Stock Price Performance, 194-2014

<Article snipped>

Can Bharat Forge follow the growth trajectory of Precision Castparts Corp (PCP), which we highlighted in an earlier article Can Asia Produce a Precision Castparts, a 1,000x Compounder? PCP grew from a small metal casting workshop to become one of the best compounders in American capital history, up over 1,700x in three decades plus to a global giant with a market cap of $34.7 billion. Bharat Forge believed…

<Article snipped>

Speed and the agility advantage is of essence (兵贵为神速) to be ready and fit for growth, as we shared with the MD of the Singapore innovator. The story of Napoleon and George Washington are worth savoring.

For thousands of years, war had been fought in essentially the same way: the commander led his large and unified army into battle against an opponent of roughly equal size. He would never break up his army into smaller units, for that would violate the military principle of keeping one’s forces concentrated; furthermore, scattering his forces would make them harder to monitor, and he would lose control over the battle. Suddenly, Napoleon changed all that. In the years of peace between 1800 and 1805, he reorganized the French military, bringing different forces together to form the Grande Armée, 210,000 men strong. He divided his army into several corps, each with its own cavalry, infantry, artillery, and general staff. Each was led by a marshal general, usually a young officer of proven strength in previous campaigns. Varying in size from 15,000 to 30,000 men, each corps was a miniature army headed by a miniature Napoleon. The key to the system was the speed with which the corps could move. Napoleon would give the marshals their mission, then let them accomplish it on their own. Little time was wasted with the passing of orders back and forth, and smaller armies, needing less baggage, could march with greater speed. Instead of a single army moving in a straight line, Napoleon could disperse and concentrate his corps in limitless patterns, which to the enemy seemed chaotic and unreadable. This was the monster that Napoleon unleashed on Europe in September 1805. Similarly, George Washington let his young leaders make their own strategic decisions in the field – capitalizing on the speed and agility advantage they had over their larger and better-trained competitors.

Understand: the future belongs to Swadeshi countries and innovators who are fluid, fast, and nonlinear. Your natural tendency as a leader may be to want to control the group, to coordinate its every movement, but that will just tie you to the past and to the slow-moving armies of history. It takes strength of character to allow for a margin of chaos and uncertainty – to let go a little – but by decentralizing your army and segmenting it into teams, you will gain in mobility what you lose in complete control. Give your different corps clear missions that fit your strategic goals, then let them accomplish them as they see fit. Smaller teams are faster, more creative, more adaptable; their officers and soldiers are more engaged, more motivated. By making officers and soldiers feel more creatively engaged, this strategy improved their performance and sped up the decision-making process. In the end, fluidity will bring you far more power and control than petty domination. With the transformational Swadeshi process which leverages on internal capabilities to exploit external opportunities with fluidity and speed, the wide-moat Bamboo Innovator is able to master the art of riding the powerful waves and staying resilient in crisis to compound value in uncertain times.

Warm regards,

KB

Managing Editor

The Moat Report Asia

www.moatreport.com

SMU: http://accountancy.smu.edu.sg/faculty/profile/108141/Kee%20Koon%20Boon

To read the exclusive article in full to find out more about the story of Bharat Forge, please visit:

|

|

“In business, I look for economic castles protected by unbreachable ‘moats’.”

– Warren Buffett

The Moat Report Asia is a research service focused exclusively on competitively advantaged, attractively priced public companies in Asia. Together with our European partners BeyondProxy and The Manual of Ideas, the idea-oriented acclaimed monthly research publication for institutional and private investors, we scour Asia to produceThe Moat Report Asia, a monthly in-depth presentation report highlighting an undervalued wide-moat business in Asia with an innovative and resilient business model to compound value in uncertain times. Our Members from North America, the Nordic, Europe, the Oceania and Asia include professional value investors with over $20 billion in asset under management in equities, secretive global hedge fund giants, and savvy private individual investors who are lifelong learners in the art of value investing.

Learn more about membership benefits here: http://www.moatreport.com/subscription/

- Individual subscription at $1,994 per year:

https://www.moatreport.com/individual-subscription/?s2-ssl=yes

Our latest monthly issue for the month of August investigates an Asian-listed company who’s the leading ecommerce group in its home country with the complete platform coverage in the Amazon-type of B2C ecommerce of selling directly to end consumers (Sales/Net Profit: 90%/78%), Rakuten-type of B2B2C platform (Sales/Net Profit: 4%/12%) to support the online SME merchants who in turn sell to the end consumers, and the eBay-type of C2C auction site (Sales/Net Profit: 2%/21%) where individuals buy and sell to one another. This “Amazon-Alibaba” is highly profitable with recurring free cashflow (FCF yield 4.6-5% compounding at 25% in the next 3-5 years) by pioneering the world’s-first 24-hour delivery promise and guarantee when world-class logistics experts said it cannot be done. In emerging markets and Asia where logistics costs is 15-20% of GDP, most ecommerce companies fail to scale up due to lack of fulfillment capabilities and inventory risk became the killing blow as they pursue growth without the intangible know-how. The company designs and builds its own warehouses to provide fast and efficient delivery with 99.68% on-time rate and also complete backend services to suppliers, widening the gap between itself and peers. With its superior infrastructure, the company is able to provide consumers a one-stop shopping experience with all goods purchased from different vendors packaged into a single box and delivered to the client’s door. The company has consignment agreements with suppliers which allow it to have control over inventory management but carry no liability of inventory on its balance sheet, in other words, there is minimal inventory risk for the company to scale up sustainably and without the usual accounting risks that plagued the ecommerce companies.

With (1) a superior ROE of 23.6% due to its wide-moat business model in 24-hour delivery system, (2) negative cash conversion cycle (-29 days) in its unique warehouse system with minimal inventory risk, (3) a sustained 25-30% recurring earnings and cashflow growth per annum in the next 5 years, especially a long run-way in disrupting traditional retailers, and (4) potential exponential growth in its option value in the third-party electronic payment business, the company can scale up multiple times. Short-term downside risk is protected by its healthy$128m net-cash balance sheet (15% of MV) and proven management execution in prudent capex expansion to support sustainable quality earnings growth. Its terminal value and long-term downside risk will be protected by giants Alibaba, Rakuten, eBay, Amazon who wish to swallow it up to possess its valuable trust and brand equity support it enjoys and its wide-moat business model in 24-hour delivery system. The company is one of the few Asian ecommerce companies with good governance and low accounting risks with its net-value revenue recognition method and it deserves a valuation premium. Upcoming deregulation in third-party electronic payment with the passing of the law in Sep 2014 will result in various government restrictions to be removed, paving the way for the company to introduce stored-value payments, O2O payment, P2P payment (money transfer without transactions), multiple currencies’ payments, big data analysis, payment services for customers outside the group to boost transaction volume and scale up its existing proprietary PayPal/AliPay business. Led by the inspiring and highly-determined founder and Chairman who established and listed the company in 1998 and 2003 respectively, the company has overcome the multiple obstacles to ecommerce transactions in its home market. The founder described the obstacles to ecommerce transactions as ‘friction’, and that he “resolve to take on the Life’s Task to reduce this ‘friction’”.

Our past monthly issues examine:

- An Asian-listed company who’s the global #1 and #2 maker of two types of patient monitoring devices for both clinical- and home-use. Founded in 1981 and listed in 2001, the company’s reliable manufacturing technology platform for over 30 years has enabled it to build a global durable franchise in the niche patient monitoring device market that has stable resilient growth and yet is experiencing potential disruptions led by its new innovation. A secret to its success is its in-house capabilities to combine Swiss design, high-precision electronics and sensors components with clinical healthcare to produce world-class products with cost competitiveness. The firm has competitive technology and patents especially its core competence of having an algorithm to allow fast reading/filtering of signals and outputting the accurate results in a short period of time. Thecompany has the potential to consolidate the market further. The company is also a sticky ODM partner to reputable companies including Wal-Mart, Costco, CVS and it has adiversified customer base with none of the customers accounting for more than 10% of its sales. The company demonstrated that it has bargaining power over its powerful customers with the ability to build its own brand since 1998 (62% of overall sales). 91% of its sales are to developed markets in US and Europe. The company is trading at EV/EBIT 9.7x and EV/EBITDA 8.8x and has an attractive dividend yield at 5.6% and a strong balance sheet with net cash as percentage of market value and book equity at 23% and 47% respectively. The firm has also undertaken the unusual capital management program to reduce 10% of its shares outstanding in Sep 2012 to boost capital efficiency by utilizing the comfortable net cash position. The proactive shareholder-friendly stance backed by its strong net cash position should limit any downside in share price. The company’s terminal value and downside risk will be protected by giants such as J&J, Bayer, Abbott etc who wish to swallow it up to possess its valuable manufacturing technology platform and worldwide patents in algorithm-technology. The company’s worldwide patents in algorithm-technology has been commercialized into an innovative product series that is at the heart of its total solution service business model. This valuable intangible asset is not factored into long-term valuation. The innovative product with the algorithm measurement technology are not merely additional features; it “forces” the clinical community to adopt them as the standard, which in turn helps drive home-use penetration as patients seek a consistent and integrated healthcare experience. It transforms the product into a unique strategy that incorporates software development to create value-added services for health monitoring and collaborating with hospitals and governments on tele-healthcare projects. As a result of its wide-moat, the company has a far superior ROE at 20.9% that is nearly double that of its key giant conglomerate rival. When we compare EV/EBIT relative to ROE and ROA, the company is cheaper by as much as 120-150% when compared to its key giant conglomerate rival. The stock price of the company is down nearly 20% from its recent high in end March 2014 on profit-taking by short-term investors. Share price is back to May 2013 level, representing an attractive opportunity to take position in this long-term durable franchise. The stable long-term shareholdings and patient capital by the founder and the management team who together own around 48% of the equity has enabled the firm to adopt a very long-term approach to building its business and cultivating new growth areas. While he may sometimes be slightly over-optimistic and thinking too far ahead with his long-term opinions, this idealistic engineer-visionary-philosopher has done a fantastic job in continuously defying the odds of many skeptics by growing the company from a small startup into one of the world’s leading patient monitoring equipment company. He is the rare Asian entrepreneur who was persistent in building his own brand despite the threat of offending his ODM customers. He was also early in cultivating and coordinating a global network with high-tech component, R&D and manufacturing in his home country, manufacturing, assembly and packaging in Shenzhen, China and medical R&D and clinical testing center in Europe, including making the difficult decision to establish a direct marketing sales force in Europe and North America given the high cost. Unlike most Asian business owners whose interest and focus in the core business starts to wane due to complacency from growing personal wealth and the inability to scale the core business, the founder is genuinely passionate in the company’s ability to add value to the patients and society. The firm can effectively run without the founder with the long-term corporate culture and management system in place, yet he can inject great value as the steward in new innovations; we believe that this combination is rare for an Asian company and deserves a valuation premium.

- The world’s #1 ODM (Original Design Manufacturer) and global #5 manufacturer of a consumer healthcare device product that is used frequently, even daily, thus providing the foundation for stable recurring cashflow. This company is also a hidden champion in a niche product segment (50-55% of group’s sales) that has become a high-growth fashion product currently accounting for less than 10% of the overall industry. The company is able to mass-manufacture this niche product, but not the giants, because of its unique process IP in flexible manufacturing system and know-how to handle large-scale complex orders. The manufacture of this product itself is difficult to replicate and requires FDA/CE licenses because of its medical device nature and the entry barrier is not capital but the know-how and R&D expertise. In particular, the manufacturing integrates different fields of science including polymer chemistry, physics, optics, engineering, materials control, process control, microbiology, and, injection molding. The firm has also developed a proprietary system of tracking the manufacturing process of different sets of product so that if a quality issue arose, when and where the problem set of products was being produced could be swiftly identified, thus diminishing the scale and cost of product recall. This system has helped the firm win the long-term trust of its ODM customers to place stable large orders. The Big Four giants do not have such a system and have to incur substantial losses from product recalls. The company also possess its own brand which has many loyal followers and support in its home market where it enjoys a 30% market share and contributes to 25% of group’s saleswhile sticky ODM customers account for 75% of group’s sales, mainly from the Japan market. As a result of its wide-moat advantages, the firm enjoys a consistently high ROE of 41%, double or triple that of the giants. From FY07 onwards, even during the depths of the Global Financial Crisis in 2007/09, the firm has not raised equity. Since listing in Mar 2004, the company has only done one rights issue in May 2005. Also, it is able to sustain a strong stable cash dividend payout (>70% with 3% yield) with its healthy net-cash balance sheet (net cash $30m; net cash-to-equity ratio 23%) and proven management execution in prudent capex expansion to support sustainable quality earnings growth. M&A deals in the healthcare and medical device sector has been growing due to their strong defensive nature and giants seeking growth to overcome their own patent cliff. The firm willalways be an attractive takeover target by giants who wish to swallow it up to possess its valuable flexible manufacturing system and know-how to fill their own missing competency gap and hence will enjoy long-term downside protection in its terminal value. In the battle between “ODM vs Brand”, we find the story of the company to be quite similar to that of TSMC (2330 TT, MV $103bn), now the largest ODM foundry in the world. “Skate to where the puck is going to be, not where it has been,” as hockey legend Wayne Gretzky advised. In our view, the profit and valuation premium in the value chain will start to skate to the “Inno-facturers” who are the hidden ODM innovators (the brand behind brands) consolidating the industry, such as TSMC and this company. While its valuation is not cheap with EV/EBIT (FY13) at 20.6x, when we compare EV/EBIT relative to ROE, the company is relatively cheap, by as much as 130-220% when compared to giants and other comparables. When we compare EV/EBITDA relative to ROE, the valuation gap is 90-160%. This long-term valuation gap implies that the company, with its far superior and sustainable ROE, could potentially double to $2.4bn, as it continues to consolidate its niche product segment and enter into a new product cycle of an innovative product whose patents are expiring in 2014/15 (US/worldwide) to make ASP/margin improvements in sustaining quality profits and cashflow. Its share price has dropped 18% from its recent high and underperformed the index by 26% in the last six months. This will present a buying opportunity for long-term value investors who can penetrate beyond conventional valuation metrics because of a deep understanding of its business model and underlying source of its wide-moat advantages. In Asia, many firms break apart or become value traps due to shareholder conflict, envy and differences in opinion on the business direction of the company. The stable long-term corporate culture infused by the late founder, who established the company in 1986 with the current executive chairman and 2 other key shareholders, to combine the energy and ideas of everyone to work hard to keep the business running forever is underappreciated.

- The Home Depot of Asiawhich has the largest market share in its home country and now seeks to expand regionally. It is one of the few home improvement retailers in the world which is able to achieve a structural negative cash conversion cycle (CCC) at -39 days for resilient, recurring and sustainable operating cashflow to enable the expansion of its store network while keeping a healthy balance sheet. It is hard to achieve negative cash conversion cycle (CCC) as a home retailer as compared to a supermarket retailer as the product nature is more durable. Even Home Depot, Lowe’s and Bed Bath & Beyond (BBBY) are not able to achieve a negative CCC. Led by the capable owner-operators since 1995, the company is a pioneer in proactively creating awareness and demand in the minds of consumers that upgrading your home can be fun and in incremental affordable steps. Its creative branding has resulted in the firm to become the “first on customers’ mind”, or what Charlie Munger elucidated as the “psychological wide-moat” advantage. 80% of sales are generated customers looking for home improvement and renovation ideas and solutions. Growth is supported by the management’s proven ability to identify and cater to dynamic changes in customer preferences. The firm’s comprehensive pre and aftersales service creates brand loyalty and sustains long-term sales. The merchandizing management is tailored to the peculiarities of customer preferences in each area to drive same store sales growth with creative customization by store, location, season and events. Its key strategy to expand its profit margin is to increase its higher-margin house brands and product-mix management. Its EBITDA/sqm of $400/sqm was higher than Home Depot until Home Depot experienced a rebound last year to $500/sqm. The firm’s resilient sales are supported by its unrivalled network of diverse locations throughout the country. Its bold vision and successful “Blue Ocean” execution in the highly fragmented second-tier markets has created a powerful wide-moat advantage that will last for many years to come. In short, the management have proven their ability to execute in difficult market and industry conditions especially in the past 5 to 7 years during the 2007/09 global financial crisis with the firm emerging much stronger. The Illinois Institute of Technology engineering graduate and quiet billionaire owner behind the home retailer is one of the few Asian business tycoons who has the thirst to scale up the business in a sustainable way, as opposed to opportunistic ventures, having been largely influenced by his early years experience observing the success of American wide-moat firms. If we can adjust the EV/EBITDA valuation metric to reflect the CCC, the company’s EV/EBITDA of 18.5x will be lower at 10-11x, while Home Depot’s EV/EBITDA 11x will be higher at 13x. Noteworthy is that Home Depot has a negative free cashflow throughout FY1989-2001 (13 consecutive years!) and yet market cap has climbed from $1.5bn to $103bn. Home Depot compounded despite the ugly valuations during the capex ramp-up. This once again highlights that the power of wide-moat is often underappreciated, misunderstood and overlooked. When Home Depot generated $180m in operating cashflow in FY1992, quite similar to this Asian firm now, Home Depot is valued at $5bn (vs $3bn). Store network is expected to double in the next 4-5 years, representing a potential doubling in market value.

- The Northeast Asian-listed companywho is the world’s largest maker of an essential component with applications in apparel, shoes, diapers, car seats etc. All top 20 global athletic shoe brands, including Nike, Adidas, Reebok, Sketchers, UnderArmor are customers and this Asian innovator with R&D capabilities has forged long-term “spec-in” partnerships with them. Its broad product offering is protected by over 110 patents. By locating its Pan-Asian production plant network in China, Taiwan, Vietnam and Indonesia close to its major clients, including sales/customer service centers and warehouses in US and Europe, the firm is better positioned to understand their requirements, deliver fast and meet their needs. While top 10 athletic shoe brands account 40% of its revenue, the firm has a diversified clientele base of over 10,000 customers, giving it resilience and growth with both the established and emerging brands as clients. The company is trading at PE14e 12x, EV/EBITDA 7.1x and EV/EBIT 10.6x with a dividend yield of 3.9%. Interestingly, its EBITDA margin is double that of Adidas and its 8.7% net margin is higher than Adidas’ 5.4%, though below Nike’s 9.8%. Given the tipping point of its Pan-Asian production network and contributions from its new products and as capex tapers off in the next few years, free cashflow could be around $50-60m and applying a P/FCF of 15x would yield a market value of $750-900m,, representing a potential upside of 100-150%. Thus, the firm offers a similar quality growth trajectory to Nike/Adidas with its unique knowledge-based business model and yet trades at a more attractive valuation and higher dividend yield as downside protection.

- The Middleby of Asia commanding a dominant market share of over 80% in hypermarkets, 50% in chain outlets, 30% in 4- to 5-star hotels in China and an overall 30% in its home market. Yet, no single customer accounts for more than 5% of its revenue. Just to recall for value investors, NYSE-listed Middleby, with its sleepy and boring business, has compounded 100-fold from around $50m to $5.7bn since its tipping point in 1999. The founders of this Asian family business demonstrated clear dedication in building up the company with its wide-moat business model backed by a strong and unique distribution/marketing network in finding, winning and binding new customers to build massive brand equity and long-lasting relationships with clients over time. Their devotion to its core product for nearly 20 years results in maximum problem-solving skills, innovative strength and product leadership and hence, to ever greater customer benefit that will protect the company to consolidate the fragmented market and provide ample opportunities to continue its profitable growth. The company is currently trading at PE13e 15.8x and an undemanding EV/EBIT 10.1x and EV/EBITDA 9.5xand its growth potential based on its unique business model is not priced in. There is a structural re-rerating of niche business models with (1) diversified client base, (2) steady revenue streams, (3) lean capex requirements that creates ample free cashflow and defensive growth. Based on PE, P/CFO and EV/EBIT, the company is trading at a 40-50% discount to the foreign listed comparables despite more efficient use of assets in generating profits and cashflow. It has an attractive 7% earnings yield growing at 20% over the next 3-5 years and a 3.8% dividend yield that is supported by its strong cashflow generation ability, steady revenue stream and lean capex requirements to limit downside risks in valuation. Based on the growth plans to penetrate new product and customer segments; build its third plant in India in addition to the ones in its home market and in China; and potential bolt-on acquisition opportunities with its healthy balance sheet in net-cash position, it has the potential to double its operating cashflow in the next 3-5 years and market value could double, representing an upside potential of 100-140%.

- An emerging Asian Walgreens which is a top 3 community pharmacy operator in its home market. Walgreens is a classic neglected American compounder up over 272-fold to $54 billion from under $200m as it quietly consolidates the market. Over the decade, we observed that it is difficult to scale services-based businesses without an entrepreneurial mindset, committment and execution and the bold and unique management system of the company since 2000 allowed the pharmacists to be part-owner of the business which will lead to increased level of commitment and an owner’s mindset in growing the business for the long-term in the community. The firm has strong cash generation ability due to its negative cash conversion cycle (CCC) in the business modelto help the business stay resilient during difficult times and to fund capex needs internally without straining the business model scalability as the network expands. The centralized logistics system provide regular deliveries to all of its community pharmacies enables the outlets to maximize retail space without the need to have space to keep stocks. This also enables the community pharmacies to optimize retail space to carry a wide range of products which is important as consumers increasingly have top-of-mind recall for the company as the destination to go to for their healthcare needs. Like Walgreens, the company believed in the power of embedding technology into the business model to better compete and its financial and warehousing/inventory management systems are integrated with its in-house POS (point-of-sale) system which is linked among all its community pharmacies and head office via virtual private network. The company is founded by five college friends who were somewhat frustrated that their pharmacy degrees were underappreciated and under-rewarded as compared to their medical degree counterparts even though they had studied hard for 4-5 years and had in-depth medical knowledge. They were eager to prove themselves that they are as capable, if not more so. This restless spirit to prove their capabilities resulted in them coming together to be entrepreneurs and they wish to provide the platform for similar restless pharmacists to apply their hard-earned knowledge acquired in the university. We find that this common purpose and camaraderie spirit is rare in Asian companies and makes the company unique to scale up sustainably. The company is currently trading at a EV/EBIT of 13.9x and EB/EBITDA 12.6%. In the next two to three years as the company expands its network of outlets, operating cashflow (CFO) could increase 50-60% and a re-rerating could result in a doubling in market value.

- An Asian-listed pharmaceutical company which has a dominant franchise in a neglected but growing diseaseand is a leader with a domestic market share of 49% in this niche segment and is the only fully-integrated player amongst the few pre-qualified WHO firms, giving it >30% EBITDA margin, better pricing power compared to the competition, and significant advantage over other players in ramping up the global business from the current 30% market share in the most-common treatment drug (vs Novartis 50%). Furthermore, the pharma company has the second-highest GP/TA (gross profit/ total asset) ratio in the industry at 56.3% and the most conservative accounting practice in the industry which “depresses” earnings relative to its peers i.e. it is the only domestic firm which expenses, and does not capitalize, all R&D. With the new plant for formulations export to US, the deepening of the niche drug franchise, growing wins in chronic pain and other niche areas and the commercialization of the potential blockbuster product of blood thinner by FY16/17, EBITDA could potentially double to $200m in the next 4-5 years, triggering a valuation re-rating to a market value of $3.4bn, a 130% upside.

- An Australian-listed company with market value $405m, EV/EBITDA 7.5x, EV/EBIT 10x, div 3%, 70% domestic market sharewhose management made the controversial bold decision to stop overseas exports in order to focus on cultivating the higher-margin domestic market with innovative marketing strategy and new products and is potentially doubling its supply in the next 3-5 years. It is in its 10th year of listing after piling the foundation in consolidation, investment, rationalization for its next stage. It has an all-time low debt-equity position 18.6% with healthy balance sheet. “Buffett of Nordic” recently increased position between Apr-Sep this year in the peer comparable of the company and the billionaire investor announced in Nov an acquisition of a rival in a wave of global consolidation and with the view on a sustained recovery in product prices.

- A Northeast Asia-listed company with global #1 market share leadership in 4 different products, including making the components for an innovative consumer product whose sales have climbed from $90 million to $526 million in the recent three years. The company is a hidden global consolidator with underappreciated growth. The stock is trading at PE 11.5x, EV/EBITDA 9x and generates a sustainable dividend yield 5.75%.

- A Taiwanand Southeast-Asian-listed entrepreneurial company, both with a dominant 80% domestic market share and have innovative business models to generate substantial cashflow to support both expansion and a 4-5% dividend yield.

- There is also a behind-the-scene conversation with the CEOsof the companies to understand their thinking process in building up the business.

The Moat Report Asia Members’ Forum has been getting penetrating quality dialogues from our subscribers.Questions range from:

- The nuances of internal dealings in Asia, including the case discussion of the recent deal in which HK billionaire’s Lee Shau-kee Henderson Landacquiring Towngas or Hong Kong & China Gas (3 HK) from his family holdings, seemingly déjà vu from the early Oct 2007 transaction when the market peak.

- The case of F&N Singaporespinning out its property unit FCL Trust and getting “free” special dividend-in-specie and the potential risk in asset swap restructuring to deleverage the hidden debt in the entire Group balance sheet.

- The dilemma of whether to invest in a Southeast Asian-listed company and hidden champion with a domestic market share of 60% due to family squabbles and a legal suit over the company’s ownership.

- Discussion of the wise and thoughtful 107-year-old Irving Kahn’s investment into a US-listed but Hong Kong-based electronics company with development property project in Shenzhen’s Qianhai zone and the possible corporate governance risks that could be underestimated or overlooked, as well as their history of listing some assets in HK in 2004.. This is also a case study of “buy one get one free” in John’s highly-acclaimed book The Manual of Ideasin which the “free” property is lumped together with the (eroding) core business to make the combined entity look cheap and undervalued. What are the potential areas that value investors need to watch out for when adapting the SOTP (sum-of-the-parts) valuation method in Asia?

- And many more intriguing questions.

Do find out more in how you can benefit from authentic and candid on-the-ground insights that sell-side analysts and brokers, with their inherent conflict-of-interests, inevitable focus on conventional stock coverage and different clientele priorities, are unwilling or unable to share. Think of this as pressing the Bloomberg “Help Help” button to navigate the Asian capital jungle. Institutional subscribers also get access to the Bamboo Innovator Index of 200+ companies and Watchlist of 500+ companies in Asia and the Database has eliminated companies with a higher probability of accounting frauds and misgovernance as well as the alluring value traps.

|

CONNECT WITH US

CONNECT WITH US