| Dear Friends,Beyond Ordinary Succession to Transgenerational Legacy: The Berkshire Hathaway Way to Identify Asian Family Innovators from the German Louis Deal“I like it that we have cracked the code in Germany.. I would really be surprised if we don’t make at least one deal in Germany in the next five years. I’ve had probably four or five letters in the last couple months, ever since the Louis deal was announced. We’re eager, we have the money, and we do fit the family situation occasionally. Prices may be a little more attractive than in the US.. We would like more companies from around the world to buy.”– Buffett at the Berkshire Hathaway AGM 2015Ordinary succession describes processes, family and successor attributes that characterize the transfer of ownership and control, but does not explain how features and conditions of entrepreneurship can be transferred and how succession can be performed to ensure transgenerational legacy. Thus, whether a professional manager or a family member is chosen as the successor is of second-order importance in accomplishing transgenerational entrepreneurship unless a missing essential ingredient is first established.This missing ingredient can be found in Detlev Louis Motorrad-Vertriebs, Berkshire’s first ever direct investment in a family business innovator in Europe in Feb 2015. The Detlev deal is essential in not only understanding the essence of “Berkshire Beyond Buffett”, but also offers an update to Buffett’s 1996 “An Owner’s Manual” to guide value investors in asking a different sort of right questions in determining whether the wide-moat characteristics of a business can endure beyond ordinary succession to transgenerational legacy, as well as to identify potential family innovators in Asia which we will highlight later with the case of Japan’s low-profile innovator Workman Co (7564 JP, MV $1.1bn) with a similar business model to Louis.First, a deceptively simple question: Why would you want to buy a family business that wants to sell itself? Families’ commitment to entrepreneurship declines precipitously once control is passed from the founding to later successive generation. Also, the really good ones will not want to sell out. If so, how to attract the really good ones to come to you – voluntarily?

When the late German entrepreneur Detlev Louis passed away in Oct 2012 at the age of 93, the eponymous-named firm endured and continued to grow to extend its as Europe’s #1 for motorcycle clothing, helmets and accessories with 74 stores in Germany and Austria and annual sales of Euro 270m. This was despite the setback of the sudden death of the second generation Stephan Louis in Jul 2011 due to heart attack at the age of 57, as well as changing consumer dynamics with the disruption of online ecommerce that bankrupted its rival Polo in Dec 2011.

The wide-moat characteristics of Detlev Louis that attracted Buffett to pay $450m is a microcosm of Berkshire Hathaway, itself a collection of companies acquired over the past 50 years to propel it to eclipse General Electric to become the largest conglomerate in the world worth $365bn and perched at #4 in the Fortune 500 list. Berkshire’s essence is that of a family business innovator, run by executives who consider themselves owners nurturing the company for the next generation, rather than hired hands. And sellers of businesses sometimes sell out to Berkshire at a price less than what they could have received elsewhere.

When asked in 2008 why family business owners would want to sell to Berkshire, Buffett quipped: “You can sell it to Berkshire, and we’ll put it in the Metropolitan Museum; it’ll have a wing all by itself; it’ll be there forever. Or you can sell it to some pawn shop operator, and he’ll take the painting and he’ll make the boobs a little bigger and he’ll stick it up in the window, and some other guy will come along in a raincoat, and he’ll buy it.” In other words, Berkshire offered the family businesses and entrepreneurs a sense of a permanent home and the autonomy to continue running the business, as argued by Lawrence Cunningham, author of the insightful book Berkshire Beyond Buffett. And this distinctive corporate culture of permanence and decentralized autonomy has been a core set of values and the glue that unites Berkshire’s bewildering variety of companies, such that bigger is not riskier and there isn’t the (steep) holding company discount to its book asset value.

Top Left: The late Detlev Louis in a photo with his congenial wife Ute; Top Right: Buffett the biker at the AGM; Bottom: Workman (TSE: 7564 JP) – Stock Price Performance 1997-2015

Buffett and Munger also emphasized the point of Berkshire’s culture at the AGM 2015:

Shareholder question from Lawrence from Germany: “You are heralded for your integrity. How can investors judge the state of Berkshire’s culture long after the two of you are gone?”

Buffett: “I think you will be very pleased with the outcome. I think BRK’s culture runs as deep as any large company should. A few days ago, the company closed on a transaction in Germany. The owners had spent 35 years or more building a retail business… it’s a vital part of Berkshire to have a clearly defined, deeply embedded culture that pervades the company. Once Charlie and I aren’t around, it will be clear that it’s not a force of personality, that it’s institutionalized.”

Munger: “As I said in the annual report, I think BRK is going to do fine after we’re gone. In fact, it will do a lot better… but at any rate, it will never again at the rate it did in the early years. There are worse tragedies in life.”

Underlying the corporate culture traits at Berkshire is the “missing ingredient” that we hope will help spark the generation of deeper questions in understanding the persistency of wide-moat: Imprinting.

Imprinting is a learning process that initiates a development trajectory that produces persistent outcomes. Building on the work of Stinchcombe (1965) in his work “Social Structure and Organizations”, organizational research on imprinting has highlighted the enduring impact of prior history on organizational outcomes by demonstrating how organizations assume elements of their environment that persist well beyond their founding phase. Imprinting has to take place and take root before the succession process can become successful.

We have observed that transgenerationally entrepreneurial families possess entrepreneurial legacy, the reconstructed narratives of the family’s entrepreneurial behavior and resilience that motivate and give meaning to entrepreneurship with today’s risks in perspective, motivating current and next-generation leaders to engage in strategic activities that go beyond ordinary succession and thereby nurture transgenerational legacy. Actions that leaders take and routines that develop during periods of environmental stress and organizational change, such as frugality in spending and calculated boldness in expansion during a severe recession, lead to profound differences in structures, strategies, and product offerings that become “imprinted” in that they persist over time. Transgenerational entrepreneurial family firms are stronger and quicker in creating new products and services as niches develop, enter new markets, adopt new technologies, and implement new ways of organizing business activities.

At Louis, the imprinting over the years enabled the firm to endure the death of both the founder and the second-generation. Founded in 1936 as a small repair shop and built by Detlev since 1946, the firm was a pioneering innovator in multi-channel sales offering an extensive range of over 32,000 products, launching its first motorcycle accessories mail-order catalogue in 1967. This was a time when motorcycle was pushed massively into the background by the car. But Detlev believed in the unique fascination with motorcycling in which he developed tuning and accessories for his races. The wide range of products, reasonable prices and almost always good services made the consumer experience at Louis more enjoyable, garnering it a loyal customer base of a million mostly very satisfied customers. The popularity of Louis stores prompted the development of a modern logistics center with conveyor technology in 1991 to supply its growing network of store branches. In 1997, the reach into the consumer was extended by online trade which generated around 20% of its sales in 2014. Throughout its history, Louis has taken care to imprint the values of economic foresight, openness to new ideas, hard work and excellent people management into its corporate culture and into its successors Nico Frey and Joachim Grub- Nail. Thus, value investors can utilize the imprinting idea to generate interesting general questions to assess the sustainability of the wide-moat beyond ordinary succession. These include:

- What was the breakthrough or innovation story in the corporate history (eg first motorcycle accessories catalogue) that enabled the company to grow and differentiate itself amidst the competition? Did the founder and management sought to imprint the intangible values (eg determination and economic foresight in establishing multi-channel sales) in the culture?

- How did the firm cope during environmental stress (eg online ecommerce threat, price war amongst rivals), organizational change (death of second generation), and periods of expansion (eg complacent vs sober in setting up the modern logistics center)? Were the intangible values (eg frugality in spending, openness to new ideas, boldness) imprinted?

To run a distribution and store network effectively takes a decentralized “core-periphery” system, an essential source of “emptiness” in Bamboo Innovators in which fibers of greatest strength occur in increasing concentration toward the periphery of the bamboo, a powerful architecture from a builder’s viewpoint. At the “periphery”, the Louis stores have penetrated into the hearts of the motorcycle culture. At the “core”, the centralized support of the modern logistics center enabled the vitality of the stores to provide a comprehensive range of products with efficient inventory and working capital management. The core-periphery business model at Louis is a microcosm of Berkshire itself: Operating managers at the “periphery” like Louis with autonomy in doing their jobs are greatly motivated by the trust and empowerment to outperform. The operating subsidiaries are all united by the distinctive corporate culture and values at the “core”.

Are there similar Louis in Asia? How can value investors use imprinting and the core-periphery business model to identify these family innovators?

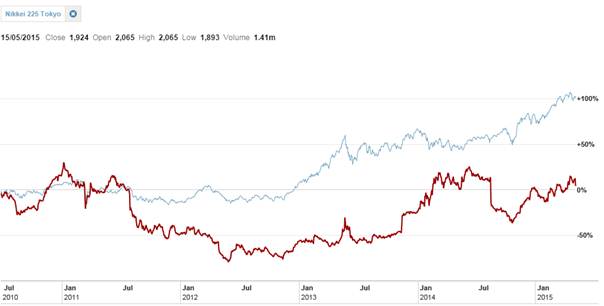

One such transgenerational Bamboo Innovator is Japan’s Workman Co (7564 JP, MV $1.1bn), dubbed the “Uniqlo of workwear market” and owned by the Tsuchiya family with a majority control of over 52%. Established in 1982 as an “artisan workshop” in Gunma prefecture, Workman is a specialty retailer of work uniforms and related goods including work gloves and safety shoes, operating 700 stores (both its own stores and franchised stores) in 41 prefectures in Japan, generating around $49m in profits from $404m in sales in FY14. Since its listing in 1997, it has compounded over 600% as compared to a flattish Nikkei 225 index.

Like Louis, Workman offers a wide range of over 7,500 items that meet customers’ needs. Workman uses sales data and other feedback from its outlet managers to jointly develop with manufacturers its own brand of products that are tailored to meet specific customer needs and price demands, in the same way that Uniqlo is both developing and making its products. Own-brand products make up over 60% of Workman’s product line-up. The remaining products sold are purchased from manufacturers produced nearly exclusively for it at low prices in exchange for assuming risks of stock valuation losses. The firm enjoys economies of scale as the number of its outlets has increased substantially. In addition, the firm has found ways to effectively reduce costs by procuring goods from overseas and by using private brand products, especially for consumable supply goods. For instance, a set of dozen cotton work gloves is priced at around ¥160, half of the regular market price.

Workman is a member of the low-profile unlisted Beisia (Iseya) group of companies, a large distribution group founded in 1958 in the northern Kanto region with ¥8,300bn ($69bn) in group sales, making it one of the top 20 business groups in Japan. which also includes the shopping mall chain Beisia (107 stores in Tokyo metropolitan area), the home center Cainz (188 stores throughout Japan), the convenience store chain Save On (582 stores in Kanto district), car parts and accessories chain AutoR (60 outlets). Yoshio Tsuchiya is the chairman of Workman since 1984 and is also chairman of Beisia since Jun 2009. Like Berkshire and Louis who have imprinted distinctive values into the culture, the Beisia group imprinted the unconventional idea in hierarchical Japan of a profit-sharing system in 1967 and was an early pioneer in adopting the IT system to be more efficient in its inventory management in 1974. Beisia was also an innovator in management system with the overseas training system in 1975. Beisia opened its modern Isesaki logistics and distribution in 1980, followed by the Tokyo Information Center in 1984 in the application of data analytics of supplier and consumer intelligence.

Importantly, Workman has the core-periphery business model in applying the know-how at the “core” of the Beisia group to maintain efficient systems for distribution, inventory management and information gathering and application. Due to its clout and dominance, Workman receives income in the form of centre fees from…

There is an interesting story imprinted about the frugal culture, the mechanism and unconventional measures built and maintained throughout the company’s history that allows Workman to sell products at amazingly low prices. In its new product presentation launches in which Workman unveils new products to the owners of its franchise stores, the highlight of the presentation event is a fashion show featuring new work wear. All of the models that appear in the show are young people who are Workman’s newly recruited employees. “It would cost about 100,000 yen to hire one professional fashion model for the show. So we use our employees instead,” said Workman’s president with an unconcerned look. Workman is determined to cut costs whenever it can do so. There is simply no room for compromise about this.

Indeed, there is no compromise at Workman, the low-profile Asian Bamboo Innovators, and BRK’s operating businesses in imprinting these BERKSHIRE values elucidated by Cunningham and value investors will do well by observing and assessing the imprinting to identify the longevity of the wide-moat innovators:

Budget conscious, as in thriftiness

Earnest, as in keeping promises

Reputation, as in personal and corporate integrity

Kinship, in terms of legacy and a family orientation

Self-starters, as in entrepreneurial behavior

Hands off, as in delegating decisions and responsibility

Investor savvy, in terms of capital investment

Rudimentary, as in easy-to-understand businesses

Eternal, as in a long-term perspective

Warm regards,

KB

The Moat Report Asia

www.moatreport.com

http://accountancy.smu.edu.sg/faculty/profile/108141/KEE-Koon-Boon

A new monthly issue of The Moat Report Asia is now available!

Access the in-depth idea presentation:

http://www.moatreport.com/members/

This month, we highlight a wide-moat innovator who is the #1 in Asia in a patented automotive electronics part that is part of the fast-growing Advanced Driver Assistance System (ADAS) market worth >$22bn by 2018, doubled from $11bn in 2014. The ADAS market is driven by more stringent safety requirements from governments forcing the automotive industry to develop automotive electronics solutions to increase vehicle safety. [Company’s name] is the third-largest in the world behind Valeo (FR EN) and Bosch. It has >50% market share in new cars sold in China, and the installation rate of this ADAS product on China’s auto is still low (35%+ on new cars vs 80%+ in developed markets). Established in 1979 by founder and Chairman Mr. C, [Company’s name] is one of the rare Tier-1 automotive suppliers in Asia to major OEM car makers that include Ford, GM, Daimler, Hyundai, Nissan, China’s top 10 auto companies such as Great Wall Motor, thereby directly shipped to them and involved in their R&D processes and early stage processes of concept car design and prototyping, creating a pre-emptive advantage in winning new orders. Over the past 36 years, [Company’s name] has forged formidable competitive advantages in scale, product quality, technological know-how and R&D capabilities and in May 2012, [Company’s name] outgunned illustrious industrial automotive giants Valeo (founded in 1923) and Bosch (founded in 1886) to sign a breakthrough global 10-year contract with GM, with the commencement of worldwide shipment to 18 countries and 25 factories at the end of 2016.

Paid subscribers get:

- The Monthly Moat Report Asia (20 issues)

- Bonus Content: The Weekly Bamboo Innovator Insight Articles (>70 Issues)

- Bonus Content: Access to the Members’ Forum

- Bonus Content: Videos and Presentations by Thoughts Leaders, Entrepreneurs and Business Leaders in Asia

|