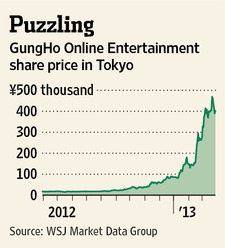

Japan’s Investors Are GungHo for iPhone Game; Tokyo-based GungHo Online Entertainment has seen a 23-fold increase in its share price this past year, with its market capitalization swelling to $4.9 billion

March 29, 2013 Leave a comment

March 28, 2013, 11:57 a.m. ET

Japan’s Investors Are GungHo for iPhone Game

Kazuki Morishita in playful mood with dragon friend

The Japanese may love videogames, but some look downright smitten.

Tokyo-based GungHo Online Entertainment has seen a 23-fold increase in its share price this past year, with its market capitalization swelling to $4.9 billion.

The excitement centers on GungHo’s smartphone game “Puzzle & Dragons.” While free to download, a fraction of users spend freely on extra virtual items that enhance play. It became Japan’s top iPhone game within several days of its February 2012 launch and remains No. 1, with GungHo’s revenue rising each of the last few quarters.

The trouble is maintaining that growth. “Puzzle & Dragons” launched on iPhones in South Korea in January and recently slipped to No. 7 there, according to AppAnnie.com. In the U.S., it currently ranks 82nd. While GungHo could spend more on marketing, the game’s odds of becoming a hit stateside diminish daily.

That is a problem. Virtually all of GungHo’s rally has been tied to this single game. The company existed for several years previously without a similar hit, so who knows when another might arrive.

And as social-gaming company Zynga has learned, highfliers can fall fast. It bought OMGPOP in March 2012 for $183 million, when that company’s “Draw Something” game was all the rage. A few months later, Zynga wrote off half that investment.

Another concern: An investment fund controlled by GungHo’s Chairman Taizo Son agreed on March 25 to sell a 6% stake in the company at a 26% discount to Softbank, run by his billionaire brother Masayoshi Son.

Yet even after a recent correction, GungHo’s stock trades at 54 times 2012 earnings. Assume, very generously, that earnings triple this year, and the forward multiple of 18 times would imply even more growth in 2014. Barring another lucky strike, the stock may soon be played out.

GungHo CEO Morishita on why Puzzle & Dragons’ success isn’t just the revenue

Revenue is just numbers. Success is the players

Jon Jordan 27/3/2013

You’d be a brave – or foolish – person to try and decide which is the most impressive; Supercell or GungHo Online.

(Actually I did that already, but all the companies in the top 5 of PocketGamer.biz top 50 developer 2013 are amazing, right?)

More seriously, there are similarities between the Finnish and Japanese companies, though.

Both are massively experienced, with staff who have proven they can make great games for over a decade. Both are laser focused on the quality and fun provided by their game experiences.

The right stuff

And actually, the companies did met up, as GungHo Online CEO Kazuki Morishita revealed through the translation of the company’s US director of production Kenji Hosoi when we spoke during GDC 2013.

“I think we have very similar cultures,” Morishita says, although being a gamer through and through, he’s notably tactful about the entire industry.

“We’ve worked with companies such as EA and Ubisoft [on GungHo’s console games]. I respect gaming companies and love playing their games,” he comments.

As aside, that’s one reason GungHo won’t be using gaming platforms such as Mobage or GREE anytime soon. “They are more like IT companies than games companies,” says Morishita.

“Sony, Microsoft, Nintendo, Apple, Google and Amazon are our platform partners.”

A game a day

Indeed, despite running the most successful mobile games companies in Japan (if not the world), Morishita still ensures he plays games every day.

Currently on God of War [Ascension, we presume], he also recently playedMetal Gear Rising: Revengeance, Assassin’s Creed III [completed in two days flat], and Hitman: Absolution.

These are all console games, but surprisingly perhaps, until 2011 when it released its first mobile game, GungHo Online was focused on PC and console titles, in part, thanks to its ownership of companies such as Acquire, Game Arts and Grasshopper.

But it’s on mobile, where Puzzle & Dragons is now rumoured to be making over $2 million per day that’s the main subject for our discussion.

“Any game we make, we expect it to be good, of the highest standard,” Morishita says.

“We were very confident that Puzzle & Dragons was a good game, but the success was mind-blowing.

“It had a lot to do with luck,” he adds.

What luck?

That’s not the answer people expect to the question of why Puzzle & Dragons is now being spoken of as mobile gaming’s first billion dollar franchise. (That was VentureBeat’s Dean Takahashi, by the way.)

When pressed on the ‘luck’ aspect, Morishita clarifies, but only slightly.

“It was intuition and luck,” he concludes.

What he means is intuition is a mixture of expertise and experience. Significantly, GungHo went through a difficult time in the mid-2000s, partly because too much of Morishita’s time was taken up with being company CEO.

His response was to get back to doing what was important and what he wanted; being a hands-on creative.

The other aspect of intuition is GungHo’s history, operating online titles such as Ragnarok Online and making console games. These meant it could develop high quality mobile titles in terms of graphics, audio and general presentation, while also knew how to operate a game as a service – vital in the free-to-play world.

These are the things that underpins Puzzle & Dragon’s succcess. Oh, and luck…

It’s just numbers

As for trying to pin him down on exact user or revenue numbers, as CEO of a publicly traded company, Morishita wouldn’t comment beyond saying that the game has 11 million users.

“We believe having 11 million people playing and enjoying our game is more important than what they are paying,” he states.

Similarly, the news announced this week that largest shareholder SoftBank Mobile will pay $265 million

to extend its 33.8 percent ownership of GungHo Online to 58.5 percent didn’t excite Morishita much.

“Nothing has really changed in terms of how we operate,” he said. “It’s just numbers.”

And on that basis, the fact that GungHo’s market capitalisation (albeit on illiquid stock) is now worth $4.5 billion isn’t something he thinks about.

“Our focus is making great games, not the stock,” comes back the response.

“The worth of our company isn’t the stock price, and if we start worrying about the stock price, that will change the way we work and make games.