The end is nigh’ for global oil demand growth: Citi; global oil demand would plummet by 18%, to around 74 million barrels a day from the current 90 million

March 29, 2013 Leave a comment

Citi: ‘The End Is Nigh’ For Oil

Rob Wile | Mar. 26, 2013, 11:21 AM | 5,312 | 10

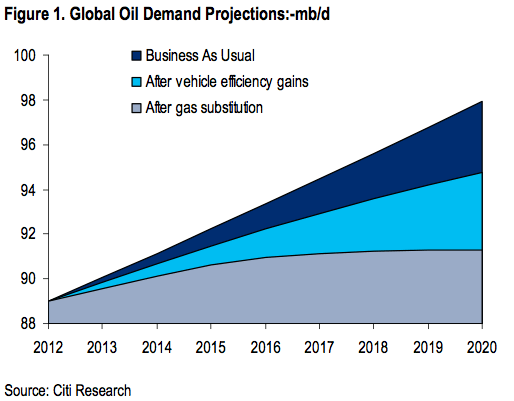

Citi‘s Seth Kleinman has a pretty sweeping note today, titled “The End Is Nigh,” in which he argues crude oil demand — and with it, prices — are is set to fall dramatically in the coming decade thanks to the rise of natural gas and more advanced fuel economies. And the trend is worldwide. Kleinman on gas: One of the many unforeseen ripple effects of the US shale revolution is a push to substitute natural gas for oil. This is set to accelerate with LNG already challenging diesel’s 13 mb/d heavy duty truck use globally but especially in China, bunker’s 3.7 mb/d seaborne market, and CNG and propane set for exponential growth not only in markets such as Brazil, Egypt, Iran and India, but in Russia and the US as well. Oil-based power generation is increasingly being replaced by gas-fired generation. As much as 2 mb/d of power generation demand in the Middle East in total could be switched to natural gas by the end of the decade, and the increasing availability of LNG towards end-decade could back out other oil for power generation needs in India and Latin America amongst others. And on fuel economy: Higher prices, the removal of many fuel subsidies and rising fuel economy mandates have dramatically improved the outlook for fuel efficiency in global automotive and truck fleets. Citi’s automobiles team estimates that new car fuel efficiency is now improving by 3-4% p.a., with trucks managing 1-2%. As cars make up ≈60% of the total global road fleet we conservatively estimate that new vehicles (cars and trucks combined) fuel economy increases by 2.5% p.a. Here’s the key chart showing global demand forecasts.

Kleinman concludes that the oil price spikes of the late ’00s were basically a fluke: The structural bull market of the previous decade was a result of surging global oil demand and consistently disappointing non-OPEC supply growth, compounded by a collapse in Iraqi and Venezuelan production. The outlook for each of these factors has now reversed, reinforcing Citi Research’s long term view that by the end of the decade Brent prices are likely to hover within a range of $80-90/bbl. The shale boom’s effects are still rippling across the globe.

‘The end is nigh’ for global oil demand growth: Citi

John Shmuel | 13/03/26 | Last Updated: 13/03/26 3:47 PM ET An increasing push to substitute natural gas for oil and improved fuel economy could lead to the end of growing oil demand much sooner than many are predicting.

That was the forecast made on Tuesday by Seth Kleinman, head of energy strategy at Citigroup.

The broad consensus in the oil industry and among analysts right now is that global oil demand will continue to grow past 2030, a forecast that echoes the strong growth of the past few decades. But Mr. Kleinman said recent trends challenge that assumption.

“Several developments in fact give reason to question the consensus and raise the possibility that the tipping point for oil demand may come much sooner than the markets are expecting,” he said.

One of the big reasons he argues oil demand will slow in the next decade is the U.S. shale revolution, which has seen a massive surge in natural gas production and subsequently, a drop in natural gas prices. The record low prices have lead many businesses to increase their natural gas use. As well, there has been a push by some to promote natural gas-based cars.

Many countries are also switching from oil-based power generation to natural gas power in light of the lower prices.

“As much as two million barrels per day of power generation demand in the Middle East in total could be switched to natural gas by the end of the decade, and the increasing availability of LNG towards end-decade could back out other oil for power generation needs in India and Latin America amongst others,” Mr. Kleinman said.

The other big game changer is fuel economy. Many cars and trucks today are benefitting from better fuel economy because of better engine technology. Mr. Kleinman estimates that new car fuel efficiency is now improving by 3-4% per automobile, with trucks improving at about 1-2%.

“As cars make up roughly 60% of the total global road fleet we conservatively estimate that new vehicles (cars and trucks combined) fuel economy increases by 2.5% per automobile,” he said.

Finally, Mr. Kleinman said that the old oil bull market was propped up by failed expectations of a surge in oil production from Iraq and Venezuela in the last decade, a trend he says is now reversing.

He predicts all those factors will combine to push Brent prices to a range between US$80-90 a barrel at the end of the decade, meaning a decline in global oil demand will happen well before 2030. That compares with Brent prices on Tuesday, which were trading at US108.27 a barrel.

The next decade could be disastrous for OPEC and Big Oil

By Steve LeVine — 12 hours ago

Ed Morse, Citigroup’s top energy economist, has taken a fresh swipe at companies and countries that rely on the global petroleum edifice. With a typically vivid title—“The End is Nigh”—Morse argues in a new report that permanent changes in the ways we produce and consume energy are hollowing out oil demand, with head-spinning ramifications.

The nub of the March 26 report: If the market transformation resembles that which occurred after the 1979 Iranian Revolution (which Morse regards as a possibility), global oil demand would plummet by 18%, to around 74 million barrels a day from the current 90 million. Such a plunge would trigger political and economic havoc in petroleum export-reliant Russia and OPEC. It would shake out the oil industry. And it would happen regardless of what steps the major players took.

Here’s how it could play out. Morse forecasts that weakening demand will make Brent oil prices drop to $80-$90 a barrel by 2020, from today’s $109 a barrel. Many of the world’s oil export-reliant countries need the higher prices to balance their state budget—Russia requires $117-a-barrel oil, for instance, and Oman requires$109 a barrel to break even. So petroleum producers would shut in fields in an attempt to arrest a free-fall in prices. But even if they propped up prices, they’d be selling fewer barrels. So their absolute income would be likely lower.

The result of this for the countries would be intensified Arab Spring-style political volatility, as governments cut back on social spending and other sweeteners to the population. As for industry, some smaller oil companies currently living off the fat of the land would vanish, and Big Oil at best would seriously shrink. Countries like gas-rich Qatar would be winners; Saudi Arabia, reliant on oil, would be in trouble.

What will cause this falling demand for oil? The trends Morse and his team are tracking couple a surge in global energy efficiency with a swing away from oil in transportation and electricity production. The biggest instrument of change is plentiful and (in the US) cheap natural gas, to which whole swathes of the global economy could turn.

In just one sector—road transportation—Morse sees a big hit to the 13 million barrels a day in diesel burned by heavy trucks around the world. He forecasts that by 2020, for instance, 30% of US cargo trucks and 50% of trash trucks will be fueled by compressed natural gas, not oil. In another—the use of oil to produce electricity in the Middle East—Morse forecasts that natural gas could displace 2 million barrels a day of demand by 2020.

Even in a “more restrained” scenario, says Morse, global oil demand could fall by 9.6 million barrels a day. That would cause similar mayhem to energy-producing countries and companies, only on a slightly less devastating scale.