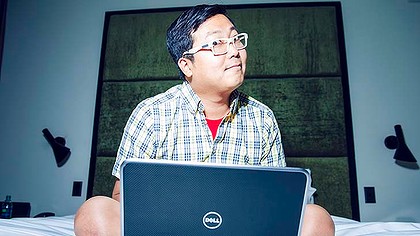

The Secret To 17-Year-Old Nick D’Aloisio’s $30 Million Success: Amazing Hustle

Jay Yarow | Mar. 26, 2013, 12:05 PM | 18,310 | 22

Now that 17-year-old Nick D’Aloisio sold his company to Yahoo for $30 million, he’s gaining widespread attention. However, in tech media circles, D’Aloisio was already well known. In 2011, Gizmodo‘s Casey Chan wrote about making D’Aloisio cry. Chan covered apps for Gizmodo. So, D’Aloisio emailed Chan to see if he would write about his app, which was called Trimit at the time. Chan said he was interested in the app. This led to D’Aloisio going nuts. “Over the course of a few days, D’aloisio berserker barraged me with over a hundred e-mails about Trimit,” says Chan, “I saw him go from calm to excited to a nervous wreck to suffering a nervous break down to threatening to bat shit crazy to borderline suicidal.” D’Aloisio never mentioned that he was only 15 at the time. After not getting quick responses from Chan, he went on to email everyone else at Gizmodo. In response to D’Aloisio’s email barrage, Gizmodo decided to name Trimit the “worst app of the week.” But, the editors felt bad about that, so they just pulled the coverage altogether. This sent D’Aloisio over the edge. He wrote to Chan:

I can’t believe this. Please just put us back on the list. Anywhere.

I feel like crying I’m that disappointed. Please.

You don’t understand what this means if we don’t get featured. We’ll go bust and I’ll end up unemployed.

Why have you done this. I can’t actually believe this is happening.

Please, seriously Casey, don’t destroy my livelihood.

I’ll do anything just please put us back. Seriously I’ll do anything I can’t let my boss see this.

We’d planned so much marketing and SEO for this feature. Now we’re not going to get the visibility and get into debt. Casey, you must understand what this will do to us if you don’t put us back on the list. I thought you liked the app, why do you want to destroy it.

Come on man, please forgive me. We all make mistakes. Why didn’t you tell me days ago to stop emailing you! I thought you weren’t getting them, that’s why I kept sending them.

Seriously without this feature we will lose ranking and then we won’t pay back our purchases and then will have to stop the business.

I plea for you to put it back to how it was before. I plea.

Now we’ve wasted $10,000 as we dont have the article to accompany the efforts.

That puts us in debt and we can’t pay that back for ourselves so now I’m going to have to go without food for the next month.

I am new, we’ve just started the startup, and I’ve never been in PR so I’m not familiar with these journalistic conducts and etiquettes I seem to have broken. I was not meaning to hurt any of you guys or disrupt your work at all; none of that was intentional. I WILL GET FIRED now because of all of this but I guess I can’t change what has happened now. Our marketing has failed since we were not featured and now I have massive debt which is my responsibility to fix.

I’ll ask you for the final time to understand the seriousness of the situation and change it back to the way it was. What is stopping you? Why ruin my livelihood and my app? Why would you want that, seriously?

Please man. Please.

I really need to know what’s going on! My boss is asking.

While this appears to be the ramblings of a crazy person, it also shows someone with a dedication, focus, and energy to succeed. (And, again, he was 15!) Gizmodo wasn’t the only publication that got aggressive emails from D’Aloisio. He was in our writers’ inboxes too. While we don’t want to encourage others to bomb our inbox with pitches, we think his behavior reveals a big part of the reason he’s successful. The kid is a hustler. He works hard. He’s aggressive. He went after his investors, he pursued the media. In one of his interviews from yesterday he told people who want to be like him: “If you have a good idea, or you think there’s a gap in the market, just go out and launch it because there are investors across the world right now looking for companies to invest in.” This is obviously an oversimplification, but it’s not terribly far from the truth. If you have a good idea, and you’re willing to work incredibly hard like D’Aloisio, you’ll probably find success.