Orphan Drugs Could Lose Their Government Subsidies; The $86 billion market for drugs that treat diseases affecting relatively few patients faces pressure from cost-conscious governments.

April 12, 2013 Leave a comment

Orphan Drugs Could Lose Their Government Subsidies

By Simeon Bennett on April 11, 2013

Treatments for rare diseases are hot properties for drugmakers, who covet the medicines for their tax breaks, through-the-roof prices, and the exclusive marketing rights granted by government regulators. Lately, though, those orphan drugs—so named because they treat rare conditions for which there are no other approved treatments—are being slammed by an unlikely culprit: the European economic slump. As more medicines win approval to treat such diseases, affecting no more than 5 in 10,000 people, Europe’s austerity-conscious governments are applying the same pricing scrutiny to orphan drugs that they do to widely prescribed medicines for heart disease and diabetes. That’s putting the brakes on an $86 billion sector of the pharmaceutical industry that’s been growing twice as fast as the market as a whole.

“We have seen countries which were providing good access to orphan medicinal products now questioning the continuation of reimbursement,” says Yann Le Cam, chief executive officer of Eurordis, a Paris-based group that represents patients with rare diseases.

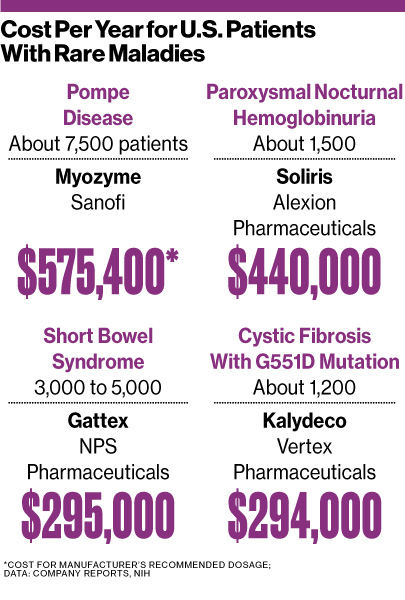

In most of Europe, national health systems negotiate the prices—and then pay the bills—for orphan drugs, whose huge development costs must be spread across a minuscule number of users. This year, the Netherlands demanded cuts in the prices of rare enzyme-replacement therapies including Sanofi’s (SNY) Myozyme, which costs as much as €700,000 ($909,000) a year to treat a single patient. Ireland says it won a “significant” reduction in the €234,804-per-patient annual list cost of Vertex Pharmaceuticals’ (VRTX) Kalydeco for cystic fibrosis, and the U.K. rejected a recommendation to expand the use of Alexion Pharmaceuticals’ (ALXN) pricey drug Soliris, prescribed for two blood disorders.

U.S. insurers may be next to join the orphan drug price-cutting push as they search for savings, says Mary Dunkle, vice president for communications at the National Organization for Rare Disorders, a patient advocacy group in Danbury, Conn. “It’s a growing area of concern,” she says, referring to long-term affordability. “The word ‘sustainability’ is something that we hear quite a bit now.”

Government assistance for makers of orphan drugs varies by country. The big incentive is market exclusivity, which prohibits rivals from making the same medicine. In Europe the exclusive period is 10 years; in the U.S. it’s seven. Other inducements include reduced fees for regulatory filings, research grants, and free advice from regulators on designing clinical trials. The U.S. also grants tax credits for clinical research on such medicines.

Global orphan drug sales rose almost 10 percent a year from 2005 to 2011, compared with 4.8 percent at the top 40 pharmaceutical companies, which had $583 billion in sales in 2011, according to market researcher Datamonitor (INF). More than 70 therapies for rare diseases have been approved in Europe since 2000, when the European Commission introduced incentives to encourage their development. That followed earlier legislation in the U.S., where more than 400 such products have been approved in the last 30 years, according to the U.S. Food and Drug Administration. “The science of rare diseases is advancing very quickly,” Dunkle says. “We also understand there are economic forces at work now, and we want to see pricing established and maintained at a level that’s going to be sustainable so that everybody can benefit.”

Pharmaceutical companies don’t charge high prices “because we can get away with it,” Sylvie Grégoire, then head of Irish drugmaker Shire’s (SHPG) orphan drug business, said in February. “The cost of development of these drugs is no different [than for mass market drugs], and the risk is no different. The number of patients in which it will be utilized is dramatically less.”

That means there will continue to be steep price tags for these often life-and-death medicines. NPS Pharmaceuticals (NPSP), a New Jersey-based developer of a treatment for short bowel syndrome that won FDA approval in December, priced the drug, Gattex, at $295,000 a year for a sometimes fatal disease that afflicts as many as 5,000 Americans. “In the U.S., if you truly go after an indication that is small, then yes, you can still take higher prices and you get away with it,” saysBarclays (BCS) analyst Michael Leuchten.

European governments are a different story. “They’ve started looking at how much money some of these companies are making,” Leuchten says. “If you make more than a billion dollars out of a product, at some point somebody’s going to wake up and say, ‘Hang on a second, clearly you’ve recouped your R&D substantially, and you’ve made an economic return that’s healthy, and we will have to go after you in terms of price because otherwise it’s unfair.’ ”

The bottom line: The $86 billion market for drugs that treat diseases affecting relatively few patients faces pressure from cost-conscious governments.