P&G, Big Companies Pinch Suppliers on Payments

April 18, 2013 Leave a comment

April 16, 2013, 10:55 p.m. ET

P&G, Big Companies Pinch Suppliers on Payments

By SERENA NG

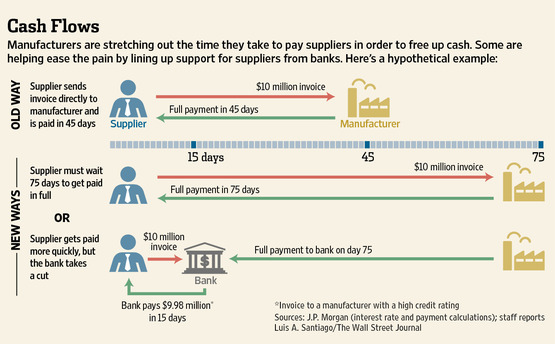

Procter & Gamble Co. PG -1.30% is planning to add weeks to the amount of time it takes to pay its suppliers, a shift that could free up as much as $2 billion in cash for the consumer products giant, people familiar with the matter said. P&G could use that cash to fund investments in new factories overseas or to help pay for stock buybacks. That added flexibility, however, will come at the expense of the companies that supply P&G with materials or services. The suppliers will have to tie up more of their own cash in receivables or eat the interest costs charged by banks to bridge the gap until P&G pays its bills.

The move highlights how America’s biggest companies continue to build on the aggressive cash management practices they adopted in the wake of the credit crisis. What began as a way to preserve cash when markets dried up a few years ago has become a means of freeing up money to fund expansions, buy back stock and support dividend payouts at a time of lackluster sales growth and shrinking profit margins. Read more of this post