Celltrion, Korea’s largest manufacturer of biosimilars, plunged on news that its chief is under investigation for alleged involvement in stock price manipulation

May 10, 2013 Leave a comment

013-05-09 16:53

CEO scandal hits Celltrion stocks

By Yi Whan-woo

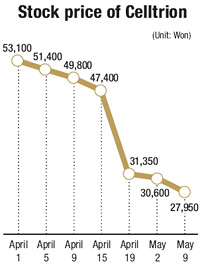

The price of stock in Celltrion plunged on news that its chief is under investigation for alleged involvement in stock price manipulation.

The country’s largest manufacturer of biosimilars closed at 27,950 won per share on the tech-laden KOSDAQ, Thursday, down 2,000 won or 6.68 percent from the previous day. It closed at 53,900 on March 29. The Financial Supervisory Service (FSS) is investigating the company and its chairman Seo Jung-jin for allegedly having ties with speculative investors who have been engaged in short-selling the firm’s shares.Celltrion flatly denied the allegations, and said it invited the FSS to investigate.

“Please be aware that the FSS has been looking into the case after our direct request to clear rumors circulating in the market,” it stated on its official site. “And we’ve had not received any notification that Suh has committed any wrongdoing.”

The company added that it made its request after Suh announced on April 16 that he will sell his entire controlling shares in a firm to a multinational pharmaceutical company.

At the time, the chairman said that his move was to protect the firm from short-selling to speculative investors.

Seo has a 30-percent stake in Celltrion. Of the firm’s affiliates, he also had a 35-percent stake in Celltrion Pharm and a 50-percent stake in Celltrion Healthcare.

Seo has claimed that the biopharmaceutical firm has been under attack from investors who deliberately distort prices by spreading false information and gain profits through short-selling.

The portion of short selling in the firm’s overall stock transaction has been much higher than those at other firms. Of 432 trading days in the past two years, the firm saw short-selling of its stocks for 412 days. In all, short sellers sold more than 8 million shares in 2012 alone.

Short selling refers to a practice whereby shares from brokerage houses or other investors are sold at the market rate in hope that this will fall so they are able to be bought back for a lower price with dealers pocketing the profit. This is often blamed for contributing to market volatility in times of uncertainty

According to industry sources, the country’s junior bourse KOSDAQ handed over sources related to suspicions centering on Suh to the FSS even before April. 16. The FSS, however, declined to confirm this.