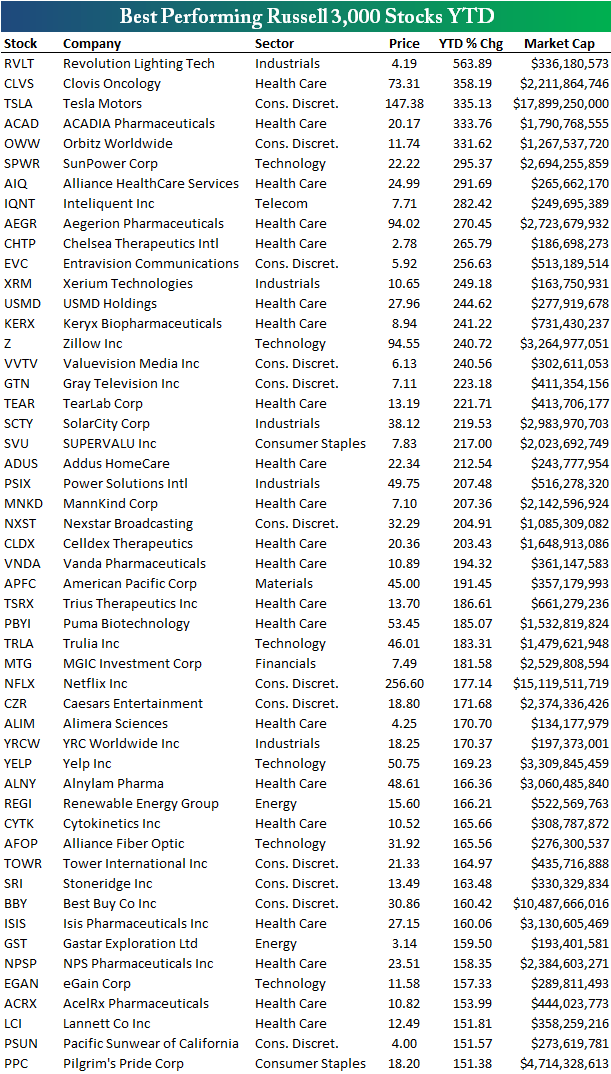

51 US Stocks Up 150%+ YTD

August 14, 2013 Leave a comment

MONDAY, AUGUST 12, 2013 AT 04:31PM

The Russell 3,000 index of large, mid and smallcap stocks represents roughly 98% of the US stock market. So far this year, this cap-weighted index is up 19.41%. The average stock in the index is up much more than that at 28.47%, so the smaller companies are significantly outperforming the big blue chips. Below is a list of the 51 Russell 3,000 stocks that are up more than 150% so far this year. If you have owned any of these stocks since the close on December 31st, your portfolio is definitely thanking you for it. As shown, Revolution Lighting Technologies (RVLT) ranks number one overall with a YTD gain of 563.89%. On 12/31/12, RVLT closed at $0.63. As of the close today, RVLT shares were at $4.19. Clovis Oncology (CLVS) ranks a distant second with a YTD gain of 358.19%, while Elon Musk’s Tesla Motors (TSLA) ranks third at +335.13%. As shown in the table, even with a 2013 gain of 563%, RVLT still has a market cap of just $336 million. What makes Tesla’s YTD gain so impressive is how big the company has quickly become. At $147.38, Tesla is now worth $17.9 billion! That means it’s now a quarter of the size of Ford Motor (F) and more than a third of the size of General Motors (GM). Investors clearly think Tesla is a game changer for the auto industry.

On top of Tesla, Elon Musk also has another company on the list. He also runs Solar City (SCTY), and it’s up 219.5% YTD. 2013 has definitely been the year of Musk!

Some of the other big companies on the list of 2013’s winners include Zillow (Z) with a gain of 240%, Yelp (YELP) with a gain of 169%, Best Buy (BBY) with a gain of 161% and Netflix (NFLX) with a gain of 177%. Who would have thought that Best Buy and Netflix would both be up more than 150% in 2013?