Legal Cloud Hangs Over Banks

August 14, 2013 Leave a comment

August 12, 2013, 3:53 p.m. ET

Legal Cloud Hangs Over Banks

Almost five years after the worst throes of the financial crisis, the biggest U.S. banks face a widening array of legal challenges. The U.S. Department of Justice this month filed civil charges against Bank of AmericaBAC +0.69% alleging it defrauded investors when selling mortgage-backed debt in 2008. J.P. Morgan JPM +0.37% indicated in its most recent securities filing that it is also facing government scrutiny related to sales of such securities, even as it continues to grapple with multiple inquiries into its “London Whale” trading debacle.

Meanwhile they and other big banks continue to wrestle with investigations, regulatory actions and lawsuits related to dealings with mortgage bonds, derivatives markets and consumer-debt products. For investors, this adds up to more than just negative headlines and a tougher regulatory environment. It also means it may be some time before litigation expense stops being a drag on earnings.

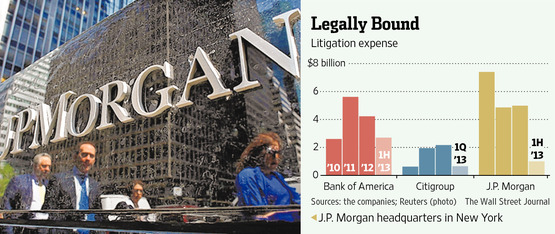

Many investors had hoped such legal charges would dwindle as the crisis receded further, especially since the top three U.S. banks by assets—J.P. Morgan Chase, Bank of America and Citigroup C +1.71% —have booked about $35 billion in litigation expense from 2010 to 2012.

In the first half of 2013, though, these three banks have taken at least $4 billion more in such expenses. And in many cases those charges don’t include billions of dollars more set aside in separate reserves to handle demands that banks repurchase flawed mortgages.

Whether and for how long litigation expense will prove to be an issue is tough to say, given the lumpy nature of such charges and because banks don’t give much detail about them. Banks don’t have to disclose the overall size of their litigation reserves.

Some of the legal issues are being dealt with. BofA, for example, has put several, big-ticket cases behind it. This spring it settled a long-running dispute with bond insurer MBIA. That was a contributor to the $2.7 billion in legal expense the bank booked in the first half.

And while banks continue to fight battles on several legal fronts, that hasn’t kept many from continuing to post record earnings. The rub for investors is that without such big, ongoing litigation expenses, those profits would have been even higher.