Asia Faces Higher Borrowing Costs; Rising U.S. Rates Make it Harder for Asian Issuers To Raise Funds Cheaply

August 15, 2013 Leave a comment

August 15, 2013, 12:18 a.m. ET

Asia Faces Higher Borrowing Costs

Rising U.S. Rates Make it Harder for Asian Issuers To Raise Funds Cheaply

MICHAEL S. ARNOLD And NATASHA BRERETON-FUKUI

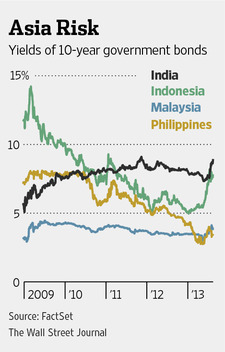

HONG KONG—Governments and companies across Asia are facing an era of tighter credit that could impact the region’s growth prospects. Since the financial crisis, low global rates have been a significant motor of Asia’s developing economies. Now, rising U.S. rates, amid expectations the Federal Reserve will taper its massive bond-buying program later this year, are making it harder for Asian issuers to raise funds cheaply. Countries and firms across the region have had to pay higher rates to attract investors, or shelve bond issuances, as investors pulled some $6 billion out of regional debt in June and July, according to data provider EPFR Global.Yields have fallen back in recent weeks, and are still lower than before the financial crisis. But the cost of borrowing in Asia looks set to rise further amid signs of renewed growth in the U.S. and other developed economies.

The higher costs could further crimp growth in a region where many countries’ economies already are ratcheting back from years of fast debt-fueled expansion.

“Funding costs in Asia are still fairly low in historical terms,” said Guy Stear, head of Asia research at Société Générale in Hong Kong. “But as the Fed moves toward tightening policy, capital could flow out of the region, pushing up the cost of borrowing and knocking growth.”

Indonesia is among countries that are suffering. The Southeast Asian nation boomed by feeding China’s demand for its commodities. But growth slowed to 5.9% in the second quarter, its slowest rate since 2010, as China’s economy cooled.

The nation’s current account deficit has widened as exports slowed, pushing the rupiah currency lower and forcing policy makers to raise rates to combat inflation.

Investors are demanding much greater compensation for risk, pushing yields on Indonesia’s 10-year sovereign bond to around 8%, a level it last touched over two years ago and much higher than a low of 5% earlier this year.

Bank CIMB Niaga, a private Indonesian bank, recently called off plans to issue $240 million in local-currency bonds. PT Perusahaan Listrik Negara, the state-owned electricity company, meanwhile, says it now will attempt to raise only half of a planned $240 million bond issuance.

“Indonesia took the brunt of the backup. They suffered the double whammy of U.S. rates going higher and spreads widening,” said Jim Veneau, investment director for Asian fixed income at HSBC Global Asset Management, which controls $413 billion of assets. “They haven’t been resilient and some of that has to do with changing investor perceptions of the macro environment.”

In India, a widening current account deficit, concerns over government debt and a plunging currency have deterred investors. State-owned Indian Oil Corp. paid a 5.75% coupon on a $500 million 10-year bond in late July—much higher than 3.75% that a similarly-rated energy company paid on a comparable bond in April. Two Indian banks–Syndicate Bank and Canara Bank—recently suspended plans to issue bonds due to higher funding costs, according to people familiar with the matter.

The Malaysian government has borrowed heavily to fund investment in infrastructure as exports have slowed. Fears the country’s current account could soon swing into deficit for the first time since the late 1990s, coupled with mounting public debt, are worrying investors.

Fitch Ratings last month warned Malaysia’s A-minus sovereign debt could face a downgrade. Government debt stands at 53% of gross domestic product, one of the highest levels in the region.

About half of Malaysian local-currency government bonds are owned by foreign investors, adding to market jitters. Last week, the yield on Malaysia’s 10-year government bond rose to 4.06%, its highest level in two-and-a-half years.

“If the public finances are not consolidated then Malaysia could start to flirt with chronic current account deficits,” said Andrew Colquhoun, Fitch’s head of sovereign ratings in Asia, “and that could impact investor attitudes.”

In China, where increased borrowing by state-owned companies and local governments has pushed up debt levels, the credit crunch also has increased borrowing costs. The yield on 3-year-maturity AAA-rated corporate bond rose to 4.9% at the end of July from 4.4% in April according to data from Chinabond.

To be sure, yields could come down, especially if the recoveries in the U.S. and Europe turn out to be shallow and investors look again to Asia to fuel global growth. The region remains a major source of expansion. China’s government expects its economy to grow by around 7.5% this year. While that would be its slowest pace since 1990, it is much faster than the U.S.’s current 2% growth.

The fund outflows are unlikely to cause a debt crisis, as they did in 1997-98 in Asia. That is because Asian governments aren’t as exposed to foreign-currency borrowing as back then and central banks across the region have amassed ample reserves.

But debt levels have been on the up, making an increase in funding costs a potential drag. Debt loads in emerging Asia—measured as total public and private borrowing as a percentage of gross domestic product—rose to 155% in mid-2012, from 133% in 2008, and higher than levels before the Asian crisis, according to McKinsey Global Institute, a unit of consulting firm McKinsey & Co.

“I am quite bearish about how the costs of higher funding will affect the region, simply because there’s been a big increase in leverage since 2008, and I think companies are not too well equipped to deal with higher funding costs as a result,” said Mr. Stear of Société Générale.

Some countries in the region that have undertaken financial overhauls, like the Philippines, aren’t seeing such a large increase in funding costs as their neighbors.

President Benigno Aquino III’s anticorruption drive and reforms to the tax system have helped the country earn a coveted investment-grade sovereign credit rating. The country is running a current account surplus and its bond yields’ spreads over U.S. Treasurys have widened more slowly than in other parts of Asia.

Last month, Ayala Land Inc., the country’s largest real-estate developer, issued $344 million in 10-year bonds at a 5% yield, 50% more than the initial offer size due to strong investor response.

“Yes the party’s over, but regular solid fundamental investing is not over,” said John Vail, chief global strategist for Nikko Asset Management in Tokyo, which controls $162 billion in assets.