Department stores have been losing customers to other retailers for decades. But some are thriving

August 16, 2013 Leave a comment

Department stores have been losing customers to other retailers for decades. But some are thriving

Aug 17th 2013 | NEW YORK |From the print edition

IN THE shopping calendar, the back-to-school period ranks behind only Christmas in importance to American retailers. It is a time for outfitting tots with superhero rucksacks and fashion-conscious teens with “metallic” oxford shoes. But events off the sales floor have distracted merchants from the tinkling of tills. In July Hudson’s Bay, a Canadian department-store chain, said it would buy Saks, an upmarket American one, for $2.4 billion. Then on August 13th Bill Ackman, an activist investor, quit the board of J.C. Penney, a less luxurious retailer, after a failed attempt to hasten the departure of its interim boss, Mike Ullman (see article).Both events are symptoms of the weakness of department stores. J.C. Penney has not recovered from the short but disruptive reign of Ron Johnson, who tried to break shoppers’ addiction to price promotions but drove them away instead. He left in April. Saks is not a basket case (partly because its customers are richer). Richard Baker, the American property tycoon who controls Hudson’s Bay, has ambitious plans. But none involves new, full-sized stores in America. Instead, there will be savings of C$100m ($97m) a year, a push into Canada and more discount outlets.

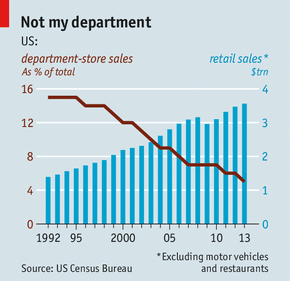

The humbling of department stores began in the 1960s. First specialised retailers, their shopping-mall neighbours, stole sales, as did discounters. Then came “category killers”, which laid claim to electronics and toys, for example, followed by online-only retailers, the current menace. America’s biggest department-store group, Sears Holdings, is one of its sickest. J.C. Penney’s customers defected not to rival stores but to discounters like T.J. Maxx.

It would be tempting to write off department stores altogether if some were not doing surprisingly well. Same-store sales at Nordstrom, a Seattle-based luxury retailer, have risen by 7.5% on average over the past three years. Those of Macy’s, which operates mainly in the tougher middle market, rose by 4.5% (but its second-quarter results, released on August 14th, were disappointing). Department stores started collecting data about their customers through loyalty-card schemes long before their rivals, says Mortimer Singer of Marvin Traub Associates, a consultancy. When these relationships shift to tablets and smartphones and are linked to modern logistics and inventory management, department stores have a fighting chance.

Nordstrom’s newest stores have more mobile devices for accepting payment than fixed ones. With them, salespeople can tell, for example, if a customer is close to an upgrade, which would entitle her to such goodies as free alterations to clothing. She can then be encouraged to claim the benefit by buying a little more. Nordstrom’s grasp of inventory is good enough that shoppers can check online whether an item is available at a specific store.

One of Macy’s tricks is to use its shops as distribution centres. This expands choice online and prevents stock going unsold. An unwanted coat in Boston can be shipped to a shivering shopper in Boise. That sounds expensive but “if you can prevent a markdown, that covers a lot of shipping costs and satisfies the customer,” says Karen Hoguet, Macy’s finance chief.

Mr Singer thinks that such wizardry makes “the next ten years incredibly promising” for some department stores. Perhaps not for J.C. Penney and Saks. Penney has burned through cash at an alarming rate this year; confidence among lenders and suppliers has been further shaken by boardroom infighting, says Liz Dunn, an analyst at Macquarie Securities. Saks would be lucky to thrive in the hands of a property mogul and may be bested in Canada by Nordstrom, which is also marching north, believes Robin Lewis, a retail pundit. Department stores have some hard schooling ahead of them.