China’s Tencent Faces Obstacles Marketing WeChat Abroad; Provenance Could Put Off Users Who Fear Reach of Beijing’s Censors

August 18, 2013 Leave a comment

August 16, 2013, 4:30 a.m. ET

China’s Tencent Faces Obstacles Marketing WeChat Abroad

Provenance Could Put Off Users Who Fear Reach of Beijing’s Censors

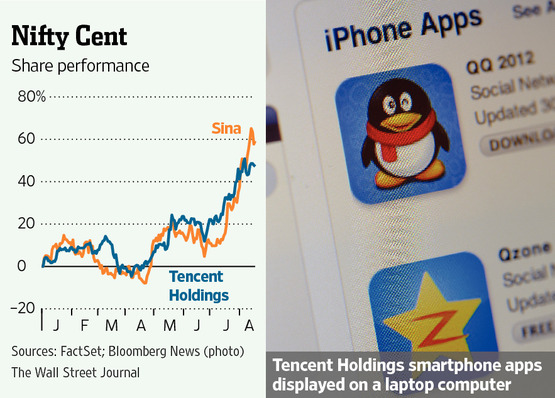

China’s Internet is a world unto itself, where foreign players are kept out by censors and a few large domestic companies wrestle for control. Now giant Tencent HoldingsTCEHY +0.86% is trying to expand abroad. Tencent plans to spend up to $200 million this year to advertise its mobile messaging service WeChat in emerging markets like Southeast Asia and Latin America. The company claims a total of 235.8 million monthly active users globally and says it already has more than 100 million registered users outside China, though it doesn’t disclose the number of active users overseas.

Breaking out beyond China in a meaningful way won’t be easy. For starters, WeChat faces stiff competition abroad. U.S.-based messaging service WhatsApp claims 300 million monthly active users worldwide—as of June, more than 90% of iPhone owners in some Latin American and European countries, as well as in Hong Kong, were active WhatsApp users, according to research firm Onavo Insights. Japanese messaging service Line and Korea’s KakaoTalk are also pushing beyond their home markets.

WeChat might have an edge in markets like Taiwan and Hong Kong, where the connection to mainland China is strong. Beyond those locations, though, WeChat’s Chinese provenance could be a concern. The sway of Beijing’s censors could put off international users who fear the prospect of having their WeChat messages blocked or intercepted if they touch sensitive issues.

Tencent can afford to speculate to accumulate overseas users. The company had around $2.4 billion in cash as of June 30. Still, $200 million is hardly chump change for Tencent. Earnings missed analyst expectations in the second quarter due to a surge in marketing expenses, which more than doubled from a year earlier. Operating margins fell to 31.7% from 37.4% a year earlier.

Even if Tencent succeeds in picking up WeChat users abroad, converting them into profits won’t be easy. The company has only just started to try monetizing WeChat by releasing games and smiley-face icons that users can buy through the messaging platform. Barclays estimates that WeChat will contribute about 4% of Tencent’s revenue next year.

Meanwhile, domestic competition can’t be ignored. Sina Corp.’s SINA +0.98% micro-blog service Weibo boasts more than 50 million active users per day, is ahead of WeChat in monetization, and recently signed a deal with dominant e-commerce player Alibaba Group for merchants to promote their wares on Weibo.

Tencent has gumption to venture outside the walled garden of the Chinese Internet. But it might be better off spending its cash fending with rivals at home.