Metal bashing: Insinuations of market manipulation accelerate another upheaval in finance

August 18, 2013 Leave a comment

Metal bashing: Insinuations of market manipulation accelerate another upheaval in finance

Aug 17th 2013 | NEW YORK |From the print edition

THE deepening relationship between America’s judicial system and its biggest banks has reached the world of metals. The Commodities Futures Trading Commission (CFTC) has reportedly issued subpoenas to Goldman Sachs, JPMorgan Chase and others as it investigates complaints that banks and other owners of metals warehouses have been hoarding metals and driving up prices. Private class-action suits filed in federal courts spanning New York, Michigan, Louisiana and Florida have made similar price-fixing allegations, which the banks vigorously deny.The focus of the complaints is on the storage of aluminium in warehouses licensed by the London Metal Exchange (LME), which was once owned by member banks like Goldman and now belongs to Hong Kong Exchanges and Clearing. The allegation is that end-users of the metal, which is found in everything from car parts to beer cans, have been needlessly forced to queue to get supplies out of the warehouses, paying rent in the meantime. A hearing held last month by the Senate banking committee included testimony by Tim Weiner, a risk manager for MillerCoors, a brewer. He said the aluminium-warehousing system imposed waits exceeding 18 months and all “key elements” of the system for aluminium and base metals worldwide “are controlled by the same entities—bank holding companies.”

The civil lawsuits are likely to be consolidated by a federal panel in the autumn. Formal discovery will follow and then, eventually, a trial. The regulatory probes may also lead to another courtroom date for Goldman et al. In the past the chance of a trial has been lower than that of a settlement, but regulators are under pressure to try more cases. The CFTC may be the lead agency at the moment but Mary Jo White, the chairman of the Securities and Exchange Commission, has publicly said her agency is looking into the involvement of banks in commodities.

The wider context of this sudden interest in aluminium is a general question over whether big banks should be owners of physical commodities and the infrastructure for finding, transporting and storing them. Aluminium is not the only bit of the commodities world where Wall Street banks have a big presence. Morgan Stanley has stakes in Heidmar, an oil-tanker operator, and TransMontaigne, a fuel distributor. Goldman is the proud owner of coal mines, a railway and a port terminal in Colombia. JPMorgan Chase paid $36m earlier this year to buy stakes in geothermal power plants in California and Nevada.

Some fret that banks are using their position to manipulate prices: they point to JPMorgan Chase’s agreement on July 30th to pay a civil penalty of $285m and disgorge $125m in unjust profits tied to alleged market manipulation in energy markets. Others worry that banks’ involvement in physical commodities increases their own risk, and therefore widens the sphere of activities that may require a taxpayer bail-out. What if a bank had owned the Exxon Valdez, an oil tanker that spilled its cargo in Alaska in 1989? Or been running BP’s Deepwater Horizon rig? Such questions were asked by witnesses at the Senate hearing.

The Federal Reserve is reviewing a 2003 decision that allowed Citigroup, and by extension other Wall Street banks, to enter into transactions in physical commodities that are complementary to their financial activities. Determining what is complementary and what is not requires the same sort of Solomonic judgment required to distinguish proprietary trading from market-making. Should banks be banned from financing commodities if that sometimes requires taking physical delivery of them?

The prospect of prolonged regulatory attention, let alone a public fight with America’s beer-drinking constituency, is encouraging some banks to provide their own answers. JPMorgan Chase has abruptly announced that it will exit the physical-commodities trading business, having spent lots of time and money since the crisis building up such activities.

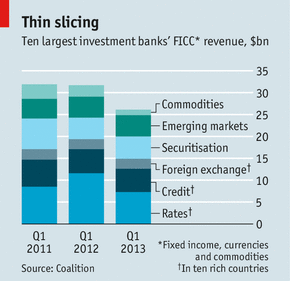

There are other reasons beyond PR for banks to rethink their commodities business. Constraints on capital mean that it is natural for banks to re-examine their ownership of illiquid, capital-intensive assets. Competition from trading houses has increased markedly. A recent report by McKinsey, a consultancy, found that the number of commodity-trading houses in Geneva alone had risen from 200 in 2006 to 400 in 2011. A relative lack of volatility in the oil price over the past few years has reduced the opportunities for banks to make trading profits. Revenues from commodities for the top ten investment banks have declined for the past six quarters, according to Coalition, a research firm (see chart).

This is a cyclical area, however, and a still-appealing one in regions that are big producers or consumers of commodities. Brazil’s investment-banking powerhouse, BTG Pactual, is building up its commodities arm. A Chinese giant, ICBC, is reportedly in talks to buy the London commodity operations of Standard Bank, a South African lender. A Chinese broker, GF Securities, recently agreed to buy the commodities-trading unit of Natixis, a French bank. And Chinese buyers are thought to be making inquiries of Goldman, should it want to sell its operations. That raises another question: would American regulators consider these firms better owners?