E&P Investors Fear the Oil Party Hangover; Oil-Company Stocks Disconnect from Crude Price

August 20, 2013 Leave a comment

August 19, 2013, 1:34 p.m. ET

E&P Investors Fear the Oil Party Hangover

Oil-Company Stocks Disconnect from Crude Price

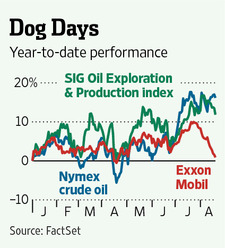

There comes a point in a boisterous night out when you order that drink that ensures the following day will be a write-off. Investors toasting the oil-and-gas sector this summer seem to have reached that moment of realization. Near-month crude-oil futures on the New York Mercantile Exchange have rallied almost 17% since the start of June. Goldman SachsGS -1.26% added fuel to the fire Monday by raising its Brent forecasts for this year. For much of the summer—indeed, most of the year—stocks of exploration-and-production companies have done even better than oil prices.But even as oil prices have held up this month, E&P stocks have been drifting lower; shares of Exxon Mobil and Chevron have seen even sharper falls.

The reason? Exuberant oil prices, like exuberant partyers, ultimately foster their own downfall.

Estimates for the level at which oil prices start causing people to curb consumption—”demand destruction” in industry parlance—necessarily mix art with science. Doug Terreson at ISI Group puts it at about $125 a barrel for Brent, about 13% above the current price.

But demand could fall back well before oil prices hit that level. While Brent is still below 2008’s all-time peak north of $145, things look different when you look at 12-month average prices. These matter because it is sustained oil-price strength, rather than just a brief spike, that drains consumers’ wallets.

Rolling average Brent prices first peaked in October 2008, but they have been sustainably above that level since the fall of 2011. Priced in other currencies, Brent averages look even more expensive. In euros, they are a fifth higher than in October 2008. In Indian rupees, the rolling average is now more than one-third higher.

While global demand for oil has risen this year as economic recovery has progressed, the main factor supporting prices is disrupted supply in usual-suspect areas including Libya, Nigeria and Iraq. This provides a fillip to oil prices, but ultimately that only adds to the pressures on consumers to curb demand. That, in turn, weighs on the longer-term price expectations that determine oil-company stock prices.

And just as oil prices over time damp consumer demand, average prices of oil determine E&P companies’ profits over quarters and years. On this front, the summer rally in oil actually looks less impressive. For example, while Nymex crude commands $107 a barrel, its average this year is just under $97, only 3% above the average for 2012.

Looking at second-quarter results, analysts expect earnings for S&P 500 energy stocks to drop 8.5% year on year, according to Thomson Reuters. As recently as July 1, the Street expected positive growth.

Major oil companies, in particular, had a dreadful quarter. That has important implications for E&P companies trying to cover cash flow gaps with disposals, such as Chesapeake Energy. Royal Dutch Shell’s write-down of some shale assets and plans to sell some suggest a key set of buyers is turning away. This, too, will weigh on E&P stocks.

It is worth noting that Goldman didn’t raise its 12-month oil-price estimate, as it sees supply bottlenecks easing later this year. They, like investors, seem to know when to call it a night.