Rising Markets Batter Short Sellers; Investors Betting Stocks Will Fall See Worst Losses in Decade

August 21, 2013 Leave a comment

August 20, 2013, 9:24 p.m. ET

Rising Markets Batter Short Sellers

Investors Betting Stocks Will Fall See Worst Losses in Decade

JULIET CHUNG and ROB BARRY

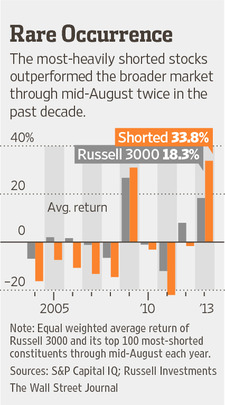

Short sellers are facing their worst losses in at least a decade, a Wall Street Journal analysis has found, as many of the rising stocks they bet against have only continued to soar. That has stung several high-profile hedge-fund managers, including William Ackman and David Einhorn, who have placed prominent short bets. In the Russell 3000 index, the 100 most heavily shorted stocks are sharply outperforming the average returns of stocks in the index, according to a Journal analysis of data provided by S&P Capital IQ. The shorted stocks are up by an average of 33.8% through Aug. 16, versus 18.3% for all stocks in the index.The gap between the performance of the most-shorted shares—as measured by percent of total shares outstanding at the beginning of the years—and the market as a whole is wider than it has been in at least a decade.

“If you just took hedge funds’ long positions, you would have pretty stellar performance,” said Greg Dowling of Fund Evaluation Group, a Cincinnati-based investment firm that invests client money in hedge funds. “It’s on the short side where guys have been getting killed.”

Stock hedge funds are expected to outperform when markets fall but underperform during bull runs, since they generally hedge their bets by betting against stocks. But the gap is wider than usual. Through July, stock hedge funds returned 7.7% on average, compared with 19.6% by the Standard & Poor’s 500-stock index, including dividends.

In short selling, an investor sells borrowed shares in hopes of buying them back later at a lower price, and pocketing the difference. When the price goes up instead, the investor suffers a loss.

To some managers, the current dynamic is reminiscent of the final days of the dot-com bubble, when stocks continued to rise despite high valuations of many Internet companies.

“It’s actually more painful now than it was in ’99,” said veteran short seller Andrew Left of Beverly Hills, Calif.-based Citron Research. He called the outperformance of widely shorted stocks this year “a fairy tale” driven by institutions chasing returns.

A losing trade for Mr. Left since July has been electric-car maker Tesla Motors Inc., TSLA +3.23% one of the most heavily shorted stocks in the market. Tesla’s stock price has gone up more than 300% this year, including a 32% rise since June 28.

A Tesla spokeswoman declined to comment.

In April, Tesla CEO Elon Musk jabbed on Twitter at doubters: “Seems to be some stormy weather over in Shortville these days.”

Other heavily shorted companies that have kept rising are Zillow Inc., Z -4.76%up 222%; Questcor Pharmaceuticals Inc., QCOR -0.28% up 151%; and Green Mountain Coffee Roasters Inc., GMCR +4.17% up 76%. Green Mountain declined to comment; spokespeople for Zillow and Questcor said the short sellers often didn’t understand their businesses or were focused on short-term price swings in the stock.

As happened with the Internet boom, Mr. Left and other managers believe their short positions will be proved right—eventually.

Meanwhile, some hedge funds are posting lackluster results.

Hedge-fund Dialectic Capital Management LLC told investors in a recent letter that its heavily short-biased fund was down 13.3% for the year through July, with a 6.3% loss in July alone. Its flagship fund, which is market-neutral, was down 3.7%. The firm managed $830 million at the end of last year, according to a regulatory filing.

Dialectic, which has bet against stocks including Herbalife Ltd. HLF +3.93% andNu Skin Enterprises Inc., NUS +2.04% according to a person familiar with the firm, is exiting some money-losing short positions and focusing on investments with a better chance of paying off soon. “In a raging bull market, we just can’t wait around for the market to realize we are right,” its letter to investors said.

Nu Skin’s share price has more than doubled so far this year. A company spokeswoman said the company had “strong fundamentals.”

Herbalife’s stock price has roughly doubled this year, also creating losses for Mr. Ackman’s Pershing Square Capital Management LP, which announced a more than $1 billion bet against the company in December.

Mr. Ackman defended his investment Tuesday. “Herbalife is a pyramid scheme,” he said. “We’ve not learned one fact that is inconsistent with that conclusion.”

Herbalife has rejected Mr. Ackman’s allegations and said it is a legitimate business. An Herbalife spokesman said “the facts clearly do not support” Mr. Ackman’s short position against the company.

Funds that have performed better still have been hurt by their short bets.

The $2.1-billion Lakewood Capital Management LP, based in New York, returned 0.1% in the second quarter, with the firm’s gains from bets on stocks largely canceled out by losses on short positions. Through Aug. 9, Lakewood had gained more than 8%, according to a person familiar with the firm.

“It has been a challenging period for short selling in recent months with companies of questionable value regularly registering impressive stock price gains, often in the absence of any meaningful positive developments,” wrote Lakewood founder Anthony Bozza in a July investor letter.

Mr. Einhorn’s $8.8 billion Greenlight Capital Inc. returned 1.2% in the second quarter, and gains in July were nearly halved by losses on shorts, according to communications with investors. For the first seven months of the year, the fund rose 10.7%.

Greenlight has been shorting Green Mountain, whose shares slumped after Mr. Einhorn raised questions about its growth prospects in the fall of 2011. But the shares this year have risen briskly.

Investors and managers say the shorted stocks that are outperforming are getting a boost from hedge funds covering their shorts, or buying back shares at a loss, in what is known as a “short squeeze” when it happens en masse. That in turn pushes the stock price higher.

Some short sellers expect the end of the Federal Reserve’s massive bond-buying program to drive share prices down of certain companies. Already in August, the markets have experienced consecutive down days that have helped short positions.

But for most of 2013, small dips in the market have been followed by bigger jumps.

Mr. Bozza, of Lakewood, is waiting out the market. He wrote he had often seen stocks he was short—whose share price had risen dramatically untethered to significant developments—later collapse “in spectacular fashion.” That remains a possibility for Tesla, his worst-performing short, he wrote. “While we certainly respect the possibility we could be wrong here,” Mr. Bozza wrote, “our continued evaluation of Tesla has reinforced our conviction in our short position.”