Google in early talks with NFL on ‘Sunday Ticket’ service; “These dynamics have the potential to exacerbate cord cutting and may create a vicious cycle as the cost of programming on traditional TV would move higher with each loss of a subscriber

August 22, 2013 Leave a comment

August 21, 2013, 4:00 p.m. ET

Google Could Open a Hole in Pay TV’s Defense

Search Company Meets With NFL Executives

Google GOOG +0.45% may have found a path to the end zone for Internet TV. Top executives at the search giant met with representatives from the National Football League, according to a report Tuesday by All Things D. Among the topics of discussion: the Sunday Ticket package, which includes all NFL games not in the viewer’s local market and is offered exclusively by DirecTV DTV -1.88% . There is no indication that Google is anywhere near a deal to offer the package. But the news raises the possibility of a powerful partnership that could be the magic bullet for Google in its goal of luring traditional TV viewers, and associated advertising dollars, to the Internet. Live sporting events are among the primary reasons U.S. consumers pay for TV. Bringing them online as a separate subscription would allow many more people to stop paying for traditional TV.It would also let the NFL broaden its viewer base by selling to those people who don’t pay for TV. For CBS, NBC, Fox and ESPN, all of which have agreed to pay huge sums for the right to carry NFL games, Google’s reach would likely be seen as a serious threat. That said, most of the networks’ deals with the NFL extend to 2022, buying the league some time. And considering the value of football to ratings and affiliate fees, it is difficult to imagine networks turning their backs on the NFL.

It is possible the NFL may have leaked news of the meeting to gain leverage in negotiations with DirecTV, which pays $1 billion a year for Sunday Ticket. That contract extends through the 2014 season, but analysts expect a new one to be announced this year.

The satellite-TV provider generates about $725 million a year in Sunday Ticket revenue from about 2.8 million subscribers, Citigroup estimates. On that basis alone, it already loses money on the offering. But DirecTV has used Sunday Ticket to differentiate itself from competitors and retain subscribers. The latter becomes even more important as more consumers cut the cord; unlike cable companies, DirecTV lacks a broadband offering.

Still, there could be a price at which the costs would outweigh the benefits. Including the profit DirecTV generates on other content from Sunday Ticket subscribers and the scale benefits in terms of lower content costs that it gets from having those subscribers, Citigroup estimates Sunday Ticket would become uneconomical for the company if the price rose to $1.5 billion a year.

That might be a worthwhile price to pay for an entree to TV for Google, which had $54 billion in cash at the end of the second quarter. MLB.com, Major League Baseball’s direct-to-consumer online subscription offering, retails for $129 a year. But football is more popular, so Google could perhaps charge as much as $200 for Sunday Ticket.

Knowing Google, though, it might well end up charging far less, aiming to broaden its reach and drive ad revenue. For the search giant’s TV ambitions, springing for the NFL could deliver the winning field goal.

Google in early talks with NFL on ‘Sunday Ticket’ service: report

7:28pm EDT

NEW YORK/SAN FRANCISCO/ (Reuters) – Google Inc has opened discussions with the National Football League to buy the rights to the “Sunday Ticket” subscription TV service now owned by DirecTV, tech blog AllThingsDigital reported on Wednesday, citing sources familiar with the matter.

The acquisition, if consummated, would dramatically boost the media efforts of the Internet search company, which is trying to ramp up original programming and earn subscription revenue as opposed to advertising income.

The “Sunday Ticket” service allows NFL fans to watch a wide variety of football games outside of their local markets.

NFL Commissioner Roger Goodell and league officials called on Google, Facebook Inc and several other key Silicon Valley companies in recent days, as part of efforts to improve their content, NFL spokesman Alex Reithmiller confirmed on Wednesday. He did not elaborate.

But the tech blog cited sources saying Google CEO Larry Page and YouTube content chief Robert Kyncl specifically discussed acquiring the rights to the popular Sunday Ticket package with Goodell and his delegation.

Google’s YouTube last year expanded its stable of original content by promoting and investing in hundreds of dedicated channels, hoping to shed its image as a repository for grainy home videos and to start putting out quality content to boost advertising sales and earn subscription revenue.

The NFL has proven to be a savvy media-rights negotiator in years past, and now controls one of the most lucrative sports-TV operations in the country. News of Google’s interest could pile pressure on DirecTV as its lock on the package expires after the 2014 season.

“I’ve always been pretty skeptical that rights holders of significant events are going to put those events on digital platforms. The leagues love to float the idea that its a possibility because it creates a sense of more competition and accelerates prices,” said John Skipper, president of the Walt Disney Co’s ESPN sports network.

YouTube’s “sites are not built for appointment viewing. You go there to watch archival content. You go there for information to do some task, to search, to do email.”

Still, a content tie-up between the popular NFL and Google could have ripple effects throughout the media industry and transform Google into a major destination for sports online viewing, analysts said. It could bolster demand for services that bypass traditional cable, pressure values for some TV and satellite networks, and encourage users to sign up for broadband, Janney Capital Markets analyst Tony Wible said.

DirecTV has sounded upbeat about its chances of renewing the estimated $1 billion-a-year “Sunday Ticket” contract with the league when it expires.

The exclusive package, which allows fans to watch games outside of their home markets, is considered by analysts an important tool for the satellite TV service in efforts to attract new subscribers.

RIPPLES

AllThingsD called talks between Google and the NFL “informal” for now.

Neither Google nor DirecTV responded to requests for comment.

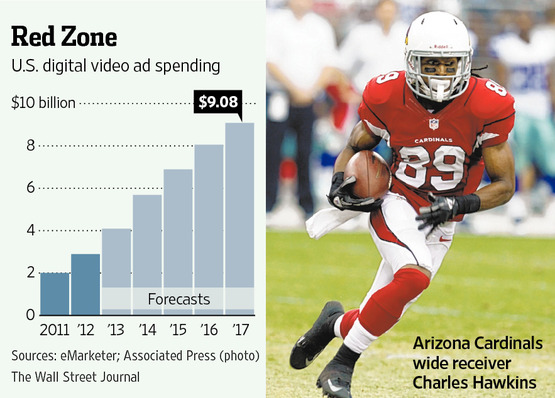

Google’s addition of “Sunday Ticket” would mark its biggest foray so far into the realm of quality programming and subscription-video services. It could also accelerate “cord cutting,” or viewers switching to online-viewing sources from traditional cable channels, analysts said.

However, the NFL could come under significant pressure from holders of its other TV licenses, the traditional TV and broadcast networks, who would seek to discourage a tie-up with an Internet powerhouse like Google.

“If Google were to secure the Sunday Ticket rights, we may have a situation where consumers can start to create a more viable alternative” to a traditional cable plan, analyst Wible said.

He speculated that along with Netflix Inc and Hulu services now available over the Internet, consumers could begin to create a true “a la carte” package in which people select the specific TV services they pay for.

“While we don’t know the pricing for any Google product, it is safe to assume this bundle would be far cheaper than a traditional TV package,” he said. “These dynamics have the potential to exacerbate cord cutting and may create a vicious cycle as the cost of programming on traditional TV would move higher with each loss of a (subscriber) – increasing the odds that another will cut the cord.”