Hedge Funds Severely Underperforming This Year

August 22, 2013 Leave a comment

Aug 21, 2013

Hedge Funds Severely Underperforming This Year

By Steven Russolillo, Reuters

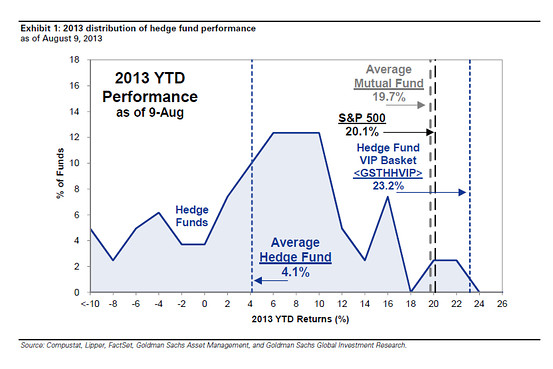

It’s been a great year for the stock market. It’s been a tough year for a hedge-fund manager. A typical hedge fund has risen 4%, on average, this year through Aug. 9, according to an analysis conducted by Goldman SachsGS -1.54%. That performance compares to a 20% total return (including dividends) for the S&P 500 over the same time frame, meaning the market has outperformed an average hedge fund by five times this year.Hedge funds, on average, underperformed the markets last year as well, with an 8% gain, compared to a 16% total return for the S&P 500.

Hedge funds typically shine when markets struggle and underperform during long rallies, largely because they hedge their bets to try to generate steady performance. But the gap this year has been wider than usual. Fewer than 5% of the hedge funds that Goldman monitored have outperformed the S&P 500 this year, while about 25% of these funds have posted absolute losses.

Goldman’s analysis tracked the investments of 708 hedge funds that had $1.5 trillion of gross equity positions ($1 trillion long and about $500 billion short) as of the beginning of the third quarter. Google Inc.’s shares were the most widely held by hedge funds, followed by AppleAAPL +0.26% and AIG. CitigroupC -1.52% and General MotorsGM -0.75% rounded out the top five, according to Goldman. Here’s a look at the 50 stocks most loved by hedge-fund managers.

Part of the blame for the weak performance in 2013 was due to how detrimental short positions have been for hedge funds.

“While key hedge funds long positions have outpaced the S&P 500 year-to-date, short selections have hampered returns,” Goldman analysts said in a note to client. The firm pointed out the 50 stocks with the highest short interest as a percentage of market cap have soared 30%, on average, this year. Here’s a deeper dive into the 50 stocks that are most heavily shorted by hedge funds.

Goldman’s analysis meshes with WSJ’s Page One story Wednesday that detailed howshort sellers are facing their worst losses in at least a decade. In the Russell 3000 index, the 100 most heavily shorted stocks are up by an average of 33.8% through Aug. 16, versus 18.3% for all stocks in the index, according to a Journal analysis of data provided by S&P Capital IQ.

The gap between the performance of the most-shorted shares and the market as a whole is wider than it has been in at least a decade.

Goldman found that these hedge funds operate 51% net long, representing a slight decline from record high levels of 53% last quarter. “Risk appetite remained roughly flat despite the S&P 500 rising to new all-time highs,” the firm said.

Turnover in these funds remained low, at about 30%. Popular positions included holding large net-short positions in emerging-market stocks, volatility, gold and high-yield bond ETFs.

“Hedge funds generally use ETFs more as a hedging tool than directional investment vehicles, but these positions reflect large changes versus the prior quarter,” Goldman says.

The upshot, however, is hedge funds continue to struggle as stocks hover around record highs.